How to think about music AI licensing

Three core questions to pave a clearer path forward.

Hi there!

ICYMI: After six years as a membership publication, Water & Music has evolved. We've made our entire research archive free, and shifted our focus to hands-on strategic consulting for forward-thinking music and tech companies.

With this context, we’ve given our free newsletter a refurbish.

Firstly, we’ve moved to Buttondown for email delivery. It’s a deliberately minimalist platform that prioritizes reading experience over marketing optimization, which fits our new direction — no hidden tracking or cluttered templates, just ideas delivered cleanly to your inbox.

Two, we’ll be returning to a monthly cadence, with the goal of giving you a window into how we're thinking about the industry's most pressing challenges. What you can expect in each issue:

One brief, focused essay on a critical industry question, written by yours truly

Featured client work that demonstrates our consulting and research approach in action

Three curated links featuring interesting perspectives on music, entertainment, and tech

The goal is pure signal, no spam.

This month, we're featuring our latest consulting project with Base for Music, and examining the market realities of AI licensing, drawing from patterns we're seeing across both sides of the negotiating table.

If you have any feedback on this new format, please feel free to reply directly to this email — I read everything that comes through.

Thank you so much for your support!

Best,

Cherie Hu

Founder, Water & Music

New client case study: Base for Music's blueprint for profitable music marketing

We're excited to share our latest consulting project: A deep dive into how Base for Music delivers measurable ROI, in an industry where 90% of campaigns lose money.

Over the summer, we partnered with the VC-backed marketing platform to validate their approach through rigorous data analysis. We tracked real campaign data for artists including KLV SLY and Cerrone, conducted stakeholder interviews, and benchmarked streaming performance against industry standards.

Our findings expanded far beyond just raw listener or consumption growth: We found clear connections between fan acquisition and algorithmic amplification, a critical step towards turning the black box of marketing attribution into something measurable.

A statement from our founder Cherie Hu:

"Working with Base for Music gave us unprecedented access to real campaign spend and performance data — something rarely shared transparently in our industry. What struck me most was seeing their platform deliver results for both emerging and established acts. This project exemplifies why we've moved into consulting: Partnering directly with founders to rigorously validate innovations that can shift how our industry operates."

Maxence Bazin, Founder of Base for Music, adds:

"We truly appreciated the opportunity to have our solution reviewed by an expert in music industry analysis such as Water & Music. Our discussions with Cherie were highly relevant and precise; she clearly understood our vision and marketing tools. It is very rewarding for us to see this case study validate the relevance of our approach."

Our full case studies reveal detailed campaign mechanics, ROI thresholds, and the specific strategies that drove these results.

Interested in the complete analysis? Contact Base for Music at raphael@baseformusic.fr.

Monthly essay: How to think about music AI licensing

Fun fact: Nearly all of our active consulting projects right now are related to music AI. And out of those AI projects, the majority are concerned specifically with the relationship between AI and music rights.

While this was not by design, it certainly fits the moment. The music AI licensing landscape is shifting dramatically in real time. Major labels are reportedly discussing settlements with Suno and Udio, while ElevenLabs just launched a fully licensed music model with Kobalt, Merlin, and SourceAudio on board. After years of standoffs and litigation, commercial partnership precedents are finally emerging.

Yet when we speak with rights holders outside the major label ecosystem about the potential AI licensing opportunity, their response is essentially a giant ¯\_(ツ)_/¯

Should I even license? To whom? For how much? For most music rights organizations, these questions about AI's commercial opportunity remain unanswered. And the frameworks being hammered out at the top aren't translating to actionable guidance for everyone else.

After advising both sides of these negotiations, we've distilled the complexity down to three fundamental questions. Get these right, and the path forward becomes much clearer.

Question 1: What's the use case?

The industry often treats "AI training" as a single, monolithic category. In reality, not all AI uses are created equal.

Consider these three different scenarios:

A stem separation tool that needs a diverse, curated set of reference examples — both mixed and isolated instruments.

A full music generation model that needs millions of songs to learn broad musical patterns.

An artist voice model that needs just a few minutes of high-quality examples from a single catalog.

Each use case has radically different commercial implications for rights holders. Stem separation enhances existing music without replacing it, while the outputs of full-stack generation models could compete directly with those of human creators (one of the core arguments being debated in the courts). Voice models raise a whole other set of complex questions about IP, identity, and consent.

The use case determines everything else: Data requirements, risk profile, market impact, and ultimately, deal structure. The mistake is starting with price instead of purpose.

Question 2: What data do developers actually need?

Once you understand the use case, the data requirements become specific rather than speculative. This is where rights holders often discover their assumptions are wrong.

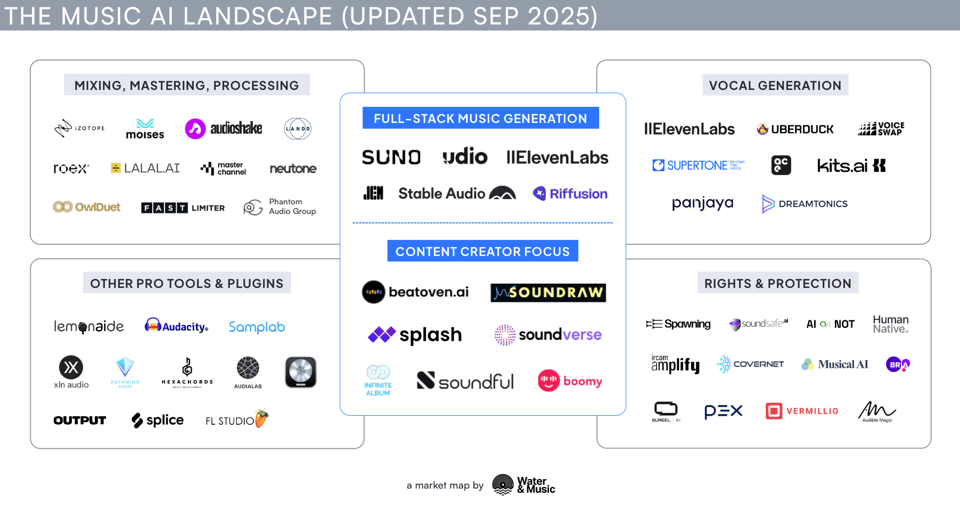

At Water & Music, we distinguish between full-stack generative tools like Suno, Udio, and Eleven Music, and functional AI tools that focus on one step of the creative process such as stem separation, mixing, mastering, or upscaling.

While not receiving as much public hype, many functional AI tools have clean business models and a solid foundation of paying customers. More importantly, they rarely need massive catalogs; quality and curation matter more than quantity.

Depending on the use case, a dataset of tens of thousands of tracks with rich metadata, clean stems, and diverse styles can be worth more than millions of random songs with messy data underneath.

The mismatch happens when rights holders bundle everything they own, rather than understanding what's actually valuable for a specific use case. It's like offering the entire library when someone just needs one textbook.

Question 3: What are the real incentives — and how long will they last?

Incentives are the bedrock of business, and music AI is no different.

While both sides (rights holders and developers) need sustainable incentives, they're often optimizing for different outcomes. As a result, the entire power dynamic is changing.

There are two realities reshaping these negotiations in real time.

First, synthetic data — or artificially generated information used to train AI models when real-world data is scarce or expensive — is getting good enough. Many AI companies can now generate their own training data without touching a single licensed track. It's not perfect yet, but it's improving every month.

Second, open-source models are achieving impressive results with minimal training costs. Outside of music, open-source models are starting to rival proprietary ones; we should treat this as a preview of music's future.

All this means that there’s a fair chance that the AI companies willing to pay for music licenses today won’t need them in 18 months, at least not on the same terms. From the rights holder’s perspective, this isn't the type of negotiation where waiting improves your position.

The successful deals we're seeing recognize this reality, and use creative structures to work around technological uncertainty — e.g. revenue sharing that scales with usage, equity stakes for long-term alignment, or attribution systems that ensure ongoing compensation.

Moving beyond the shrug

The three questions outlined above — use case, data needs, and incentives — are a first step towards cutting through the complexity of AI, by changing abstract anxiety into concrete business decisions.

Small differences in how you answer these questions create massive downstream consequences. License to the wrong use case, and you might enable your own replacement. Provide the wrong data, and you've wasted leverage on low-value assets. Structure the wrong incentives, and you're either leaving money on the table or killing the deal entirely.

While the ongoing major-label and big-indie deals with AI companies will set precedents, they won't answer every question. Other indie labels, publishers, and production libraries need frameworks that reflect their unique positions.

In our view, the difference between thriving and surviving in this market comes down to a mindset of proactive innovation. As a rights holder, you can ask two fundamentally different types of questions:

The defensive stance: "How do we stop AI from replacing our artists?" "What's the minimum we should accept?" "How do we prevent unauthorized use?" These questions assume AI is something happening to the industry, a threat to minimize.

The strategic stance: "Which AI applications could amplify our artists' reach?" "What unique data assets do we have that AI companies actually need?" "How can we become essential partners rather than reluctant licensors?" These questions recognize AI as something the industry can actively shape.

The AI licensing landscape is finally moving from theory to practice. For rights holders ready to engage thoughtfully, the opportunity is real; for those waiting for perfect clarity, the window may be closing. ★

Want to explore what AI licensing could mean for your catalog? Have other burning questions on music and tech that we could help answer? Dive deeper into our consulting case studies and book a discovery call. Or, just reply directly to this email — we read every response and would love to hear your perspective on where this market is heading!

Cool links

Three interesting perspectives on music, entertainment, and tech.

It’s the Inventory, Stupid!

Music-tech founder and consultant Jack Stephens writes on why attempts at ticketing disruption often fail, especially in the U.S. Without access to the tickets fans want to buy, even the best tech innovation is functionally useless. And in the U.S., most inventory is locked in exclusive venue deals that the likes of Ticketmaster and AXS pay millions of dollars annually to secure. This echoes Water & Music's 2021 analysis asking "Where is the Spotify of ticketing?" — the answer being that unlike music streaming where songs can appear on multiple platforms, ticketing in the U.S. operates like if Spotify had 100% exclusive content and was also owned by Universal Music. A key aspect of Jack's proposed solution involves open APIs that modularize inventory, letting tickets flow wherever discovery happens (similar to what happens with airline travel).

The K-popification of F1

For Teen Vogue, culture writer Crystal Bell tracks how Formula 1's fanbase transformed from male-dominated grandstand brawlers into friendship-bracelet-trading, fancam-creating communities who discovered the sport through online spaces. Women now comprise 41% of F1's 750 million fans, and many of them treat racing teams like boy bands. For artists and music companies watching streaming fatigue set in, F1's success turning athletes into multimedia franchises could offer a valuable reference for cross-platform narrative-building, especially in a way that keeps fans emotionally invested between main events.

Music and Artificial Intelligence: Artistic Trends

Stability AI researchers analyzed 300+ AI music artworks to map how artists actually use AI tools in their creative process. They found that most artists retain creative control through co-composition and sound design, rather than relying on full AI generation – a stark parallel to our commentary earlier in this newsletter about the value of functional vs. full-stack tools. This seems to be good news for professional artists: Those who maintain agency while exploring AI's unique capabilities (e.g. scalable multi-genre generation) create more lasting impact than those chasing pure automation.