Finding the why for your money resolutions

We're near the end of January and you're probably feeling one of two ways: you're feeling good about your low or no-buying plan or you're dying to buy something for that dopamine hit.

Or you have another money goal for 2025 and might be feeling conflicted about sticking to it for the next 11 months. I’m going to talk about low- or no-buy resolutions.

A lot of us started a low-buy or no-buy year as a way to reset our spending habits. The first month is always easy. It’s like starting at the gym. We’re motivated to be fitter and see some immediate results, but as we continue, we see fewer immediate results, get bored of the repetition and soon find excuses to not go the the gym.

For me, doing a no-buy year isn’t easy as I want all the things because I’m part magpie, but I also want to DO all the things. That means doing more planning than just deciding I wasn’t going to buy stuff. That works on January 1st. It doesn’t work on January 31st.

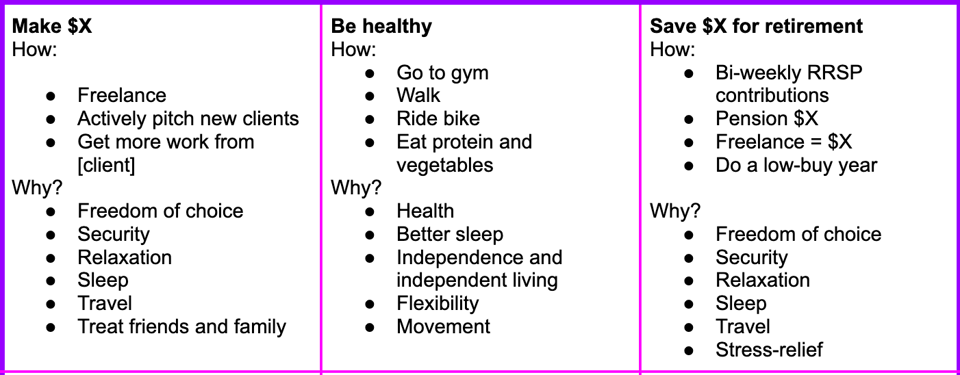

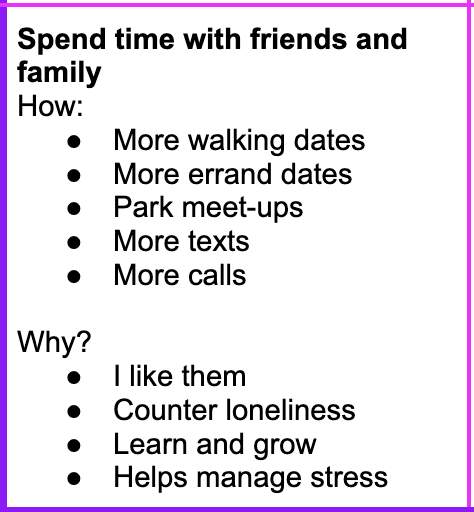

What I’ve realized is that I need to know the why and the how of doing this kind of challenge. Sure, there’s the ‘save money’ aspect but that’s not enough. Yes, I absolutely want to save money, who doesn’t? But that’s not a good enough reason. I had to dig deeper into my whys.

Without sliding into wellness or social media-therapy speak, I knew that I wanted more experiences and more of a safety net. I was talking to my friends Ryan and Anne about what I was hoping to accomplish this year, and said it was more about finding time to do all the things.

As it’s just me and I don’t have a partner who can help support financially by splitting costs, these things take time as well as money. I knew I wanted to focus on getting time back, more security, and freedom both now and later. That means being able to save more so I can do (or pay for) the things without worrying about bills.

This is what I’ve been doing to keep motivated past January.

Planning for replacements and breakages

Things will run out or break during the year. Makeup, skincare, and medicine are prime examples. The key is to anticipate these needs. Do you have enough foundation or mascara to last the year, or will you need a replacement? Take stock of what you already own and plan accordingly. For non-essentials, ask yourself: Do I really need this, or can I make do with what I have? Most of the time, the answer is no, I don’t really need this and yes, I can make do with what I have, like the other five red lipsticks in my drawer. It’s an obsession, really.

Slip-ups happen

Maybe you bought something you didn’t plan to, or an unexpected expense threw off your budget. Don’t let one mistake derail your entire year. Instead of throwing in the towel, ask yourself: “What can I learn from this?” Did boredom lead you to online shopping? This is my issue, so I’ll chat with friends, read a book, go for a walk or look at my list.

Was it a lack of preparation? Use those insights to adjust your approach and keep going. Habits take time to form and break. Be patient with yourself and focus on progress, not perfection.

Address mindless shopping habits

For many of us, shopping isn’t always about need. Sometimes, it’s just something to do when we’re bored. I realized how often I turned to online shopping to fill time, even when I didn’t need anything. One of the best things I did was delete shopping apps from my phone. That simple step made it harder to act on impulse. I also disconnected my PayPal from my bank account. I never put in my credit card number so I didn’t have to worry about that.

Another helpful trick? Create a “want” list. Whenever you feel the urge to buy something, write it down instead of purchasing it right away. If it’s clothes, I write it on the mirrored closet door. I find that most of the time, I don’t need it.

Be careful with shopping. You may say you’re not buying one item but then substitute with another. If you find yourself doing that, try to pause and reflect on why.

Be a little proactive

If you find yourself about to buy something with your debit card or cash, why not put it in a specific account. I’ve talked about giving each dollar (euro, yen, pound, etc.) a job. There’s something motivating about seeing that amount grow. I’ve also removed my cards from my phone to stop the mindlessness of just tapping. Now I have to pull out actual cards and that makes me stop for several seconds. I’m not saying it works 100 per cent of the time, but it certainly works… 80 per cent? I’ll take that.

Stay focused on your goals

Remind yourself why you started this journey. Maybe it’s to save for a big goal, reduce clutter, or break free from the cycle of consumerism. Or in my case, security and ideally, freedom now and in the future as you’ve seen from my list. Whatever your motivation, keep it front and center. Celebrate small wins along the way, like resisting a sale or finding a creative way to repurpose something you already own.

This week’s readings:

How many of these did you know? 10 financial buzzwords we kept hearing in 2024 (MoneySense)

Ok, this isn’t specifically about money. How Not to Be Psychologically Destroyed by Your Newsfeed (Psychology Today)

The Walmart Effect (The Atlantic)

How to report predatory landlords in LA (X. Yes, I know)

As an advisor told me, waiting to leave money when you’re dead means wealth continues to transfer to older people who may not need it by then but younger people do. Millennials and Gen X want to share wealth now. Boomers will wait until they’re dead. (USA Today)

I’m a personal finance editor. Here’s how loud budgeting helps me hit my money goals. (Cnet)

By me: Lights, camera, legacy: Storytellers document family history, tales of resilience, business success (Canadian Family Offices)

Also by me: Booking a vacation? Why travel agents are back — and could be the secret to a stress-free trip (Toronto Star) I also did a reel (Instagram)

Next issue will be Money for One #2. Subscribe and consider upgrading (Pay what you can) to read it. If you’ve missed the first one, you can read it here.

Add a comment: