We're all preppers now with money

It’s December already so let’s talk about prepping ourselves for 2026. Side note, I can’t believe it’s already December. How did this year seem so long yet pass so fast?

First, I want to say hi to all the new subscribers who found me via the Globe and Mail’s On Money newsletter last week where I spoke with reporter Erica Alini about the book. (Keep reading for the contest.)

Anyway, back to prepping. I got a press release from RBC Insurance about how Canadians could make some strategic financial moves that could pay off at tax time and set the stage for RRSP season.

The 2025 Canadian Retirement Survey found that 66 per cent of Canadians who aren’t retired expect to work in retirement to support themselves financially, while 49 per cent are anticipating a decline in their quality of life once they retire. It’s not great and aligns with how we’re feeling about the economy.

Single people are grouped in that survey but we do have some unique factors to consider such as no second income to fall back on and no income splitting. As I’ve written here before, there were 4.4 million people who live alone in 2021, according to Statistics Canada so it’s not really that much of an edge case.

I reached out to Farzana Damji, Senior Director, Product Development, RBC Insurance, to ask what can we singles do to make sure that we’re as comfortable as we can be.

“Canada’s singles population is growing, which brings a unique financial challenge—how to secure a comfortable retirement without the traditional safety net of a dual income,” said Damji via email. She mentioned the 4.4 million single people as well as a Statista report that there were 1.8 million single-parent families in Canada in 2024.

Damji points out that with homeownership costs soaring and living expenses rising, singles must take a different approach to long-term financial planning.

“When a single person is unable to work due to illness or injury, they may not have a partner to rely on to cover things like health costs, mortgage payments and everyday expenses,” she said.

In addition, she points out that singles may also have additional responsibilities, such as caring for aging parents, which I’ve talked about before. Damji recommends disability or critical illness insurance. “[They] can enhance financial security in case the unexpected happens.” If you decide to get critical and/or disability insurance, you’ll have some money coming in while you can’t work. A critical insurance policy can cover up to two dozen illnesses.

If you’re a single parent, there are other considerations. One thing Damji suggests is life insurance to ensure their family is protected. The policy will pay out to the children in the case of the parent’s death.

“A year-end review of your finances can be an excellent opportunity to evaluate your protection against unexpected circumstances,” she says. “In the event of a health crisis, you may need to liquidate investments early to pay for immediate expenses. A longer term condition will further impact your ability to earn an income, potentially reducing future contributions to your portfolio or even requiring withdrawals.”

Other tips from Damji:

Reviewing your RRSP and TFSA limit for the year to maximize retirement savings and set aside emergency reserves.

Consider other investment opportunities in discussion with a trusted advisor to ensure your asset allocation meets your long-term objectives.

Don’t be too quick to make changes based on short-term performance lags. In other words, don’t react emotionally to the market.

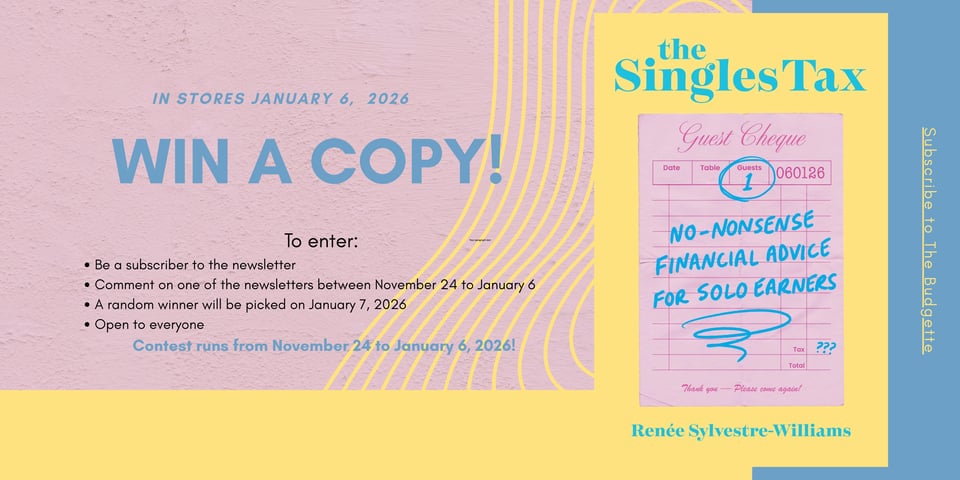

Contest details! Win a copy of The Singles Tax: No-Nonsense Financial Advice for Solo Earners

To enter:

Be a subscriber to the newsletter.

Comment on one of the newsletters between November 24 to January 6.

A random winner will be picked on January 7, 2026.

Open internationally. I will mail it out to you wherever you are.

Contest runs from November 24 to January 6, 2026!

This week’s readings:

Here’s the Average RRSP Balance at Age 44 for Canadians (Motley Fool via Yahoo)

Canada is increasing the GST/HST Credit - Here’s how much you can get in 2026 (NarCity)

Condos were king in Toronto. After the crash, will they ever come back? (Toronto Star Graphics)

I love this because I remember a finance book from ages ago said to buy things that people use and I think Walmart was a suggestion as people shop and people like deals. It’s interesting how some things don’t change. Why some young people are investing based on vibes, not research (CBC)

Topics I’m looking at for future newsletters:

Will the rise in single people change tax and housing policy? Aiming to start this in January.

What if you do have a lot of money in your RRSP, how do you avoid high taxes since single people can’t benefit from income splitting? Based off this newsletter from Robb Engen. Currently talking to planners and advisors for this.

The year-end round-up

-

I am so happy that I have learned about your newsletter and your upcoming new book through The Globe and Mail's On Money newsletter (the issue written by Erica Alinim dated November 27, 2025). Finally, a new book exploring personal-finance challenges for single people. Bravo!

-

Thank you for running this contest. I've been following your newsletter since 2022 and it's one of my faves. Looking forward to reading your book!

-

I am so glad someone is covering this topic, which deserves far more attention than it gets. Thank you!

Add a comment: