The High Cost of Capitulation

I’m going to keep today’s newsletter relatively brief because we are traveling. We’re on our way back from a weekend in Al Ain, in the interior of UAE. It is sometimes called the Garden City, and is home to one of the largest oases (that’s the plural of oasis, apparently) in the region.

Last week we talked about affordability in the US and I gave four examples of items whose recent price appreciation has far outpaced inflation: streaming services, used cars, the housing market, and an anecdote about my recent watch purchase.

But if we widen our aperture a touch there are two other sectors where prices have climbed even faster: higher ed tuition and healthcare costs. The latter is my focus today.

As if on cue, the week served up developments that are going to make all of this much worse.

The longest government shutdown in US history came to an end as Senate Democrats capitulated to the administration’s demands to eliminate subsidies for Affordable Care Act plans. An estimated 22.5 million people, or roughly the equivalent of the entire population of Taiwan, rely on those subsidies to buy health insurance.

Before going further I think it is worth revisiting what the ACA actually included:

Part one is the individual mandate. In theory, everyone is supposed to have health insurance. The ACA created a tax penalty to push people into coverage, but that penalty was removed at the federal level in 2017. However, many states kept or imposed their own penalties for going uninsured.

Part two is Medicaid expansion. This broadened eligibility so that more low-income people could receive insurance. It drove the uninsured rate down in a historic way and saved countless lives. Medicaid is funded mostly with federal dollars and administered by states. Most states accepted the federal money for expanding Medicaid. The ones that did not were universally run by Republican governing majorities, see below. Make of that what you will.

Part three is the creation of ACA exchanges, the part that matters most today. These are marketplaces where people who are self-employed, freelancers, work for companies without benefits, are retired but not yet eligible for Medicare, or who are otherwise outside the employer-provided healthcare system can go online and buy health insurance.

The exchanges are at the center of the present tumult. The ACA created subsidies for people who buy insurance on these marketplaces, and those subsidies were expanded during the pandemic. Eliminating them will send premiums soaring.

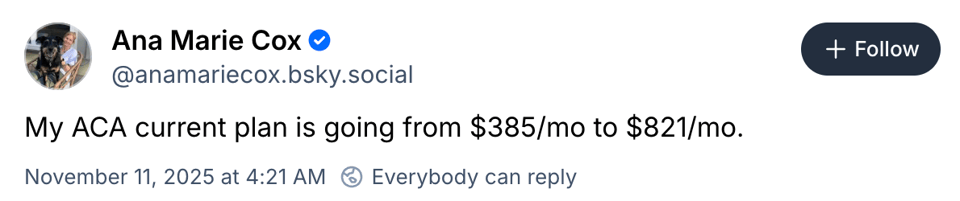

This week I came across a thread where people were sharing their current premiums and what their insurers told them to expect next year. The numbers are jaw-dropping:

The news was worse in the replies:

“Mine is going from $1200 to $2112 and I am sick to my stomach every time I think about it. I don’t know what me and my kids are going to do.”

“$160 to $1280 here.”

“$192/month to $1273/month.”

“$350/month to $2781/month, bronze HDHP with an HSA for 2 middle aged non-smokers.”

People are being told to expect soaring premiums for the same coverage, and at the same time they are being hit with higher deductibles and higher out-of-pocket costs.

They are literally paying more to get less.

If Americans are already struggling to pay more for streaming services, for their cars, and for housing, getting a three to eight hundred percent spike in the cost of simply holding an insurance policy is going to tighten the vise even more. And this is not even the cost of receiving care. This is the cost of possessing the card that allows you to enter the system in the first place.

It’s a whole ass and fully foreseeable and preventable for families.

Before I get out of here, I want to plant a mental flag in your head that we will pick up next week: corporate profits are a zero sum game.

When we talk about consumer prices rising much faster than inflation, we are talking about a wealth transfer from Main Street to Wall Street.

In addition to tariffs and inflation, greed is the reason you are paying more for your groceries at Walmart or Kroger. National chains are fattening their bottom lines in the name of shareholder value. The same is true for vehicles, apparel, and especially healthcare. Libertarians have this adage “taxation is theft” and I’m always like “no my guy, dividends and stock buybacks are theft.”

We are going to return to that idea next week.

For now, I want to hear from you. This is usually about the time in a series cycle when reader responses start coming in. Consider this the Reader Bat Signal. If you have thoughts about affordability, the Democratic capitulation on ACA subsidies, or any of the threads flowing in this conversation, I would love to hear from you.

See you in seven days.