Affordability: This Math Ain't Mathing

Life in the United States for the lower 75% of income earners has become unaffordable. For people in the bottom 25% it's a full blown crisis.

This has been the topic of an ongoing series in the newsletter that I will conclude today by sharing thoughts that came in from readers and tossing in some data to paint a more full picture of the moment. This is the fourth in our affordability series but as reader S.K. pointed out, the series on affordability is functionally a continuation of the series about oligarchic wealth consolidation. So maybe this is actually Part 9.

First, let's ground our conversation in data:

The median US family earns $83,730 dollars per year, or $6,977 per month.

The median single family home rents for $2,018 a month, while the median apartment rents for $1,659.

The median US family spends $438 on groceries each month.

Health care costs for the average US family total $35,119; this is covered by a mix of government spending & subsidies, employer contributions, insurance coverage, and out of pocket expenditures.

The cost of owning a vehicle in the United States is roughly $6,900 per year.

The median US family has $6,523 in credit card debt, a number that is trending upwards.

You can see pretty quickly this math ain't mathing.

What is emerging in the US is what economists call a K-shaped economy (see video below).

In this emerging paradigm, wealthier households make up a larger and larger percentage of consumer spending while households in the bottom 75% of the economy find themselves in increasingly precarious financial situations. A recent USA Today headline describes it aptly: Rich people are spending. Everyone else is cutting corners. Working families are finding themselves squeezed in every direction and that squeeze has been super-charged by the imposition of tariffs by the current administration. In particular the situation is especially dire for the bottom 25% of the income scale and households earning at or around the minimum wage.

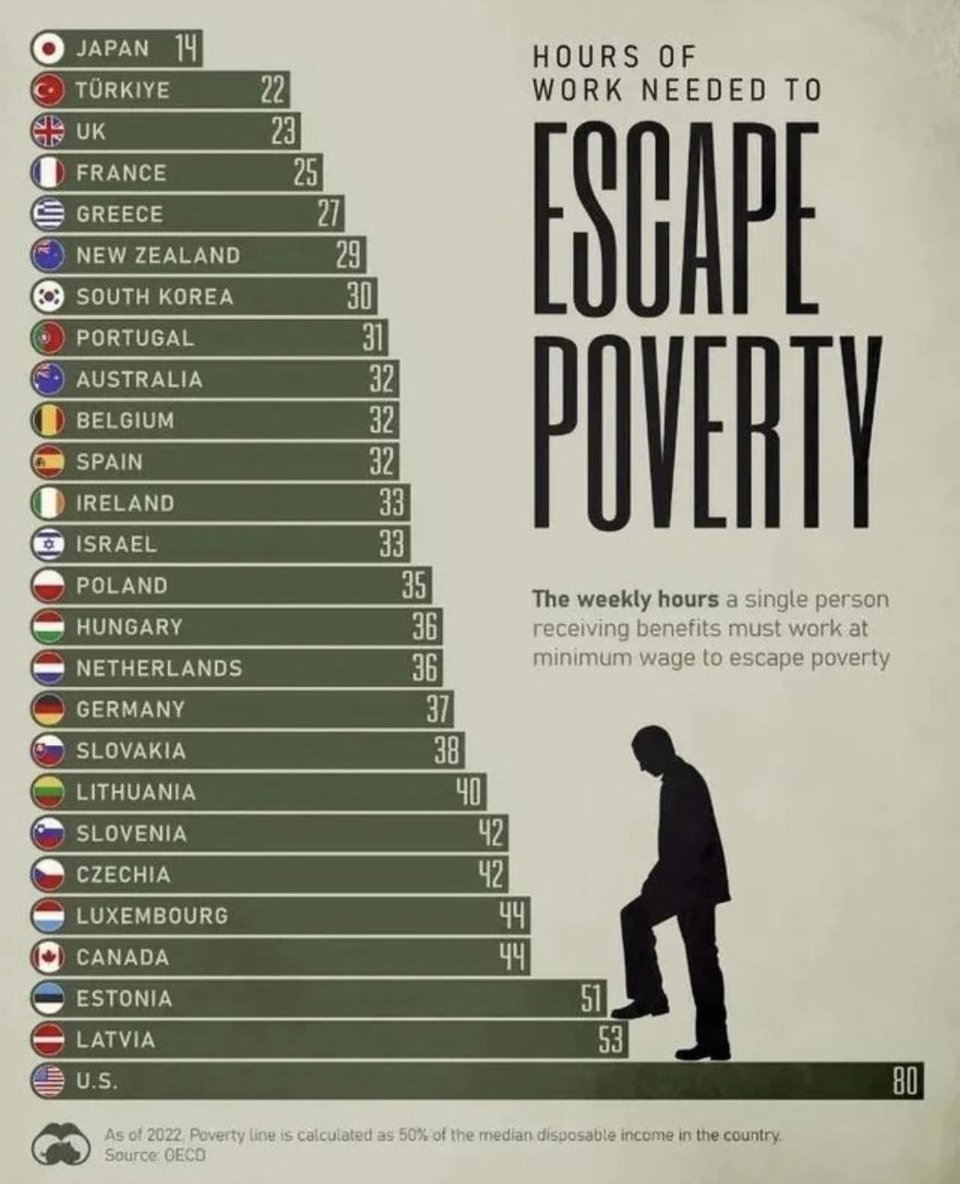

A reader, I.C., shared the following image; the picture tells a thousand words.

Because of Republican opposition and Democratic ineptness, the federal minimum wage is frozen in amber at its 2009 level.

The math is blunt. A worker earning the federal minimum wage has to put in roughly 80 hours a week to escape poverty in the US. That is more than five times the hours required in Japan and more than triple what a worker in the UK would need. While thirty states have set higher minimum wages, twenty have not, locking millions of people, especially women and young workers, into a poverty trap they cannot reasonably work their way out of.

Again, this math ain't mathing.

One reader, M.M., pointed out that most working-class Americans are not able to grasp how comparatively high the costs they pay are relative to people elsewhere because they don't leave the US: “if you don't leave the country you have no idea how much worse we have it.”

My brain always goes back to the comparative cost of rent. For example, the average rent in Tacoma, Washington, $1,800, costs more than rent in Rome, $1,210, or Manchester, $1,401, and it's not particularly close. Further, folks in Rome and Northern England aren't burdened with health care premiums and benefit from ample public transportation, further reducing their relative cost of living and offsetting wage differences relative to the US. But you would not realize any of this unless you found yourself in one of those cities randomly Googling the price of apartments while riding the metro.

Reader M.D. pointed out the complicity of Democrats in the affordability crisis and how it has contributed to the party increasingly being in the political wilderness:

The Democrats are having a bit of a reckoning. They focused on college educated upper-middle class voters for so long they completely lost touch with their working class base.

Just this week, House Minority Leader Hakeem Jeffries (D-NY 8) floated a new slogan meant to rival Trump’s “MAGA” message. The cringey “strong floor, no ceiling” lands like something lifted from George H. W. Bush’s 1988 campaign. The inability to articulate a message that resonates with working people is how Democrats ended up where they are—in the minority despite the least popular president of my lifetime—and why they are likely to stay there.

After the most recent newsletter, where I wrote about the ways Wall Street’s earnings obsession holds down wages and adds to the weight working families carry, Reader C.C. passed along this absolute banger of a piece.

Here is the money quote:

Since the electorate’s retirement is now fully tethered to equity performance, the government has no choice but to intervene. The “Fed Put” isn’t just about financial stability; it’s about social stability.

This is why the market is guarded by both sides of the political aisle. Democrats and Republicans alike cannot afford a crash because it destroys not just the middle class but also their donor class. Add it all up and the S&P 500 has effectively become the national pension system.

And like any “Too Big to Fail” entity, it incentivizes moral hazard. If the government must support asset prices to keep the pension system solvent, then risk is effectively subsidized. This is the mechanism behind The Theater of Nominal Growth. We cannot allow contraction because contraction now means destitution for the voters.

Because working people have been shunted into defined contribution, self-funded retirement schemes, their futures are wedded to stock market returns in a way that people in similarly wealthy democracies find unimaginable. According to Gallup, sixty-two percent of US poll respondents reported owning stocks. Because of a more robust pension system, in Germany that percentage is only about seventeen percent.

The result is many in the US thinking and voting like investors and supporting pro-corporate policies rather than pro-labor ones. Picture your friend who opposes taxing the wealthy because “they’re going to be rich one day” or think about how many times you've seen people excuse the lawlessness of the administration by talking about the performance of their portfolio.

Tying a dignified retirement to perpetual 7–10% S&P 500 returns, rather than it being a public good guaranteed to all people, is great for Wall Street and death to working class solidarity.

I reckon this is the part of the newsletter where I’m supposed to pivot to solutions, but you can’t treat a patient who is indifferent to the diagnosis and unwilling to begin the therapy. I don’t know how to unring this bell, but what we’re living through—unprecedented wealth consolidation driven by monopoly capitalism and the rise of a K-shaped economy where half the country can’t afford daily life—is functionally the French Revolution in reverse.

This is a path we were set on during the Reagan/Thatcher Trans-Atlantic consensus and one I don’t think we’ll emerge from until we can solve the aforementioned class solidarity gap.

I should stop there before I catch myself blathering about guillotines.

Next Sunday will be my last Sunday here in the Gulf before Hope and I head home for the holidays and in that newsletter, I'll be sharing a travelog that we are working on about our time in Budapest.

See you next week.