It's Not Just Laws About Books Breaking Libraries. It's Also New Tax Reforms.

Two states have passed property tax cuts that are directly impacting public libraries. Expect to see this happen more.

Book bans have never been solely about the books. They’ve been about the systematic silence and erasure of the voices those books represent, and they’ve been about the intentional dismantling and destruction of public goods that serve as institutions of democracy. That’s why book bans don’t stay at the local level. They move upward, sometimes to city or county-level policy creation. More commonly, they skip straight to the state level. This is especially true in states that are “red”; that is, states that have historically disenfranchised or gerrymandered their voters to get the conservative outcome they desire.

As if authoritarian sycophants needed more help to dismantle arenas of civic engagement, they’ve gotten it this year with the gutting of the Institute of Museum and Library Services and the Department of Education.

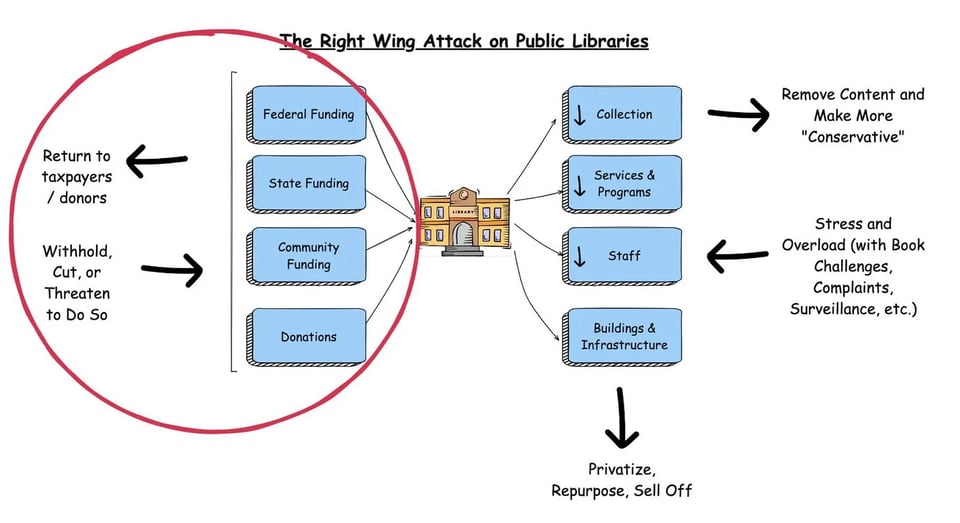

I like to share this graphic by John Norcross whenever I talk about the bigger picture of book bans, as some people say that this kind of thinking sounds conspiratorial–and it does if you don’t understand where and how public libraries or public schools work and the attacks happening on them right now, too.

One of the latest tactics in defunding public goods, however, is not receiving the attention it deserves. Over the last year, several states have implemented tax reforms, presenting them as significant relief to state residents amid an era of increasing financial burdens. The reality is that these new reforms are part of a larger effort to dismantle public goods. The states that have implemented these tax “relief” measures are already seeing the fallout, just months into their installation.

Two states adjusted their property tax formulas in 2025 for Fiscal Year 2026: Indiana and Wyoming. Missouri passed property tax reform legislation for 2025, but a lawsuit has put this into the court system (and while that makes its way through the judiciary, the governor has started promising the elimination of income tax in the state, too). A fourth state, Ohio, has property tax reform on its agenda for the upcoming session. While each of these state reforms differs in terms of the specific tax cut, each one directly impacts the ways libraries in those states are funded. For politicians, this isn’t a mistake or accident.

It’s intentional.

State Tax Cuts and Library Pain

Wyoming passed a 25% property tax cut this year. Anyone in a home with an assessed value of up to $1,000,000 gets relief here. When legislators passed the bill, they made zero plans for how local governments would make up the (significant) loss in revenue.

Actually, that’s not entirely true. In 2024, the state implemented a voucher program that would allow parents to withdraw their children from public schools and use public tax dollars to fund their private education. Voucher plans were refined further this year before parents and the Wyoming Education Association filed a lawsuit against them. The voucher scheme has been tied up in the courts, though, with the latest ruling from October saying that the lawsuit can move forward. We know that vouchers benefit the already wealthy, and in rural states like Wyoming, vouchers are especially detrimental to already under-resourced public schools.

With Wyoming’s property tax cut, communities suddenly lost a quarter of their budgets. Libraries are feeling it. Fremont County Commissioners informed their beleaguered public library^ that they wouldn’t be hit with the 10% cut other departments were facing. Their cuts would be at 20%.

Big Horn County closed two of its public libraries this year, before the property tax reforms hit. The system worries that more libraries within it, already operating with fewer hours than they were a year ago, will have to close down as well. Not only are the hours winnowed, but library staff are also taking on additional duties on top of the hundreds they already do daily. Among them? Janitorial work. This isn’t a belittling of janitorial responsibilities; it’s highlighting that the people who did that work are no longer being paid to do it. That’s because they’re just gone.

From WyoFile:

On top of reduced staff hours — Lovell losing 10 a week, Greybull and Basin down 12 — librarians in all three counties have agreed to take on some janitorial duties to reduce that part of the library budget.

“There’s so much that these women, because they’re all women… are doing other than checking books in and checking books out,” Ely told the board. “Their hours are considerably cut, and we’re just hoping they can still continue to get all of that programming done and get all of that stuff done with less hours.”

“While asking them to maintain buildings,” Greene added, with no workers’ compensation.

Three library managers and Ely agreed to give up their Wyoming retirement benefits, amounting to $24,000. Commissioners requested confirmation on the legality of this concession; should it prove faulty, that money will have to be cut elsewhere.

In addition, all library employees gave up their three personal paid days off.

Ely forfeited reimbursement for her mileage driving between towns. Troy Butler, who handles the library’s bookkeeping, agreed to a 20% decrease in the fees for his accounting services.

Before this year’s property tax cuts, Carbon County Libraries saw their budgets slashed by 53%. This resulted in significant reductions in operating hours. Now facing even bigger cuts, who knows what will remain of the system.

These are a few of the examples of what’s happening right now statewide. Per state law, each county is required to operate a public library; however, the requirement is for only one library per county. This means that branch libraries serving more rural communities will continue to be the first to go, severing lifelines for residents who depend on them.*

None of this is to mention that Wyoming’s legislators have also proposed one of the cruelest anti-library, anti-youth bills in the nation. The bill is back on the table, setting the state up for a one-two punch of defunding and dismantling libraries simultaneously.

Libraries add value to a community. While property tax cuts appear to be a win for the right, they’re not wins for residents or the state. Who wants to move to a place where they have nothing in their community for them because there’s no money in that community to support public goods?

Only the rich, who’ve found Wyoming to be a great place to continue capitalizing on their wealth. The consequences of these decisions will be felt for generations, and they’re creating the potential for private interests to come in and “save” these spaces . . . to their direct benefit, of course.

Let’s head east to Indiana, where conservative legislators have spent five years doing what they can to kill libraries. Republicans attempted to make it illegal for libraries to seek property taxes for their funding, which would have helped them keep their budgets separate from municipal budgets. Although the bill did not progress, it was clear that republican legislators were eager to take the limited power public libraries had away from them. Remember this proposed legislation. It ties into the state’s property tax reform that passed earlier this year.

Senate Bill 1 cuts taxes for homeowners throughout Indiana, with bigger cuts for seniors and disabled veterans. The idea is that the state would step back from imposing taxes on property owners and instead shift the responsibility to municipalities, who could impose taxes themselves. Recall that the legislators attempted to restrict libraries’ rights in this regard, and although the effort failed, it revealed their intentions.

The property tax cuts will create a massive deficit in Indiana, amounting to nearly two billion dollars over the next several years. Who do you imagine is being hurt by this? Libraries, of course.

Indianapolis Public Library+ posted a fantastic graphic about where and how they get their funding. 75% of it? Property taxes. Three-quarters of the state’s largest public library system is funded by the property taxes that are now being cut.

We’re already seeing the results of this property tax scheme–one that lawmakers are already going back to “tweak” because of the absolute destruction it’s bringing to communities statewide. The Monroe County Public Library has to reduce its hours due to a projected $300,000 budget deficit. The library wouldn’t be open past 7 p.m. on Mondays through Thursdays. While those may not be the prime hours for library use, they impact some of the most vulnerable populations the most directly: students and working families. Not to mention that once library hours are cut, they’re not coming back.

The depth to which these cuts go isn’t being understated. Library workers statewide are doing everything possible to speak out and educate others about the issue. But unfortunately, the full impact won’t be seen for a year or two. By then, it might be too late, especially as legislators will be working on more anti-library bills. That’s what they’ve been doing every year in Indiana since 2021.

Just a few hours west by car, Missouri passed Senate Bill 3 this year. It’s a wide-ranging, unwieldy bill that includes significant and confusing changes to property taxes in the state. The bill allows 97 of the state’s 114 counties to put a measure on their April 2026 ballots related to property tax cuts. Those counties are broken up into two groups. Group one counties are considered zero-percent counties, and there are 22 of them. These counties are a mix of rural and suburban areas, and their ballots would allow property taxes to remain frozen at current levels. Taxes would not increase without a levy vote. Group two comprises 75 counties, all of which are rural and considered to be five percent counties. These counties could seek to cap the annual increase in property taxes, tied to the Consumer Price Index.

The 17 counties not included in the bill aren’t given the option to vote on property tax reform. These are, unsurprisingly, the most significant population centers in the state, such as St. Louis County and Greene County. More information about how this would work is available here.

A lawsuit over Senate Bill 13 was filed shortly after its passage. Two state lawmakers and a citizen believe it to be unconstitutional, though their contentions with the bill related to how it passed and its implications for how taxpayer money could be used for sports stadiums in the state. A judge just this week set the stage for the trial. Even as this bill is in the courts, Missouri’s governor is already, and republicans eliminated the capital gains tax in Missouri this year–the first state to do this.

In September, a bipartisan committee of state House legislators wrapped up a listening tour throughout the Show-Me State. Their goal was to understand what could happen if property taxes were eliminated.

The answer was, of course, the disappearance of public goods. It’s something Missouri’s governor has been in favor of, as seen in his gleeful cut of $3 million from the Kansas City Public Library this year.

From MissouriNet:

Michelle Swane, Director of the Ozark Regional Library, told the committee that the people they service count on money from property taxes to provide vital services to community members.

“Our property tax income from our 2024 budget was 92% of our budget,” said Swane. “We have an uncertain federal funding. Ozark Regional serves approximately 22,000 residents. We provide local, state and federal government support. We provide passport services.”

Michelle McBride, the St. Charles County Collector, spoke not in her official role — but as a Missouri resident. She said the push behind Senate Bill 3, which would freeze property taxes for some homeowners, feels like an old tv show.

“It’s jack*** legislation. Everyone says they want the services, but they don’t want to pay for them,” said McBride. “When you force counties to put the Senate Bill 3 language on the ballot, the voters will pass it, and our local entities won’t be able to keep up with their rising costs. We can’t solve all the inflation problems just by attacking property taxes.”

That one library system in the state gets 92% of its budget from property taxes. Losing property tax money would shut its doors; there is no amount of fundraising, refiguring, tightening the belt, or slashing hours that can make up for only having 8% of your budget allocated to you for the year.

St. Joseph Public Library and Rolling Hills Public Library? They receive 90% of their funding from property taxes. Those are higher rates than in Wyoming or Indiana–two states where it’s already clear how terrible the elimination of property tax has been for public libraries.

This property tax cut would decimate libraries statewide, especially in rural areas. What’s being created is a system where those who live in urban areas will have access to information and technology, while those who live in the suburbs or rural communities will not. The very people whom the right claims to support–and who seem to support the right right back–are those who stand to lose the most.

But hey, they won’t have to pay a few bucks a year in property taxes to the library and can just hope they never need to use the internet, never want to read an ebook, don’t have kids doing reports, or desire a third space where they can simply hang out without any expectation of money changing hands. They can, instead, pay significantly more to private corporations for inferior services.

Ohio’s Mess Continues

While there are other state legislatures hearing rumblings about property tax elimination, the one of most concern at this moment is in Ohio. Ohio republicans changed how their libraries are funded through the state this year. Public libraries used to receive a guaranteed percentage of the state’s General Revenue Fund–something that made Ohio libraries among the best and most unique in the country. Now, public libraries are a line item in the budget, meaning that their funding could change at any time. This puts public libraries at the mercy of the state, meaning that if they don’t follow whatever rules the state decides are necessary–say, that LGBTQ+ books cannot be in sight lines of those under 18 (enrolled state budget, page 1307)–the state can just zero out their budget allocation.

As a result of this change, 20 libraries in the state put levies on the ballot this fall in hopes of securing stable, long-term funding. A whopping 18 of those measures passed, reiterating that people want their libraries to exist.

Several ideas, as well as several bills, have been floated through Republican legislative circles in the state regarding how to cut property taxes. They’ve yet to figure it out, but some proposals have included examining the reduction of taxes in relation to how schools are funded.++ Here’s the latest proposal as of November 19.

Ohio public libraries, already being crushed by how the state recalculated their contributions to their budgets, would be brutalized by the elimination of property taxes. Cuyahoga County Public Library gets 70% of its funding from property taxes.

From Today in Ohio:

While homeowners understandably feel crushed by rising property taxes, Atassi pointed out that the library and park levies make up a tiny fraction of most tax bills—“about 72 bucks to $130 a year for every $100,000 of home value.” Yet these modest investments fund services that millions of Ohioans use and love.

More, from Cleveland.com

Particularly frustrating to local officials is that these decisions and proposals at the state level could override local decisions made by local residents and patrons.

“The voters have spoken,” said Greg Cordek, chief financial officer for the Cuyahoga County Public Library, whose last tax increase was approved in 2020 with a 60% yes vote.

“They have voted to fund our library system. These property taxes are levied at the local level. That is certainly a frustration.”

If property taxes were abolished, as backers of the petition drive suggest, Cordek said the county library system that serves 47 cities, villages and townships with its 27 branches would be out 69% of its operating money – or roughly $65 million a year, based on this year’s budget.

“We would have to shutter branches. There’s no way we could operate with that kind of funding cut,” Cordek said.

The library system said it had 3.9 million visits last year, lending out 11.5 million items and putting on 13,000 programs.

Similar concerns were raised by the Cleveland Public Library, a 156-year-old institution that operates 30 branches.

“Losing more than half of our funding would be devastating to the library’s staffing, collections and the programs and essential services our community relies on every day,” a spokesperson said. “It would be challenging to keep our buildings open and continue our planned facilities improvements.”

Local property taxes raised $41 million for the Cleveland library last year, representing 57% of total revenue.

Zooming Out: The Bigger Picture

These property tax cuts don’t just impact libraries. They harm every municipal good or service, depending on what’s being funded by those communities or counties. That includes firefighters, EMS, disability services, parks and recreation, schools, and many more.

What these state legislators are doing is taking advantage of a populace who has no idea how government works–that’s partially by design and partially because most folks have never needed to think about where or how their communities work because it has simply worked!–by making promises of tax cuts that stave off legitimate concerns of the rising cost of living. They make these sweeping cuts to get more votes, even though those cuts directly impact every single part of a citizen’s life. They point back down at those communities and lay the blame on them for not “doing something” when they’ve got the levers to do so. The bad guy then becomes the local community for having to keep going back to residents and asking for another levy here and another levy there.

It’s the same narrative we see from the federal government, decreeing everything “states rights,” but now it’s states pulling their hands out and calling it “local control,” even if it’s far from what local control truly is.

In an era of continued attacks on libraries, it is crucial to lay out there exactly what’s happening, where it’s happening, and how it’s happening. It provides additional context for the firehose of bad news about library budget cuts that is rolling in this year.

This isn’t one attack. It’s a multi-headed hydra, fed and nourished by politicians and interest groups eager not just to grift but to benefit from the privatization and enshittification of public goods substantially.

Notes:

^See here, here, and here, among stories about the mess at this library, all wrought by far-right politics and conspiracy theory.

*I beg you to read Megan Greenwell’s Bad Company: Private Equity and the Death of the American Dream, particularly the sections about the private equity takeover of Wyoming hospitals. It illustrates the importance of small-town services in rural states, and this isn’t just applicable to for-profit healthcare. It applies to public taxpayer-funded goods, such as libraries.

+Just last week, the Indianapolis Public Library shared this story about how standardized test scores in public schools are up because of how much access those kids have to their public library. These kinds of stories matter, especially when the right deals in lies about reading proficiency and test scores (as well as what is or isn’t actually in public libraries). They also matter tremendously in states like Indiana, where such public goods and collaborations are constantly under attack.

++It’s not how you might think, either–communities which support their schools with levy passages wouldn’t see property tax relief, but communities which said no to helping the schools would see those cuts. The proposal would create more inequity in schools and public goods, most harming smaller and rural communities once again. It’s almost as if republicans realize the only way they can retain power (outside of stealing it through election maps) is to keep what they believe to be their biggest base without access to education or knowledge.