🐋 Whale’s Insight: The IRS Loophole the Wealthy Don’t Want You to Know

🐋 An obscure rule, 408(m), could unlock a tax-free “second paycheck” from your retirement accounts.

The Hidden Current 🌊

Every financial storm leaves two kinds of investors: those who sink with the tide and those who find hidden channels to safety. While most Americans watch their retirement accounts bleed from taxes and penalties, insiders have quietly used a little-known IRS rule to protect themselves — and even generate tax-free income.

It’s not about luck. It’s about knowing where to look. And if you’ve never heard of Section 408(m), you’re not alone. That’s by design.

Deep Dive

Section 408(m) of the IRS code sounds boring enough to ignore. But hidden in that dry legalese is a wealth strategy that allows retirement accounts like 401(k)s, IRAs, TSPs, and 403(b)s to do something remarkable: spin off tax-free income on a monthly or even weekly basis.

Think about that. While most savers worry about required minimum distributions, penalties, and tax hits, the wealthy are shielding gains and quietly paying themselves. All without triggering cash conversions or red tape.

And here’s the kicker: it’s 100% legal, fully IRS-approved, and available to ordinary Americans. But Wall Street won’t tell you. Why? Because it benefits them when you play by the standard rules, paying the fees, taxes, and penalties that insiders avoid.

If you’ve ever felt the game was rigged, this is proof — but also your chance to play smarter. Imagine a second paycheck arriving without tax erosion, even during a downturn. That’s the kind of buffer that separates those who survive the next crash from those who thrive through it.

The real question: will you act on this knowledge before everyone else catches on?

Ad by Allegiance Gold

Did you know there’s an IRS loophole—408(m)—that lets you pull monthly or weekly income from your 401(k), IRA, TSP or 403(b) completely tax-free?

Most Americans have never even heard of it. Yet the wealthy use it to shield gains, avoid penalties and stay fully invested—while everyone else sits exposed.

This isn't a theory. It’s a legal, IRS-approved strategy that can put a second, tax-free paycheck in your pocket—no cash conversion, no red tape, no catching penalties.

Grab your FREE 408(m) Guide now

Stay protected when the next crash hits.

P.S. Wall Street won’t tell you about 408(m). The insiders move first. Claim your guide (and bonus gold coin) before everyone else wakes up.

Second Wave 🌊

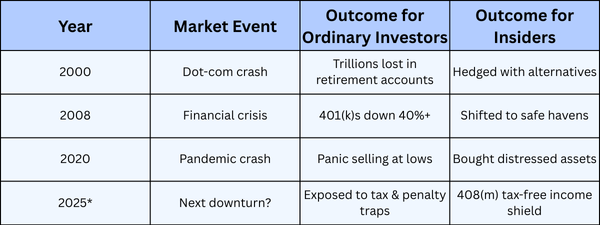

Crashes aren’t “if” events; they’re “when.” In 2000, tech wiped out trillions. In 2008, housing crushed retirements. And in 2020, markets fell 30% in weeks. Every time, insiders found ways not just to survive — but to come out stronger.

Now, as markets flash signals of tightening liquidity and rising volatility, the urgency is greater than ever. Those who tap into strategies like 408(m) can lock in protection and income streams while others scramble.

Because when the next wave hits, you’ll either be explaining your losses… or showing off your tax-free paycheck.

Whale’s Fact Break 🐋

Did you know humpback whales sing songs that can last up to 20 minutes — and are repeated for hours? In finance, too, the most powerful patterns repeat again and again, if you know how to listen.

Data Snapshot 📊

Moments when insider strategies separated winners from losers:

Ad by Allegiance Gold

👉 Grab your FREE 408(m) Guide(and bonus gold coin) now before everyone else wakes up.

🐋 Whale’s Final Word

The market isn’t fair — but the rules are there for anyone who dares to read them. The insiders already know 408(m). The only question left is: will you swim with them, or be left adrift?

— Whales Investing 🐋