To the Victors, Go the Spoils: Part I

I didn’t write last week.

It wasn’t because I didn’t have anything to say, but that I don’t think anyone wanted to hear where my head was. Midday Sunday Hope asked me “aren’t you going to go write the newsletter?” and I shrugged. We ended up watching an unremarkable movie and going for a walk. I have avoided the election post-mortems and instead am thinking about what the next few years will look like.

That said, I have little interest in the scandal or outrage of the moment. I think there are better venues for that. I understand that the electorate doesn’t care about policy nuances, but I do, and I bet you do as well.

So for the next few newsletters, I am going to focus on the policy agenda we’re walking into.

On Tariffs and the Cost of Goods

A notable feature of the incoming President is his ability to propose policy without being held to account in the realm of details. This is especially true in the area of economics. A centerpiece of his domestic agenda is protectionist tariffs. A tariff is a tax on imported goods, designed to make foreign products more expensive and protect local businesses. The US already has a robust tariff system in place. He intends to expand it.

Trump imposed tariffs in his first term; Biden kept most and expanded others. The reason you don’t see any of the extremely cheap (in some cases sub $10,000) and awesome Chinese EVs in the US market is tariffs. The US currently imposes tariffs on a broad range of imports, particularly targeting goods from China. High tariffs, such as a 100% tax on electric vehicles (thank Biden for that one) and 25% on lithium-ion batteries, aim to protect domestic automotive and battery production.

There is bipartisan agreement on tariffs. But the incoming administration has pledged a massive expansion of the tariff regime. Here’s a useful explainer from PBS from September:

He has proposed a 60% tariff on goods from China — and a tariff of up to 20% on everything else the United States imports.

This week, he raised the ante still higher. To punish the machinery manufacturer John Deere for its plans to move some production to Mexico, Trump vowed to tax anything Deere tried to export back into the United States — at 200%.

And he threatened to hit Mexican-made goods with 100% tariffs, a move that would risk blowing up a trade deal that Trump’s own administration negotiated with Canada and Mexico.

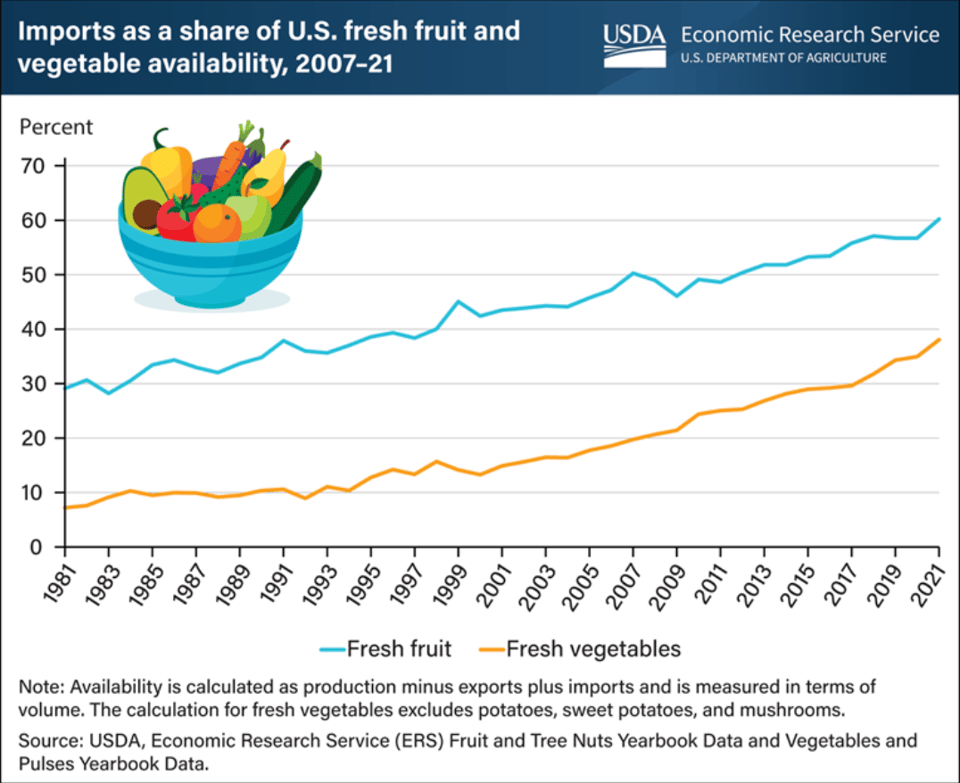

A fun fact about Mexico. They’re the source of roughly 51% of the fruit in the US market.

The PBS article continues:

Trump insists that tariffs are paid for by foreign countries. In fact, it is importers — American companies — that pay tariffs, and the money goes to the U.S. Treasury. Those companies, in turn, typically pass their higher costs on to their customers in the form of higher prices.

To be clear, expanding tariffs will significantly increase the cost of imported goods, directly driving up prices for essentials like electronics, vehicles, and food. These added costs will ripple through the economy, forcing businesses to pass them on to consumers. For households already (allegedly) struggling with inflation, and rising living expenses, tariffs will function as a significant additional tax.

Tax Cuts for the Wealthy

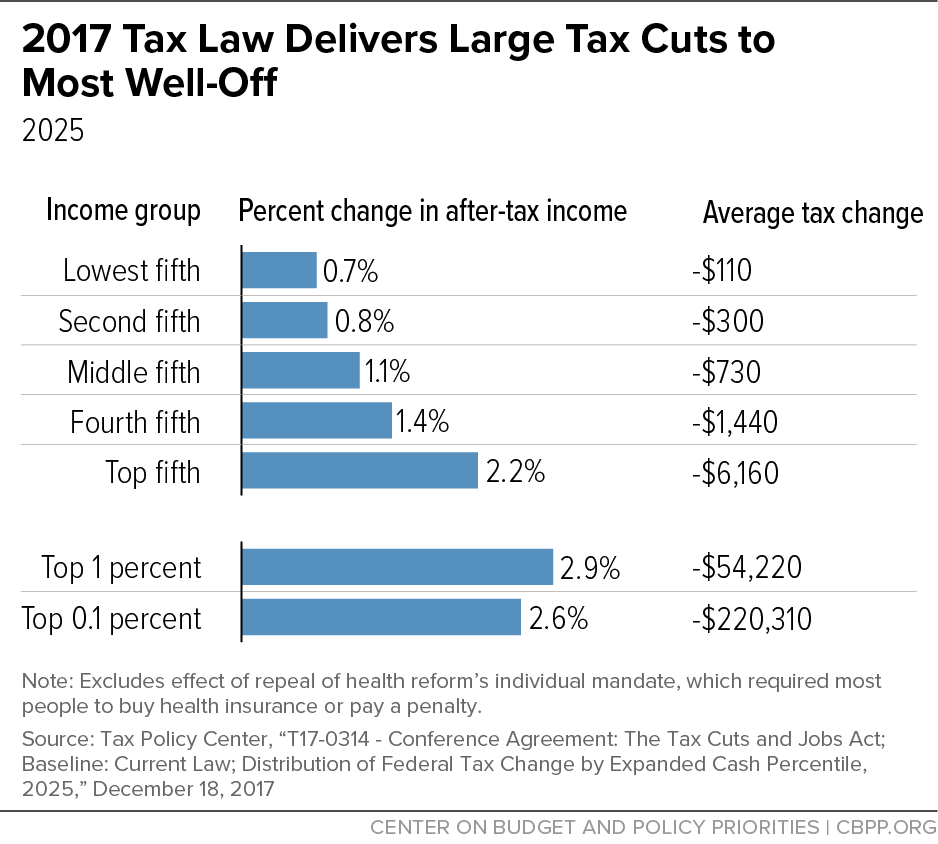

The tariffs are part of a tax-policy two step. They will raise prices but also generate substantial revenue. That revenue will serve as a partial offset to more deficit busting tax cuts for the wealthiest Americans. In his “temporary” 2017 tax cuts the vast majority of the benefits went to the wealthiest 10% of Americans. Given GOP control of both houses of Congress, these tax cuts will be made permanent and likely expanded.

To put these tax cuts in perspective, the bottom 20% of Americans couldn’t cover the cost of a Netflix subscription with their extra $9.10 per month. On the other hand, the top 1% percent of the country got the equivalent of two years tuition for their kid at an elite private school (or a Mercedes-Benz C-Class C 300 Sedan). The top 0.1% got an annual tax cut equivalent to the median home cost in the State of Oklahoma.

He’s suggested dozens of other tax ideas: at one point in October he proposed removing all income taxes; he also discussed removing taxes on overtime and tips but those are unlikely to be at the core of his eventual proposed bill.

Extending those tax cuts comes with a price tag of five trillion dollars (5,000,000,000,000 USD).

His corporate tax ideas are nothing if not ambitious.

He wants to slash the corporate tax rate to 15% for companies that manufacture within U.S. borders—another trade protectionist policy. More broadly, he wants to allow companies to immediately deduct the full cost of certain investments, such as equipment or property, which would further lower their tax obligation.

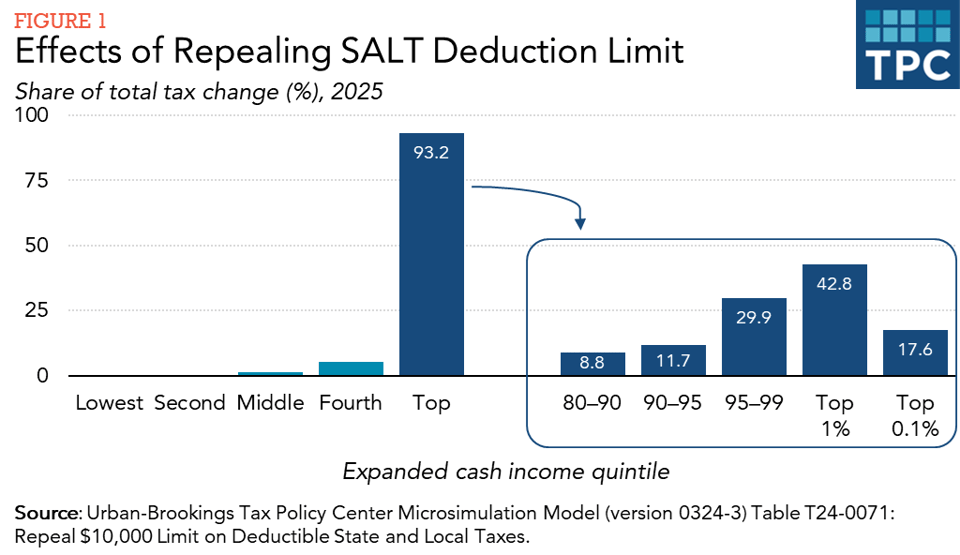

As for individual taxpayers, his proposal to ditch the $10,000 cap on state and local tax (SALT) deductions is a golden ticket for wealthy families in high tax states.

In a familiar tune, 93.2% of the benefits for this will go to the top income quintile.

So in review, under the policy proposals currently on the table, prices for food, consumer goods and gadgets, are likely to rise sharply for most families due to the imposition of tariffs. Those same people will also save enough in federal income taxes to pay for a Spotify Premium subscription. Meanwhile the top 1%, those earning over $590,000 will see the lion’s share of the benefit from the continuation of the 2017 tax cuts and most other measures on the table.

The French revolted over less than this in 1789.

Next week, I am going to dig into what “mass deportation” and the administration's other immigration proposals may look like. I will also be tackling that topic on the podcast.

In closing, thanks to newsletter reader Craig [Last Name Withheld] for his recent gift to Channel 253. Craig, your donation paid for six months of hosting costs for the newsletter. Thank you.

See you all next Sunday.