5 things I’ve learned from writing The Budgette

Usually this last newsletter of the year is my ‘X things we learned this year about money’ but when I was pulling it together, I realized it’s the same thing as last year and the year before. I’ve linked them so you can read.

Instead, I took a look at some overarching themes that threaded through the twenty-something newsletters that made up the 2025 edition of The Budgette.

If there’s one thing consistently reinforced by writing The Budgette, it’s that money advice looks very different when you’re on your own. After years of newsletters, reader questions, research rabbit holes, and conversations with friends, advisers or by myself that start with “is this weird or is it just me?” here are five of the clearest lessons that keep coming up.

1. Most personal finance advice wasn’t designed for solo earners

So much mainstream money guidance quietly assumes two incomes, shared expenses, and a built-in financial backstop aka, the other person’s income. When you’re single, the margin for error is smaller and the stakes are higher. That doesn’t mean you’re behind. It means the traditional framework needs to change to accommodate us.

2. You can’t budget your way out of structural problems but you still need a plan

Housing costs, stagnant wages, and rising food prices aren’t personal failures. They’re systemic as I’ve banged on and on about. Still, having a financial plan and a knowledge of what your money and investments are doing, insurance, boundaries, and priorities gives you more stability and more agency.

3. Boring money basics matter more than hot takes

Emergency funds, investing early with whatever sum of money you have, and diversification show up again and again because they work. They aren’t exciting and definitely not sexy like AI, crypto or gold, but they can work, especially important when there’s no second income to fall back on.

4. Talking about money with friends is underrated

Some of the most useful financial insight doesn’t come from experts, but from peers. Salary transparency, honest conversations about debt, and sharing what actually works helps break shame, correct bad assumptions, and build collective confidence. Also, it gives you reassurance (ideally) that it’s not just you.

5. Not all experts deserve your trust

Just because someone is loud, wealthy, or popular doesn’t mean their advice applies to you. The Budgette takes a skeptical approach to experts. This entire newsletter is a side-eye with some occasional cut-eye.

Understanding what you’re investing in, questioning trends, and ignoring advice that doesn’t fit your life is a form of financial self-respect.

If there’s a through-line here, it’s this: good money advice should make you feel clearer, not ashamed. If it doesn’t work for your life especially as a solo earner, it’s allowed to be wrong for you.

Thank you for another year (the fifth!) of delving into finances and lifestyle for solo earners. I appreciate your support.

I had some spectacular writing opportunities (apart from that one) this year. Here are some of my favourite things that I wrote:

From The Walrus: Are We Going to Feel Broke Forever?

This piece came about when my editor and I started talking about what affordability is and what that actually means for Canadians. I spoke with several economists and did a lot of reading. The story evolved to tie into the federal budget which dropped in November. This was a tough story. Would I do it again? Absolutely.

Another Walrus piece I wrote this year was How Far Can “Buy Canadian” Really Go? This was the first piece I wrote for the magazine. It came from a February newsletter I wrote, Did Donald Trump not expect tariff retaliation, which was written in a haze and sent at 1:30 in the morning. My editor reached out to me on the Monday, we talked for an hour, I had a first draft to her on Wednesday, edits then it went up. This one was a whirlwind to write.

For the Toronto Star, I got to flex my opinion on housing. That led to this piece: It’s time for Canadians to stop making this one big (false) assumption about housing

The Walrus wasn’t the only place I wrote about tariffs. I wrote, How to survive tariffs and an anxiety—inducing news cycle for Financial Pipeline

And obviously the book. It’s nearing the end of a three-year journey from meeting my agent, actually sitting down to write the proposal, meeting my editor, writing and editing this thing to it being on the shelf and me being an author. It’s odd, I’ve been published for years but it feels different from a news byline.

If you’ve pre-ordered it, you’ve probably already received it, based on what my friends are telling me. It hits the bookshelves in 15 days.

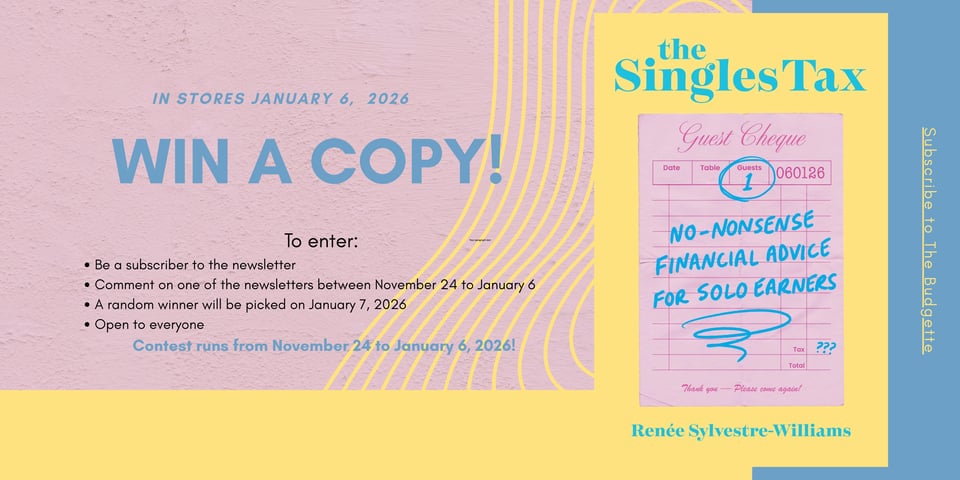

Contest details! Win a copy of The Singles Tax: No-Nonsense Financial Advice for Solo Earners

To enter:

Be a subscriber to the newsletter.

Comment on one of the newsletters between November 24 to January 6.

A random winner will be picked on January 7, 2026.

Open internationally. I will mail it out to you wherever you are.

Contest runs from November 24 to January 6, 2026!

Happy Holidays and Happy New Year. May 2026 be better than this year.

-

Super interesting perspectives for us singles!

-

Ooh I never leave comments because I always read it in the email. But I always WANT to comment, it never dawned on me that I could over here! LOL It took the contest to show me I could! That being said, I never talk about solo earning and solo living as if it's the unusual scenario and double incomes are the norm. I'm obnoxious about how I presume everyone is on a single income and how absolutely unusually lucky and rich and privileged you are if you are not.

Where I work, a lot of the employees are ten month (I'm twelve) and I say things like "Oh wow, I have to pay rent twelves months of the year, I have no idea how the ten-monthers do it!" and they look at me like I'm crazy. -

I just came across your writing and I have to say thank you from the bottom of my single heart for writing about the single person challenges, and advocating for us in the Canadian tax system that is designed for couples and designed to provide benefits to couples, resulting in singles paying more in taxes.

-

Thank you for all the advice, happy holidays!

-

Very helpful!

-

Love the Walrus articles! It's so nice to have a Canadian writing on solo (and childfree) living and finances, I find most of the folks I read are from the states or the UK. Looking forward to the book!

Add a comment: