Learnings from public companies

Exploring the freight market's health and future through analysis of public companies' actions, mainly in the logistics sector.

Mapping the ecosystem

We should have more public companies to understand the depth of a domain and the health of the market.

Most of the writing of a public business is to understand the movement of stock price which is far less fun than understanding how operators are viewing the market and future earnings of their company.

It also helps in providing context around the challenges you are looking to solve if you are building in a similar space.

Lately, I have been spending time reading the transcripts of public companies in the logistics space. Both in India and US to make sense of the freight market.

I am using the LLM chat interface in Quartr to generate some basic reports that would help me layout the map of the ecosystem.

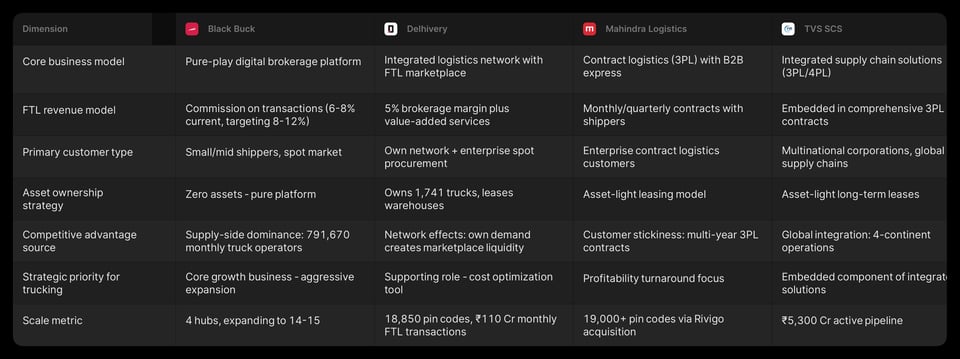

Let’s start with the lay of the land in India. I am considering 4 companies with differing business models and strategies but operating in Indian freight market.

Blackbuck which recently became public on the merits of having a large supplier base for value add services to fleet owners and the potential to grow in the $180 billions road freight economy. They state around $120 billions is currently serviced by offline brokers making 8-12% margins with 30% efficacy, book 2-3 loads per day when faced with 20-30 loads.

Delhivery which built its network and business servicing e-commerce companies is using Full Truck Load , FTL as a means to optimise its own Parcel Truck Load(PTL) and Less than Truck Load(LTL) costs. Their revenue has been flat and huge uncertainty about whether it is possible to grow FTL business .

Both TVS and Mahindra are focused in the business of managed transportation. FTL is one part of the managed service. Signing big enterprise contracts is their GTM as 3PL and 4 PL.

While India was busy proving the potential of on the road freight, companies in US and Canada have been busy deploying AI.

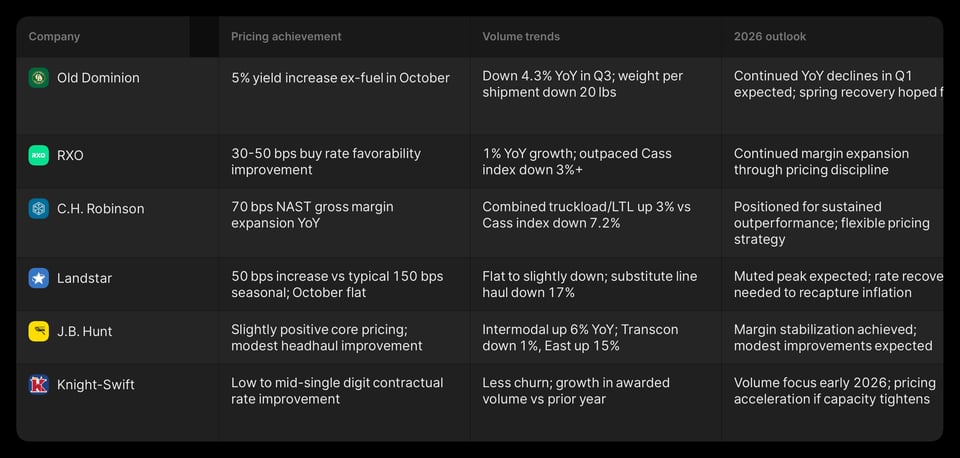

5 of 6 companies listed in the table dropped the word AI and productivity in the same paragraph. The productivity gains are significant that they are reporting in earnings call.

AI and productivity gains are only the positive trends in a stagnated freight market with soft rates for on the road freight.

Even the volumes have been down to make any significant investment. The operating income1 was flat for most of the companies. And things are not looking any better for the next year.

Operating in this space ties to the concept of being macro aware but micro focused2. When talking to folks or prospects in either regions, I have a better sense of the situation and use it to make a problem or propose a sale.

Blackbuck hasn’t even scratched the surface of the brokerage business in India and Brokerage entities in US haven’t really leveraged AI to retain better gross margins.

Disclaimer: This is not investment advice and the point of view is mine alone.

Round up

Two pieces on my personal blog to get into flushing out an idea first.

Moments of Serendipity turning into a haphazard career

Work has to be more than just means to an end, it needs to be where I play and exercise my creative juices. I read business literature as a recreational activity. It’s fun for me and I want my work to feel like play when delivering outcomes.

Second post is about deploying AI agents in legacy domains like Logistics.

Deploying Agents in legacy domains

The real skill for technology companies in legacy domains will be mapping the workflow and deconstructing it into simple components.

I will be writing more of my thoughts on my blog which will help connect multiple themes.

Links that resonated

Inside Cursor is a post by Brie on Cursor org for Colossus magazine.

There are only two strategies left in B2B marketing is a post by Sriram who is a startup operator in startup marketing space.

Sign off

I have been actively posting on LinkedIn about the public appearances I am doing as a representative at the day job. This has led to limited time to write the newsletter post. It’s a similar story for the following week as well but I plan on posting most of my LinkedIn writing first on the blog.

The reason behind the decision is the many number of bad takes in the domains I follow and hassle of refuting each one indirectly. If I am writing through my thought, why not present it in the most native environment first and make it part of the network of posts.

Signing off till next time,

Vivek, flexing writing muscle.