Choose your fighter: AI or superfans

A critical feedback loop forcing the industry back to basics.

Hi there!

We’ve had over 200 new subscribers join us since the last issue. If you’re one of these folks, welcome! Feel free to reply directly to this email to introduce yourself — I read everything that comes through.

Today is a ✨ special bonus issue ✨ to commemorate our next IRL event: a special Halloween edition of the NY MusicTech Meetup, taking place this Thursday, October 30 from 6PM–8PM at Isola Brooklyn. Check the flyer below for details and featured presenters.

Since we're spotlighting music startups, I thought it would be timely to give an update on the 2025 music tech investment landscape. Below, I break down how the market is taking shape, the resulting feedback loops and power dynamics, and some key questions founders and investors should be asking right now.

To spare your inboxes and focus the conversation, this is a shorter issue without the additional sections on featured clients or "cool links." We'll be back to regular monthly programming in mid-November.

Thank you so much for your support!

Best,

Cherie Hu

Founder, Water & Music

This Thursday: NY MusicTech Meetup, Halloween Edition 🎃

We’re thrilled to be teaming up with Seth Hillinger for a special Halloween edition of the NY MusicTech Meetup on Thursday, October 30 at Isola Brooklyn!

Along with plenty of time for networking, our meetup will feature live demos (no pitch decks!) from the following startups:

MusicAtlas: Deep audio intelligence that makes every song searchable and comparable, with the ultimate mission of reigniting fans’ passion for active music discovery.

Recoupable: Artist-trained AI agents for automating key music biz ops tasks across, marketing, reporting, and fan growth. Currently serving 100+ beta users across artists, rights holders, and distributors, including paid pilots at both major and indie labels.

Join over 90 other attendees hailing from diverse professional backgrounds and organizations, including Virgin Music, Spotify, TIDAL, Output, Meta, Epic Games, NYU, Columbia, and dozens of early-stage ventures.

RSVP here to reserve your spot. Costumes are highly encouraged 👻

Choose your fighter: AI or superfans

You can also read this article online via our newsletter archives or on LinkedIn.

Spend any time at a music industry conference lately, and you'll notice two topics dominate the conversation: generative AI and superfans.

On the surface, these might seem like opposing futures. One is a world of infinite, machine-assisted creation, focused on the mechanics of how music gets made. The other is a world of deep, human-to-human loyalty, centered on the art and science of who music is for.

What's become clear in recent months is that these aren't separate trends. While they point to different business models and power dynamics, they are two sides of the same coin — locked in a powerful feedback loop that’s forcing the industry back to basics.

A critical shift in how I map the market

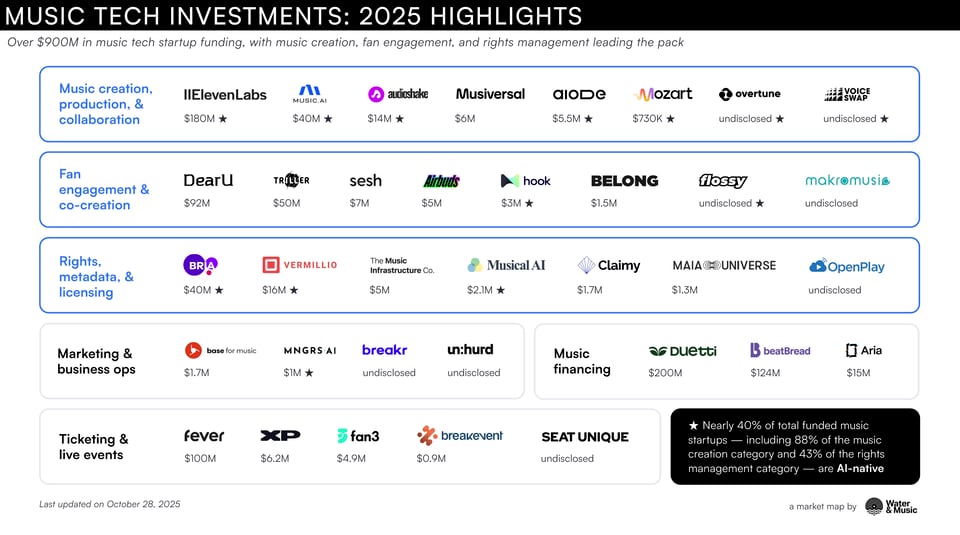

One helpful lens for understanding this shift is Water & Music’s 2025 Music Tech Investment market map, which I’ve been updating regularly for the past three months.

When I first published this map in July 2025, I highlighted "Generative AI” as its own category at the top, lumping everything from creative AI tools like ElevenLabs to AI attribution platforms like Musical AI into one row.

Fast-forward to today, and that framework no longer makes sense. AI momentum certainly hasn’t slowed — quite the opposite, in fact, such that our understanding of the market’s structure requires a fundamental correction:

AI isn't a category or a business model in itself. It's a horizontal capability that cuts across every part of the music business, and can solve a vast range of industry problems.

To categorize a company as an "AI company" in late 2025 is to miss the point. Lumping voice generation and rights attribution tools together simply because both leverage AI is like comparing Shopify to Meta because both use the internet. The true story lies not in the tech itself, but in the use case it serves.

Hence, I’ve updated the map to reorganize companies around their core industry functions, allowing for a more accurate, apples-to-apples comparison of the investment landscape. While this might feel like semantic housekeeping, how we map the market reflects how we understand where value is actually being created.

And the latest data paints a fascinating picture: by the number of deals announced, "Music creation" and "Fan engagement" now stand side-by-side as the top two investment categories.

This parity is the clearest signal of a new market dynamic, where the explosion of AI-generated content is creating an equal and opposite demand for tools that foster genuine human connection.

Music creation: AI becomes table stakes

The music creation category is now almost entirely an AI category.

Of the eight startups in this vertical that have publicly announced funding in 2025, six are AI-native (ElevenLabs, Moises, AudioShake, Aiode, Mozart, and Voice-Swap) — meaning they launched with AI-centric products from day one.

Importantly, several of these companies are not competing directly with Suno on full-stack AI music generation. Instead, they’re focused on functional, B2B use cases that slot into existing creative workflows, and have applications far beyond music.

For instance:

Moises announced an integration with Ableton focused on stem separation.

AudioShake raised $14M to expand its stem separation tech beyond music into other industries like film and sports broadcasting.

Voice-Swap is expanding beyond music to target “broadcast, advertising, post-production, [and] agentic AI solutions” for its voice synthesis tech.

The overarching theme is that AI is no longer a novelty, but is becoming the infrastructural foundation for the next generation of creative tools.

The superfan gold rush

Running parallel to the boom in AI-native creation tools is an equal surge in platforms focused on fan engagement.

This isn’t a new trend per se. For as long as music fans have existed, a small fraction of an artist’s audience drives a disproportionate share of their revenue.

What feels new to this moment is how quickly industry giants are jumping on the bandwagon and targeting that coveted segment of super-spending “superfans.” In the last year, major players like Universal, Warner, Sony, Spotify and even Goldman Sachs have published research or built products focused on nurturing direct artist-to-fan relationships. As streaming growth continues to slow, the market is pricing in a future where engaged fan communities matter more to the long-term health of the music business than passive streaming audiences.

Moreover, as the 2025 music tech investment map shows, "fan engagement" is not a monolithic concept. The diversity of business models receiving funding in the category demonstrates that the market is still in a vibrant, experimental phase, testing multiple hypotheses on how to capture this value.

For example:

DearU ($92M) offers fans a subscription service to receive messages that feel like one-on-one chats with their favorite artists — akin to what Community and Weverse provide.

Sesh ($7M) provides comprehensive infrastructure for artists to own their fan relationships directly, across merch sales, tour management, email CRM, and more.

Flossy turns merch into a collaborative experience where fans become active co-creators of their favorite artists’ brands. On Flossy’s platform, fans can co-create and "remix" merch designs based on an artist's guidelines, with final products made and sold only after artist approval.

The feedback loop: More content, more discovery, more plumbing

After music creation and fan engagement, the third-most active investment category so far in 2025 is, unsurprisingly, rights, metadata, & licensing. This supports our ongoing “Boring is Back” thesis that many of music tech’s biggest checks are going to the industry's least glamorous problems.

The rights category is also becoming increasingly AI-native. Three of the seven funded startups in the category focus specifically on helping rights holders manage licensing, track usage, and ensure proper compensation in their deals with AI companies. Major labels and distributors are coming on board: Sony Music led Vermillio’s $16M Series A, while Symphonic opened up its catalog for licensed, monitored AI training through Musical AI.

Together, the top three categories in music tech investment form a self-reinforcing cycle:

Content flood | As AI-powered tools make music production faster and cheaper, the volume of content being released is accelerating exponentially, creating unprecedented saturation across all platforms.

Discovery crisis | In an environment of infinite content, the primary challenge for artists shifts from production to connection. Breaking through the noise becomes exponentially harder, creating market demand for tools that help artists find their audience and build direct relationships with their most dedicated supporters.

Clogged plumbing | The explosion of AI-assisted and AI-generated content creates a logistical and legal nightmare for tracking ownership, attribution, and royalty payments — on top of the existing nightmare that music rights management already is! It's a garbage-in, garbage-out scenario, where the muddiness of AI compensation gets exponentially worse without clean, easily accessible data on who owns what in the first place.

Ironically, the rise of futuristic creation technology is forcing the industry back to basics to solve its oldest, most fundamental problems.

You can’t choose your fighter

So which is it… AI or superfans?

The answer, of course, is that you can't pick just one; they're mutually reinforcing with every additional funding round. And all the while, rights management faces the immense challenge of scaling to match this surge of activity.

My near-term question for everyone building in this space: Which link in this chain captures the most durable value over the next 18 months? The creation tools flooding the market with content? The fan platforms fighting for attention in the discovery crisis? Or the rights infrastructure struggling to keep the whole system honest?

I'd love to hear where you think the leverage is. Feel free to reply directly to this email to let me know your thoughts! ★

Want to explore what music tech means for your brand, catalog, or bottom line?

Water & Music’s research and consulting services have helped rights holders, streaming platforms, FAANG companies, early-stage startups, and artist teams cut through the noise on emerging music tech trends, and turn “disruption” into concrete, actionable business opportunities.

If this sounds like a good fit for you, dive deeper into our consulting case studies and book a discovery call today!