Deleting all the gift guides in my inbox and older renters

This is going to be a long one.

Opting out of gift guides, positively

New report found renters are getting older

Questrade launches new investment options

Contest details

This week’s readings

Future topics for the newsletter

Even the ones written by friends. Sorry.

It’s that time of the year when your email is overwhelmed by gift guides by everyone from magazines, substacks and stores. It’s also Black Friday and Cyber Monday, the biggest shopping weekend of the year.

When it comes to gift guides, I had to draw the line somewhere and the line was ‘95 items to consider gifting this year.’ Who had time to consider that a list that long?

I know this is your job and I understand advertising, affiliate links and income as I used to work in print and digital magazines. When I was the manager, creative services at Transcontinental media, I was involved in those splashy ad pages for Indigo, etc., the two-to-three pages of suggested gifts for everyone in your family including your favourite plant. I’ve written copy on why you should absolutely buy that piece of pointless technology for your sibling/parent/friend/iguana.

I don’t want this to be negative by dumping on gift guides and their producers. I appreciate the people who go deep on Ebay, Vinted, Poshmark, The Real Real and Vestiaire to find affordable, vintage leather jackets. I’m here for you to get your money but I’m opting out of it being my money this year. So let’s look at the positive sides of opting out of gift guides.

There is the budget obviously but we all know that so let’s look at other reasons. I’m taking this approach from the point of view of being a solo earner shopping for multiple people. Also, also in this economy? People are planning on scaling back their shopping but there’s always the risk of overspending.

So the first thing I like about opting out of gift guides is missing out on being influenced. There are many great, good, and crappy things out there that work as gifts and I don’t want to know what they are.

Instead, we give each other a few things we’d like to get (not all) and go from there. I love lists because no matter what you get off said lists, you know the person will like it. “But what about the surprise?” I can hear some of you saying or thinking.

The surprise is the one thing you’re getting them off the list. There’s still an element of surprise.

The next thing I like about not looking at gift lists is how I shop. I start local and go online to either compare prices or find discounts but most of the time I buy local. That means chats with the store owners and staff and recommendations from them. Just last week I went to one local place to ask if they had a particular item, they didn’t but suggested something else. It wasn’t quite the same but I did find something else for another person.

Less stress is another reason. I can’t control the emotions of others, which tend to be heightened during the holiday season but I can control my own emotions. (Yes, I’ve been reading up on Stoicism). Other emotions including envy and jealously. I do reserve the right to some gluttony on the 25th.

I’m spending more time considering purchases instead of impulse buying, which is relaxing, and in the long-term, means minimal credit card shock in the new year.

So I know gift guides are big business right now and several of my friends and colleagues write them. The items are pretty but this time I’m opting out, thank you.

Renters are getting older

What does the average Canadian renter look like? SingleKey, a rental technology company, released its Rental Intelligence Report. The topline findings were:

The median age of a renter is 32 and it’s aging. Most are employed full-time.

Renting is no longer considered a short-term, transitory period towards owning a house.

In order to afford rent as well as other costs, most renters live in a two-person situation, with a partner or with roommates. Rents are exceeding 30 per cent of gross income across most of the country.

ICYMI: Tiny condos are an insult to single people

Questrade gets license for Questbank

Questrade received their schedule 1 bank license for Questbank, which means it’s a Canadian bank, not a subsidiary of a foreign bank. With that came an announcement of new trading options. Gold is one to no-one’s surprise. There’s also custom indexing, private equity access and crypto.

Friends who invest together

Every so often I like to see what the latest studies or working papers have about single people. I missed this one but Ben Le Fort, who writes Making a Millionaire, looks at a recent study from the National Bureau of Economic Research on the effects of friends on your investments. Turns out when you have friends who invest, you’re more likely to do the same.

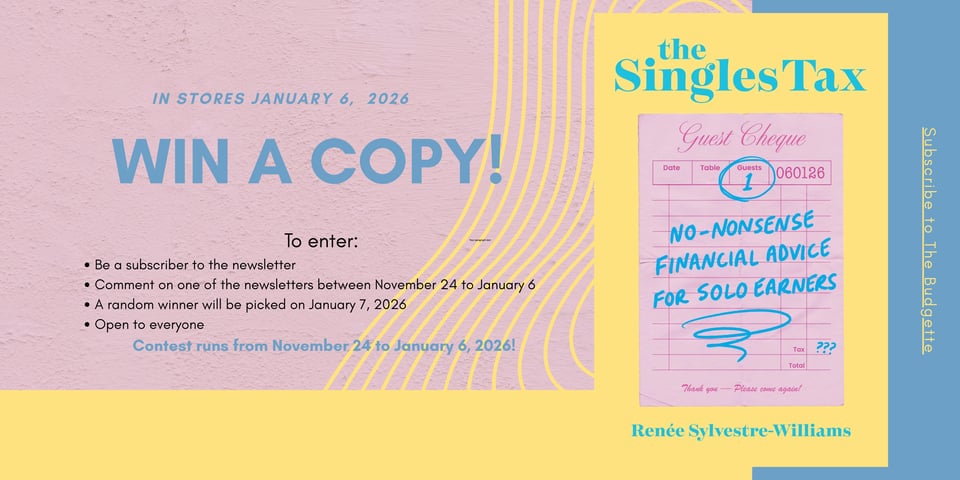

Contest details! Win a copy of The Singles Tax: No-Nonsense Financial Advice for Solo Earners

To enter:

Be a subscriber to the newsletter.

Comment on one of the newsletters between November 24 to January 6.

A random winner will be picked on January 7, 2026.

Open internationally. I will mail it out to you wherever you are.

Contest runs from November 24 to January 6, 2026!

This week’s readings

ETF fees are falling - but should investors really care? (Yahoo Finance)

AI Financial Advisers Target Young People Living Paycheck to Paycheck (Wired)

I Talked to 3 Overemployed Canadians and They Explained How They Make it Work (MooseMoney)

By me: More grown children are living at home due to high costs. Should you ask them to pay rent? (Toronto Star)

I wish the article had gone into some actual effects instead of just listing the possible reasons why. Where are the policy changes? Are there any? (I need to write a newsletter on this, don’t I? The rise of singlehood is reshaping the world (The Economist, paywalled but you can subscribe for free to read it)

3 women shared their wealth goals. We provided action plans for each (Financial Review)

Report finds early-onset health issues increasing among Canadian women (Benefits Canada)

Topics I’m looking at for future newsletters:

Will the rise in single people change tax and housing policy?

What if you do have a lot of money in your RRSP, how do you avoid high taxes since single people can’t benefit from income splitting? Based off this newsletter from Robb Engen.

The year-end round-up

Add a comment: