Aggregators vs platforms in logistics

Build platform not aggregators in logistics to future proof marketplaces

Concept meets context

Much of the literature around marketplaces is based on FAANG (Facebook, Apple, Amazon, Netflix and Google).

Stratechery’s series of articles on aggregation theory are accessible and hence a good place to start.

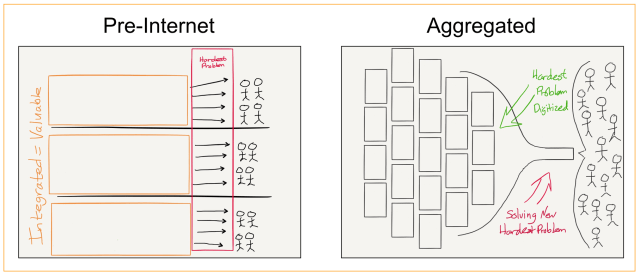

The fundamental disruption of the Internet has been to turn this dynamic on its head. First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

This has fundamentally changed the plane of competition: no longer do distributors compete based upon exclusive supplier relationships, with consumers/users an afterthought. Instead, suppliers can be commoditized leaving consumers/users as a first order priority. By extension, this means that the most important factor determining success is the user experience: the best distributors/aggregators/market-makers win by providing the best experience, which earns them the most consumers/users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.

The above framing makes complete sense when you look at most of the consumer marketplaces, Airbnb, Uber and Netflix. Each one of them scaled by leveraging better user experience in aggregating demand while commoditising suppliers. The conversation of attractive profits article unpacks how each one of them achieved the commoditisation of their suppliers.

Now coming to Logistics, in the last issue I wrote about how logistics service providers are already a commodity service. They are modularised due to the constraints on region and nature of transaction.

With Netflix, you are essentially viewing content in the form of film or series.

In logistics, a transaction for a company involves multiple service providers. You stitch these transactions across suppliers and co-ordinate the execution to move the goods from one point to another.

We are essentially a service provider looking to differentiate when the market forces our services to be commoditised. It is local in nature and for a company looking to move goods, it ties multiple such service providers together to make it happen

Building a marketplace to enable transactions between counterparts is what software service providers strive to achieve in logistics. Yet, we are still to witness the success of an aggregator who has successfully aggregated demand to make suppliers flock to the system.

I will go out on a limb and say there are no strong network effects or large economies of scale in logistic marketplaces.

Instead there is an immense opportunity in building the multi-sided platform where counterparts transact. For this, we first need to highlight the definition of platform.

A platform is when the economic value of everybody that uses it, exceeds the value of the company that creates it. From Bill Gates Line

So what could be the value a platform company can create for counterparties to transact on it. First, it shouldn’t be in the business of providing the service with the platform.

For example, digital brokers will always run into the problem of principal agent priorities. Should we prioritise the better margin loads for our service or for the benefit of other service providers.

Second, it shouldn’t mediate the match. It should rather assign a value to the potential match between two counterparties relative to all potential matches between counterparts.

If there are 10 carriers and 5 companies buying freight from the carriers. The possible combinations are 50 and if the platform can provide a pricing function to all 50 transactions, each can decide who their counterpart should be.

This is similar to clearing house functionality where the overall supply and demand aggregate for a commodity or company stocks available to trade. It allows diversity in type of transactions to not matter as much and all counterparts could then build their businesses on top of the platform. And yes, it is required even when agents represent the companies when negotiating a transaction.

When you build such a platform, regional limitations of the logistics don’t become a bottleneck. On the same platform a multi-national company could transact with carriers in each of the continents and it would be able to take the decision by the price attached to each of those transactions. The dollar amount may be different but it can benchmark its buying basing on the price. Did it save compared to the value of the transaction.

As an employee of a publicly traded company, you get to buy shares at a discounted price. The value of the share doesn’t change, you get to buy it at a cheaper price because your employer decided to offer it you, their shareholders.

Similarly, in the above example of multi-national company buying freight. If they are buying freight in USA and India, they will have a price attached to each transaction. Suppose that the company bought freight cheaper than the listed price in US and expensive than the listed price in India. They bought freight in contracted rate in US whereas in India they had to go the spot route. The value of the transaction was ascertained relative to the conditions the company inhabits in both US and India, and now it knows that it needs to improve its operation in India to buy better than the listed price. The platform should be able to enable this extension of expertise for the company.

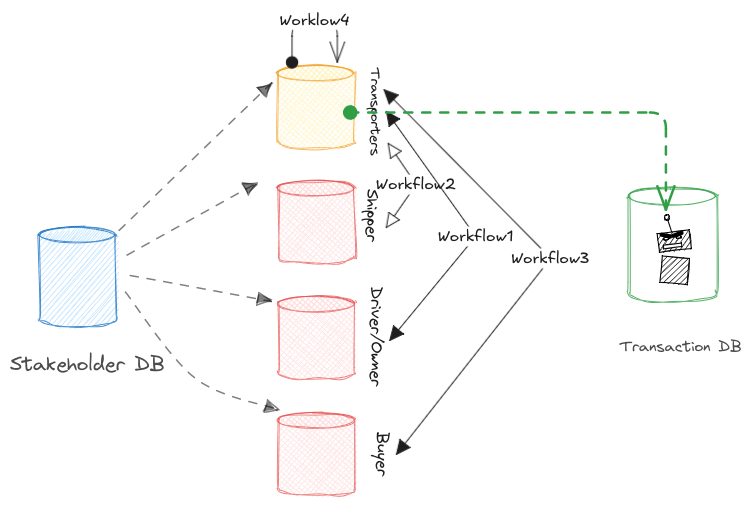

All of this comes to down owning the data and then using that data to build the pricing function.

This illustration and following excerpt of Data Networks in SaaS Marketplaces does a fantastic job of concluding this point.

…. Because SEMs(SaaS enabled Marketplaces) deploy SaaS to both the supply side and the demand side, these companies can develop an exceptional understanding of their market. Access to supplier data and consumer demand provides four key advantages to SEMs.

First, SEMs understand the supply/demand curve at every second. … Second, SEMs understand the operational excellence of their suppliers. … Third, the accumulated data on both consumer demand and supplier performance compounds into a unique data asset that erects a moat around the business. … Fourth, because of the visibility into supply/demand, a deep understanding of supplier excellence, and the ability to identify the right types of buyers and sellers, SEMs benefit from a more efficient go to market.

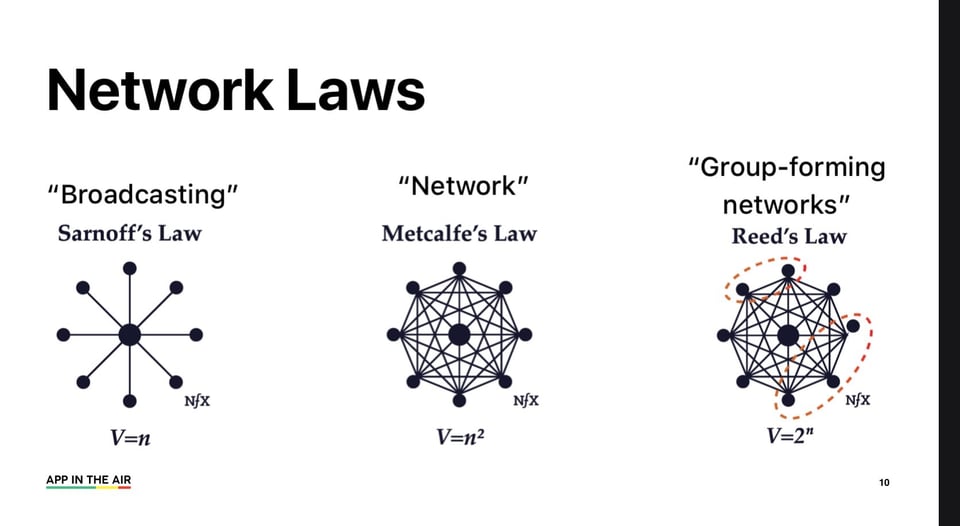

The node in the network is not the counterparts that are transacting, instead it is the transaction itself. Once we move past seeing entities are nodes in the network to contracts as nodes. Moats can be built using laws of network effects on demand size. They come in three types.

A type of transaction of many companies of a specific region is on the platform. Then value of network is derived using Sarnoff’s law comes into play. Each new transaction is connected to all the other similar transactions in the region. And the value of network is in providing relative performance compared to the cohort.

Differing types of transaction on the platform exponentially increases the value of the platform as in Metcalfe’s law as it could derive different causal inferences through correlations. Each new transaction increases the value of the network to the twice the value of the network. A platform that will predict future outcomes of similar transactions by training on all the differing transaction parameters.

Category of Company with type of transaction leads to formation of clusters, analogous to groups. The value of platforms comes from multitude of groups a single transaction can be classified under. Value of the network is showcased if you want to generate the market sentiment of different transaction types across different categories of companies.

Viewing the transactions as nodes and then layering the network effects on the demand side and economies of scale on the supply side is a good place to start. On the operating side how you go about building the marketplace depends on pricing function that you ascertain to each transaction and the take rate of your platform. You could get a good head start if you follow the principles prescribed in these series of articles from my super boss.

But it all starts with constraining your marketplace to a specific transaction type and defined region till you reach density to represent the market.

Round up

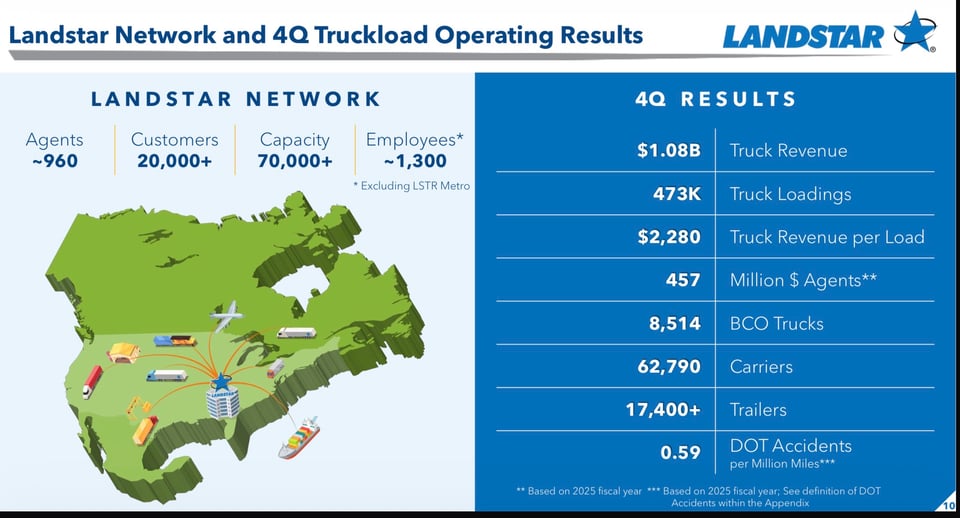

Agency model is US and commission agents in Indian trucking both are very similar. Both operate with the focus on making the carriers/truckers to make them the first port of call when looking for their next load.

They do it by aggregating supply and then finding demand that can routed through them. The latest Landstar reporting emphasised a log on deploying AI agents to their own agents.

With a network on 980 agents in its network. It would be interesting experiment to see.

This ties to an earlier post I wrote about LLMs being used to improve the productivity of a commission agent.

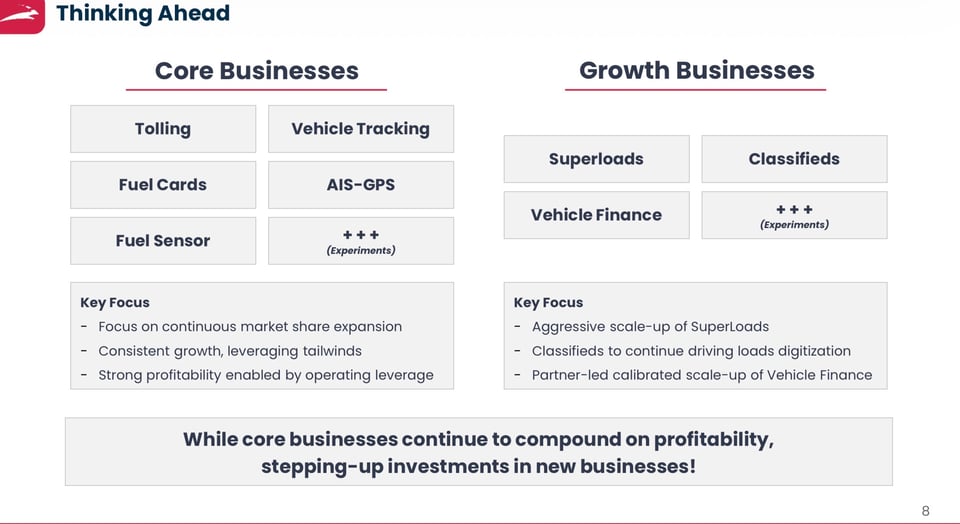

We have Blackbuck reporting its quarter results and it is building a managed marketplace business, Superloads. It is currently live in 9 cities and many of the questions in the call where around how many more cities it will scale to. The current approach they are taking is inherently not scalable because its non replicable.

This is also being mimicked by other public companies in this space.

Instead if you could build a AI toolkit for commission agents to speed up their operations without changing how they do business. You will be scaling up pretty fast.

A commission agent has an AI agent that does all of his or her back office work in a seamless way. So that they can continue to focus on building and growing their network.

Build the platform not aggregator. If you come across anyone in India building this right now, do let me know.

Disclaimer: All opinions and words in this post are solely of yours truly and doesn’t represent the views of my employer.

Sign off

I am skipping links this time around. It is already long and honestly little all over the place in my opinion. I have broadened my focus area so revisiting the topic of marketplaces once again in my day job and it is leading me to different rabbit holes.

In the process of writing this post , I have opened 10 tabs on network laws. All to say, this is a first stab at the concept and through multiple recitation over here it is going to get sharper and tighter in its framing. But I believe I am directionally correct at the least.

Singing off till next time,

Vivek, fattening up due to cold winters and windstorms