The Fifty Year Mortgage

Last week we wrapped our series on wealth consolidation and the billionaire class. But you all, and the impunity of the oligarchs, keep dragging me back in.

I closed the series by saying “We’re living through a second Gilded Age, only this time the monopolies are not just over steel or railroads—they’re over attention, speech, and reality itself.” Reader P.C. immediately replied to the email, pointing me to the Great Gatsby themed party at Mar-a-Lago. The symbolism is impossible to ignore. The president of the US, literally cosplaying the Gilded Age at the exact moment that food stamp benefits lapsed for millions of households.

If that’s not on-the-nose enough for you, later in the week, the White House went before the Supreme Court and successfully blocked the resumption of SNAP benefits during the shutdown. It was a one-two punch that captures the impunity of our moment. Our first billionaire President hamming it up while millions of Americans are pushed into food insecurity.

Relatedly, Tuesday evening Zohran Mamdani won the New York mayoral race, running on a platform centered on affordability in the city. Which brings me to the topic for today and for the next few newsletters. For the record, I do not prefer to do multipart series. I like each newsletter to be responsive to the moment. But sometimes the moment demands more than the standard eleven hundred words.

Affordability is the defining political issue of our moment. It goes by many names. Every conversation about inflation, housing costs, healthcare costs, tuition, insurance premiums, childcare, groceries, repair costs for cars, transit fares, hell the cost of a beard lineup, is a conversation about affordability.

My vantage point on this is atypical. I earn a salary in a currency that is pegged to the dollar. I save and invest in US equity markets. I move between these two price regimes enough that I can make clear, apples-to-apples comparisons on the cost of goods here versus what I pay when I go back to Washington or when I send things to family in Tacoma.

The short version is simple: y’all are getting squeezed from every direction. From the cost of streaming services to ATM fees to surcharges on utilities to the cost of healthcare and prescriptions, everything in the US costs more. You don’t get more for your money—it just costs more.

Here is a concrete example, a bougie example, but still illustrative. I recently decided to retire my Xiaomi smartwatch. It cost me around fifty USD and had reached the end of its usable life. I wanted a dress watch and had my eye on a Citizen. I spent a fair amount of time this fall looking at marketplaces like Chrono24 and the r/Watches subreddit. Once I settled on the timepiece the math was fascinating.

If I bought the watch online from a marketplace (or a certain Seattle based retailer) and had it shipped to my mailing address in Tacoma (as a Christmas present to myself), thanks to tariffs, I would have paid more than $350, plus ten percent sales tax. If I bought the same watch here, sans tariffs, it would cost $252, and arrive that evening.

That is only one example founded in my conspicuous consumption. But the larger truth is that life in the US has grown steadily more expensive over the last few decades without any corresponding improvement in what people receive for their money.

We all understand this intuitively, but it helps to put real numbers in front of us. Here are three quick concrete comparisons. In each case the price increases far outstrip the rate of inflation.

In 2011, Netflix streaming service cost $7.99, ($11.54 adjusted for inflation). In the interim they’ve enshittified the service by adding ads. A “standard plan”, now required to get the same ad-free experience, is $17.99, far outstripping inflation. The story is the same with every streaming service.

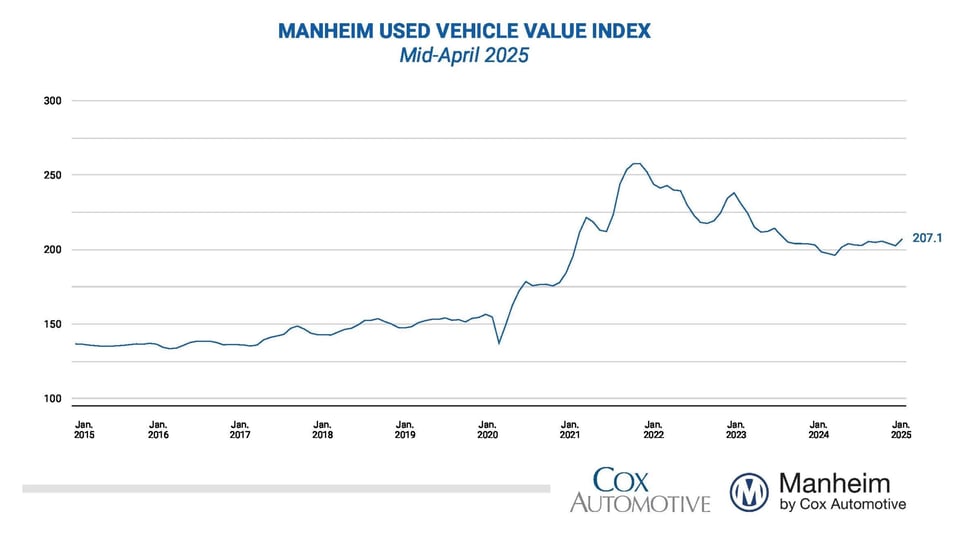

Let’s look at used cars.

We know that the price of cars and car parts spiked during the pandemic because of supply chain failures and production bottlenecks. Prices have come down from those highs, but the median price of a used car is still more than $7000 higher than it was a decade ago. Again, far outstripping inflation.

An apologist for the auto industry might argue this is because the typical used car on the market today is “newer” than the used cars of ten or fifteen years ago. But that is not evidence of improved value. It reflects the fact that newer vehicles are turning over more quickly, often because repair costs are so high that owners replace cars sooner. The shift to “newer used cars” is itself a symptom of the broader affordability crisis, not an explanation for it.

Lastly, we know there’s a housing and rent affordability crisis. I’ve documented it thoroughly in the podcast and the newsletter and don’t want to waste your time rehashing all that (but if ya want, try here, here, here and here).

However, I noted this week that in response to housing affordability concerns, the White House rolled out a proposal to introduce a fifty-year mortgage. I can't overstate how awful a policy this is. It would trap homebuyers in a near-permanent debt cycle:

Here's some back of the napkin actuarial math I shared on Bluesky for a fifty-year mortgage for $300,000 at 6%:

Principal: $300,000

Monthly Payment: $1,579

Total Interest Paid: $647,520

Total of All Payments: $947,520

I picked those figures because I could do that math.

The median home price in Q1 of 2015 was $204,700 (inflation adjusted, $280,513). But the median home price in the US has soared to $462,206. Again, outstripping inflation. So someone using one of these mortgages would pay $1,000,000 in interest to the bank over the lifetime of the loan.

This is not an exaggeration—a million dollars in interest per home.

This is not a lifeline to homebuyers; it’s a giveaway to banks and bondholders. If I were a bond trader, I would break someone’s arm to get my hands on a six percent note with a fifty-year maturity and a steady stream of payments backed by residential collateral. It is a dream product for the financial sector and a lifetime shackle for buyers.

Affordability is a slow, grinding erosion of security, opportunity, and dignity.

In the next few newsletters, I want to explore where this crisis came from and why it’s gotten so much worse over the last few decades.

Buckle up folks, we’re finna get wonky.