Do adults need gifts?

If a finance newsletter doesn’t talk about holiday shopping, is it really a finance newsletter? It’s the newsletter version of the tree falling in the woods.

So we’re going to talk about it but not about saving money while shopping for family and friends.

I’ve read a few articles over the last few years about whether adults should get presents. There’s this 2021 piece from Slate and this 2022 piece from Quartz, with the writers making the argument that not only is it financially burdensome but personally and emotionally stressful.

Which is completely understandable. Some people are great at gifts, some aren’t. Plus this year is going to be more financially stressful for 56 per cent of us, according to Angus Reid.

But are there good reasons to not give gifts apart from it being expensive and people are hard to shop for, which are extremely valid?

Turns out there are studies on gift-giving that attempt to explain why some of us stress out so much around gifts.

One study is from the European Economic Review, a peer-reviewed journal started in 1969. The paper, Social norms and gift behavior: Theory and evidence from Romania, found that social norms, reciprocity and altruism play a role in gift-giving. People give gifts because they either expect a gift of the same value and thought, or because it’s an indication of care.

Another article, Better late than never? Gift givers overestimate the relationship harm from giving late gifts, from the Journal of Consumer Psychology looked at the effects of giving gifts late and the decision to not give gifts at all. The study found that people who give gifts worry far too much about hurting their relationship if they are late, but the biggest mistake they can make is deciding not to give the gift at all. That’s because the potential gift givers worry that it shows no care for the relationship.

We are an over-thinking bunch, aren’t we? Either we give gifts with the expectation of getting one of the same value in return, then get mad when that doesn’t happen, or we worry we’ll hurt the relationship with a late or poorly chosen gift. So no gifts instead!

That’s really the tension of adult gift-giving, there’s social norms, emotional bandwidth, and financial reality. Most of us aren’t sitting around judging gifts, though I will judge the tiniest you if you rush out for a basic bath gift basket for a good friend or family, you know the kind I’m talking about.

We’re just trying to show we care without blowing our budgets or adding to our mental load for our adult family and friends. Kids on the other hand will give you the entire list of what they want. I envy that energy.

So if you’re feeling conflicted this year, you’re not alone. The research basically says two things can be true at once: gifts do matter for relationships, and also, the pressure we put on ourselves around them is wildly inflated.

Which brings us back to holiday shopping.

Instead of approaching it as a checklist, think of it as an opportunity to line up your money, your boundaries, and your relationships in a way that actually feels good for you.

Yes, I’m going to share a few practical ways to shop smarter this season because the tree fell in the woods, but also, keep in mind that the holiday giving that works for you doesn’t wreck your budget or your brain.

So my tip if you are going to buy gifts, you know about shopping around for deals, waiting for Black Friday and Cyber Monday but I like a good double-digit cashback from Rakuten, not sponsored.

I’ve been using Rakuten for years now and use it mostly around this time of year for holiday shopping. It’s usually about timing so you can get the 6-12 per cent cashback offers at your favourite stores. If you want to take advantage, Rakuten CEO Jennifer La Forge said that the offers go up around the big shopping events, now, Black Friday, Prime Days, etc.

Also, here’s another tip. Since all the big stores tend to hop on the Black Friday/Cyber Monday bandwagon, the smaller, local stores have their sales now. If you’re a local or independent shopper, now’s the time to shop.

Give gifts, they’re fun but also, you difficult-to-shop-for people? For the love of whatever you believe in, have one or two things in mind, please. Stop frustrating people and give us something to work with.

ICYMI: Tiny condos are an insult to single people

Contest coming soon!

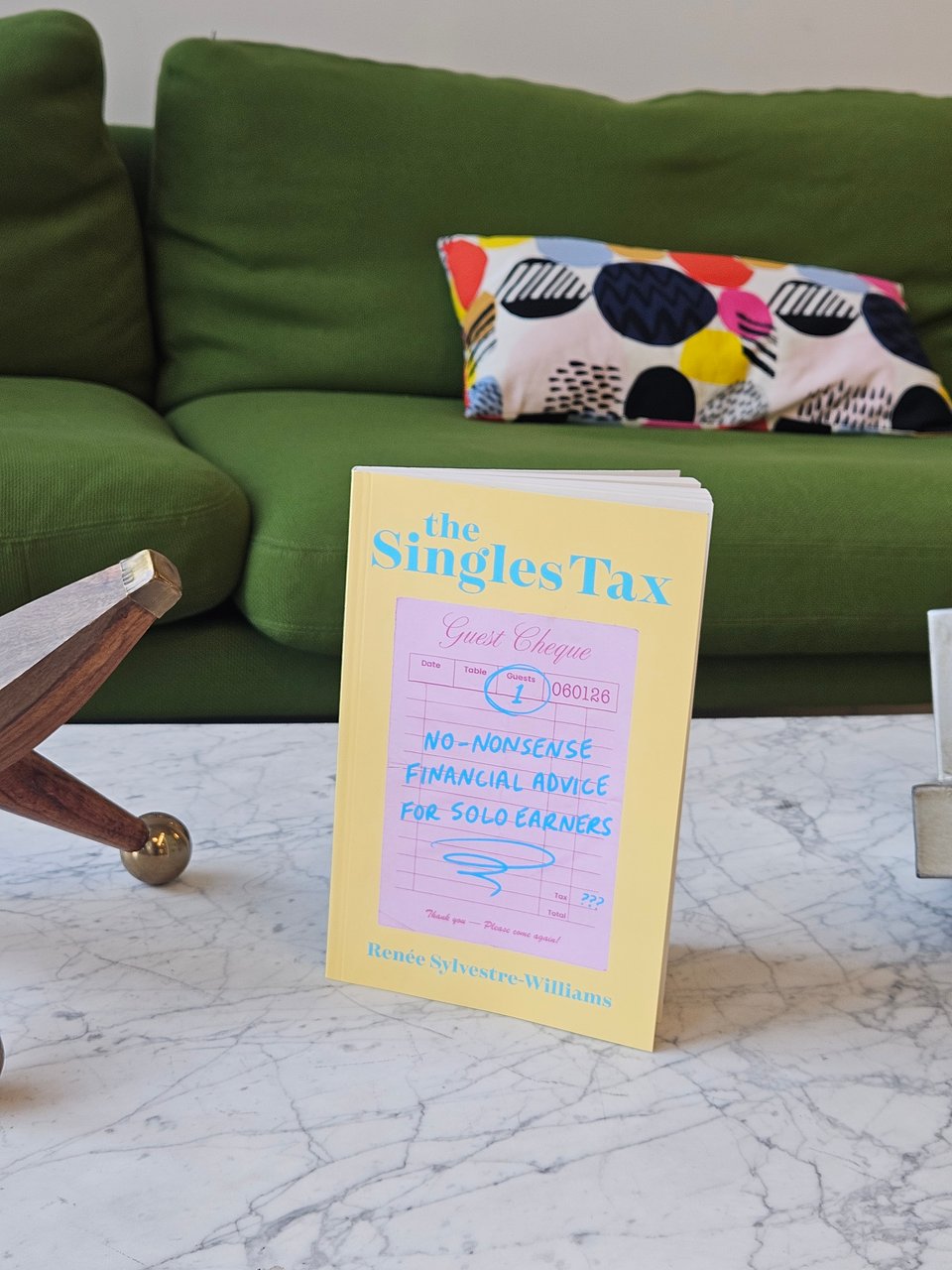

I’m working on a contest where one paid subscriber will win a copy of the Singles Tax: No-Nonsense Financial Advice For Solo Earners. It’ll be open to any paid subscriber and will be shipped globally.

This week’s readings:

David Chilton released the updated The Wealthy Barber. I’m pretty sure my parents have the original copy in the basement. I’m tempted to do a comparison of the two.

The finfluencer’s classs is in session. Is it worth paying for? (The Globe and Mail, paywalled)

Halal Investing finds broader appeal beyond faith based roots (BNN Bloomberg)

I wrote this for Maclean’s. The Secret Tax on Being Single (Maclean’s)

New research from TD found that 41 per cent of Gen Z and Millennials aren’t investing the money they’re holding in their TFSAs. They like the TFSA because it’s really easy to open (True) but aren’t investing because primarily they want access to the money.

Robb Engen acknowledged that single people who may have large RRSPs don’t benefit from the income tax benefits of income splitting. He does describe this as edge cases but what can we do? Off to talk to advisors. The Myth of the Too-Large RRSP (Boomer and Echo)

Add a comment: