Two Years Later: Clipboard History Pro

How we acquired and grew Clipboard History Pro.

Authored by: Harrison Roday

From late 2022 to 2023, our team at Third South Capital evaluated dozens of potential acquisitions. The idea was to pool our personal capital and start a permanent holding company of niche software businesses. After six months, we had nothing to show for it.

Things started to change when we met Denis Leonov. His product, Clipboard History Pro, became one of five companies we acquired in less than two months. This is the story of the acquisition, completed two years ago in July 2023.

Meeting Denis and Kicking Off Diligence

In acquisitions, building relationships is as crucial as evaluating the company itself. Our first interaction with Denis set the tone: he was responsive, provided helpful information, and was quick to offer a call.

We set up a call for May 18th. As is typical for us, one partner, in this case, myself, joined the preliminary discussion. I was impressed by what Denis had built. At Third South, we signify our enthusiasm for a potential acquisition by creating a dedicated Slack channel. If a project gets a channel, it's officially under diligence.

Every sale process is unique. Many sellers on marketplaces like Acquire.com see Letters of Intent (LOIs) as the first step in due diligence, unlike traditional buyside where an Indication of Interest (IOI) signals valuation first. While LOIs often act as IOIs in today's software acquisition market, submitting one is a considerable commitment for us.

Immediately after the call, I created the #clipboardhistory Slack channel, and messaged the team: “TLDR - I actually think we should think about submitting a letter here.” Things were moving, fast.

Our Initial Investment Thesis

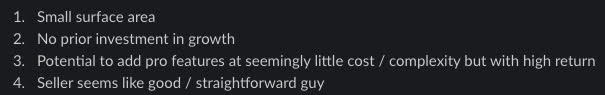

After our initial intro call, I offered this set of thesis points into the team:

Small Surface Area: At Third South, we often talk about "small surface areas", a concept Justin uses. To me, it signifies strong product-market fit. We prefer acquiring a tool which excels at a specific task rather than a larger platform, which while commanding higher prices, also demands continuous feature expansion and a higher level of support. This "small surface area" thesis is something we constantly test as we scale our operations.

Organic Growth: Denis shared Clipboard History Pro's "no prior investment in growth." Unlike products which need on ads or extensive content for SEO, his extension grew organically through word-of-mouth. This was a significant plus for us.

Ease of Iteration: Two years later, we're still working on realizing this point, but I can confidently say Clipboard History Pro is one of the "easiest" products in our portfolio for implementing new ideas.

Straightforward Seller: Throughout the sale process (and afterwards!), Denis was transparent and straightforward, a quality we highly value.

The Deal Accelerates

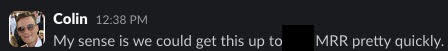

Within days, after internal team discussions, our enthusiasm for the deal grew. This rapid increase in interest, rather than diligence concerns leading to "death by 1,000 cuts," is a strong indicator of a good fit. Colin shared his evolving views:

While we never asked him to define “pretty quickly”, the tale of the tape is we have been able to materially grow Clipboard since our acquisition. Nice job Colin!

Not to say we didn't have concerns…we encountered two minor issues:

P&L Evaluation: We had some questions regarding historical profit and loss statements, such as gross-to-net fees and other Paddle-related issues, which were resolved.

Microsoft Edge Extension Transfer: Transferring ownership of the Edge extension (we support both Edge and Android users, though the Chrome extension is the primary revenue stream) also presented a minor hurdle.

The most significant ongoing "issue" we've faced is navigating Chrome MV3, which is a cost of doing business within the Chrome ecosystem, and highlights one of the drawbacks of being anchored to a specific platform.

Getting to Close

At Third South, roles and responsibilities often align with individual enthusiasm. Colin's zeal took the lead on subsequent due diligence calls, reporting back to Justin and me on growth opportunities and next steps.

Ultimately, we followed our standard closing process:

documenting assets for transfer

scheduling a closing call

transferring assets

wiring funds.

Some transfers, like Chrome extensions, require specific permissions from the Chrome Web Store Team, adding a layer of complexity.

Valuation

We aren't "high bidders"; the blended EBITDA multiple for our portfolio is below 4x. However, when we like an asset and our math supports it, we will bid what we believe will secure the deal. We considered Clipboard History Pro an attractive asset and paid our highest multiple ever for a business (though still in the low single digits). Two years later, this decision has paid off. We're on track to earn 20% more in Calendar Year 2025 than the last twelve months' earnings we calculated in mid-2023.

We even increased our bid between the LOI and closing to reflect Denis' desire to sell us an additional, pre-revenue asset called Jot & Paste. We also utilized our standard legal documents with few modifications, streamlining the process.

Lessons Learned

A Cooperative Seller is Priceless: Having a seller who is easy to work with, both before and after the close, is invaluable.

Validating the Narrow Surface Area Thesis: Our belief in products with a narrow surface area has been validated. While we don't anticipate Clipboard History Pro reaching $1 million in annual revenue, we believe it's a valuable addition to our portfolio.

Ecosystem Dependence: A Double-Edged Sword: Operating within an ecosystem like Chrome has its benefits, contributing to consistent growth. However, it also presents challenges, such as limited genuine access to our user base (making reliable communication difficult) and restricted data on tool usage. This is an inherent trade-off when investing in ecosystem-dependent products, but one we would make again (and have!) for the right ecosystem.

Further Reading

I recommend reading our recent interview with Denis. We wish him all the best in his next endeavor!

Best,

Harrison, Colin, Justin, and Myles

You just read issue #3 of Third South Capital. You can also browse the full archives of this newsletter.

Add a comment: