About being a single edge case and a massive RRSPs

So a couple weeks ago, Robb Engen wrote this piece on the myth of the too-large registered retirement saving plan (RRSP). He mentioned that single people with large RRSPs are edge cases.

Well, those were not-quite-fighting words but enough for me to find out what might happen if you’re lucky enough to have a too-large RRSP. Also, I’d like to remind you that widows and widowers do exist

I spoke with Herman Chan, founder and CEO of Crimson Financial about whether these edge cases exist, how it could happen and what could be done about it.

Are single people with large RRSPs actually edge cases?

Are they at a disadvantage compared to those with little in RRSPs? Absolutely not. I compare it to high income earners. They should be proud to be a in higher tax bracket – means you had success; saved, and invested well!

What is “large?” What threshold really matters?

It depends. Everyone’s different, especially spending habits. I say $1M and more.

Even if you're single when you retire, will you drop into a lower tax bracket? What would keep you in your current bracket?

If you’re single, and have rental income or have a well-funded defined benefit pension waiting, then investing in a RRSP may not have been the wisest decision. Focus on the TFSA first.

So let's talk these edge cases. We can't split income, so what can someone do if they're planning for tax-effiicency in retirement?

Singles should meet with a financial planner who specializes in retirement (I like to call it transition) planning, so they can compare withdrawing from the RRSP well before 71, investing right back into a TFSA and delaying CPP and/or OAS.

What alternative strategies exist beyond “just RRSP → drawdown?”

Great question. A lesser-known, and alternative strategy besides withdrawing from RRSPs early or not contributing to them at all, is saving into a permanent life insurance policy. For those that like to manage their portfolios could use a universal life policy, while those that like it professionally managed can opt for a participating whole life policy. Then they can borrow from their policies tax-free in most cases when needed like market downturns!

They can also allocate their CPP payments towards a permanent policy, and make their favourite charity the owner and beneficiary. Then the annual premiums become tax-deductible charitable donations. Lastly, they can get a permanent policy, remain as owner and payor, but make the charity the beneficiary so the estate gets a big tax-free payout to offset the tax bill.

Are singles really the only demographic for whom this may be a problem or are there overlooked groups?

Singles and widowers. They get the tax-deferred RRSPs after their spouse passes, but if they already have their own, then their total becomes larger with no income splitting opportunity, and impacts OAS clawback.

Are singles then more vulnerable to OAS clawbacks because they can’t split income across two people?

Yes, unfortunately.

What happens when you combine RRIF minimum withdrawals with CPP and OAS, does that automatically push many single retirees into higher brackets?

Maximum CPP and OAS payments combined is $36,000, the minimum RRIF withdrawal percentage is 5.28% (fair market value on Jan 1 of that year) so a $1M account at 71 would result in a $53,000 withdrawal. OAS clawbacks start at $93,000.

How does the lack of pension income-splitting change withdrawal strategy compared to couples?

A couple can withdrawal up to $186,000 combined before hitting the OAS clawback threshold, while a single will take a hit starting at $94,000. Couples can also elect to split up to 50% of their eligible pension income by completing the T1032 form and submitting it before filing their taxes. Basically, they can drop into lower tax brackets and pay less tax.

If you die single with a large RRSP or RRIF, what’s the actual tax hit on the estate and is that edge case or common?

If you’re single with no dependents like a child or grandchild under 19, then RRSP and RRIF accounts are deemed disposed at death. That means the total amount would be added as taxable income in your terminal tax return. In Ontario, the top marginal tax rate at $1M is 53.5%. That’s 535k tax payable which leaves only 464k for the estate!

What policy changes could be made to create more equity between singles and couples?

I’m not a politician or policymaker, but reducing the RRIF minimum withdrawal percentage if accounts are $1M+ at a certain age, raising the OAS clawback threshold for single retirees, or offer a non-refundable tax credit based on income and age.

(This interview was edited for length)

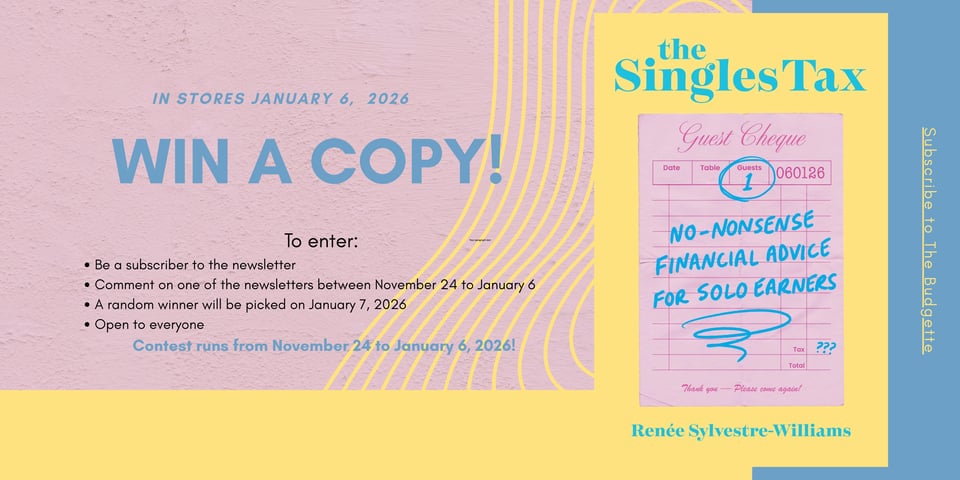

Contest details! Win a copy of The Singles Tax: No-Nonsense Financial Advice for Solo Earners

To enter:

Be a subscriber to the newsletter.

Comment on one of the newsletters between November 24 to January 6.

A random winner will be picked on January 7, 2026.

Open internationally. I will mail it out to you wherever you are.

Contest runs from November 24 to January 6, 2026!

This week’s readings:

I did a TikTok with the Maclean’s magazine team to discuss the singles tax. (Maclean’s)

Ok Robb, I see you. RRIF Reform, Fairness for Singles and My First Globe Op-Ed (Boomer & Echo)

Ugh. Food prices in Canada are set to rise in 2026 and here’s what will cost you the most (NarCity)

Add a comment: