Network Mode

Startups thrive in logistics and agriculture by leveraging existing networks, not building platforms.

Platform vs network

From the outside, a platform in legacy domains looks like a reasonable solution for solving many of the stakeholder transaction problems .

In the case of farmers, it is to help find buyers. Or shippers who are looking for trucks to move their cargo.

From the inside, things are starkly different. A platform is a bottleneck and an unnecessary middle layer for enabling these transaction.

Then there are networks which are interconnected web of associations with other stakeholders who facilitate a transaction. These connections will seem inefficient to the uninitiated but are built over the duration of multiple transactions in the domain.

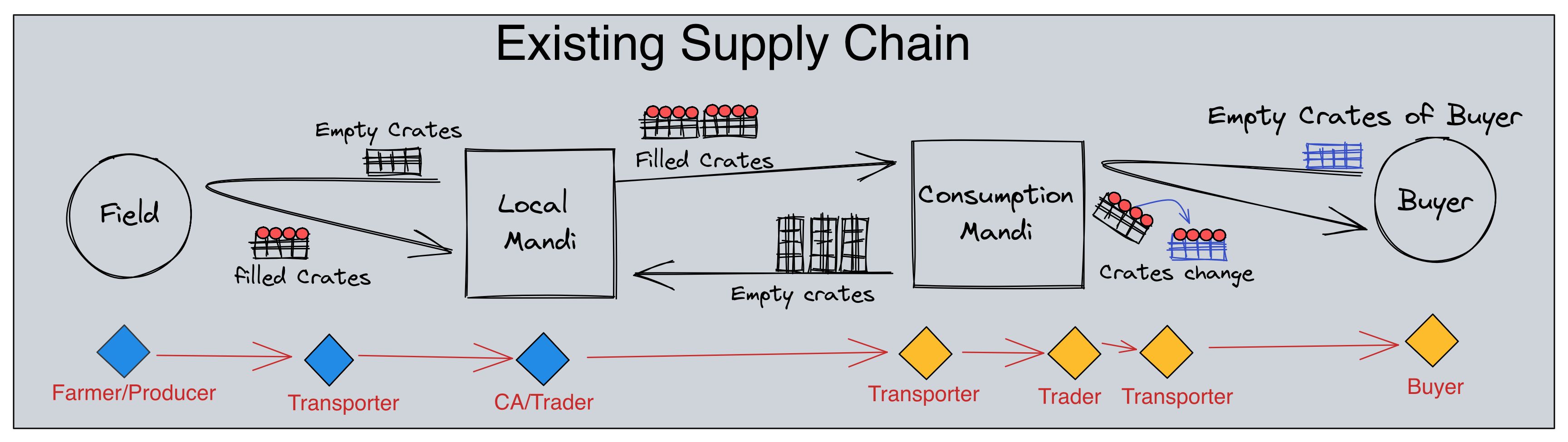

Going back to our example of the farmer. For the sake of outlining, let us assume that they grow tomato. The supply chain looks as outlined in the following illustration.

Farmer hands over produce to first mile transporter who is hired by trader that sells the farmer’s produce at local mandi(marketplace). The eventual retail buyer who sells to consumers like you and me is 3 more hops away.

The number of stakeholders interconnecting the eventual buyer to farmer is what the platform will need to integrate for it to add incremental value.

We need to consider that the immediate stakeholder that interacts with the farmer is local and one phone call away. Intermediating these interactions in a new format often reaches the outcome, death by thousand cuts.

I have survived working for a business to tell the tale of slow decline in trying to build a platform in agriculture. Slowly revealing that they are existing to serve not the stakeholders but mainly themselves. I have since moved on to an another business executing within a network where I see the value created due to an innovative product.

The reductionist version of building value in domains like agriculture and logistics is based on transactions within the network or increasing the network for individual stakeholder.

And, if someone suggests ride sharing as an example to talk about success of a platform businesses. Don’t bother and just say that we are in the business of managing stakeholders which is all together a different ball game.

Round up

I spoke a lot about networks without giving you any operator insight. We have Anvesh who happens to be one of the best operators in logistics. He has started writing down the lessons learnt building a team and a product extracting network knowledge as a new entrant.

Linking all of them for your reference with a little bit of context from yours truly

Power Dynamics in spot trucking

There are 3 stakeholders who interact with one other within their own networks to move a agri-commodity shipment. This article outlines the power equation across different stages of shipment.

Digital broker X Local broker

This article outlines how digital platforms have categorically failed in understanding the distributed networks in play when it comes to transport brokers.

Links that resonated

The existing Financial Gaps in Logistics

Prince writes one of the best Fintech Newsletters out of India. He penned a piece that outlined the entire Trucking market of India while viewing it as fintech opportunity.

In this process, commercial fleets power the entire supply chain from the first to the last mile. And there are more than 15 Mn vehicles on Indian roads today that do this daily (not accounting for the passenger three-wheelers or buses). Quietly underlining all the consumption, production, and trade in the country.

Over decades, many organised commercial fleets have attempted to capture large parts of the commercial road transport segment. Yet the largest of fleets continue to remain only a fraction (<0.01% each) of all commercial vehicles on the road. In fact, the sector remains so deeply fragmented that the small-fleet operators continue to make up 70% of all commercial fleets.

The entire article consists of data surrounding the trucking. Primarily due to lack of transaction data and secondarily due to the incentives of Small Fleet Owners.

He did allude to it slightly but the trigger nature of logistics(bottom of the value chain) is why Fleet owners are always under-capitalised.

….to cover their underwriting risk, lenders seek some recourse or guarantee from borrowers. A common recourse is to only underwrite invoices of a well-regarded anchor. However, for this segment, we found the process of anchor evaluation to be of higher scrutiny than for other vendor segments. This is because, in times of stress, corporations de-prioritise the payouts of fleet operators first. We understood this to be due to the lower switching costs for corporates of their fleet vendors, compared to the other vendors.

In a supply chain crunch, the fleet operators are often short changed. This is not unfortunate but the nature of the business as trucking is a commodities service without any of the value addition activities of 3PL(3rd party logistics service).

Sign off

The success of startup in agriculture and logistics is predicated on building within the network. This is the root cause of why startups end up hiring from the industry.

If you are supplying commodity to a company. Hire the procurement agent of that company and make him/her your sales agent. Task the person to sell to their previous company itself from the other side.

Your platform is the cost of doing business for the sales agent. So, he/she will put up with it until it not mandated by you in the pursuit of more business.

When this happens, all pretence is out of the window. You have just hired a node off the network and became a part of it without adding any value.

Signing off till the next time,

Vivek, witnessing trucking industry for over half a decade.