Shopify Theme Vitals: April 2025

Welcome to the monthly update! Consider sponsoring this newsletter to support new feature development for this project.

The Chrome User Experience Report (CrUX) data for April 2025 is now live on Theme Vitals. In this post, I’ll cover:

- ✨ New features ✨

- Change in the data population

- Aggregated theme performance changes

- Most improved themes for web performance

- Highest growth themes in market share

Thanks to Cronix

Thank you to our corporate sponsor, Cronix, a full-service ecommerce and digital agency.

You can add your individual support through a paid subscription or through Github or Ko-fi.

New features

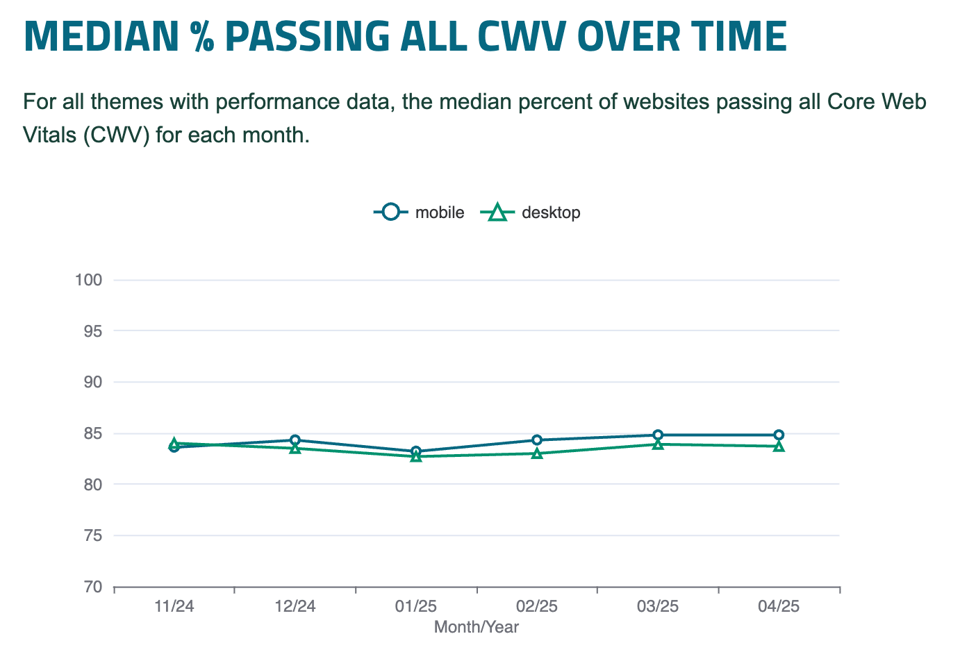

We had a flurry of new features last month. This month, I'm happy to share that I had a bit extra time to develop historical charts for the aggregated theme performance.

You can charts for each Core Web Vital plus the combined metric on the aggregations page.

Change in data population

The total number of Shopify websites included in the data set decreased slightly.

New themes added this month were Futurer, Couture, Etheryx, Machina, and Primavera. Elysian was dropped. I now show 287 total themes.

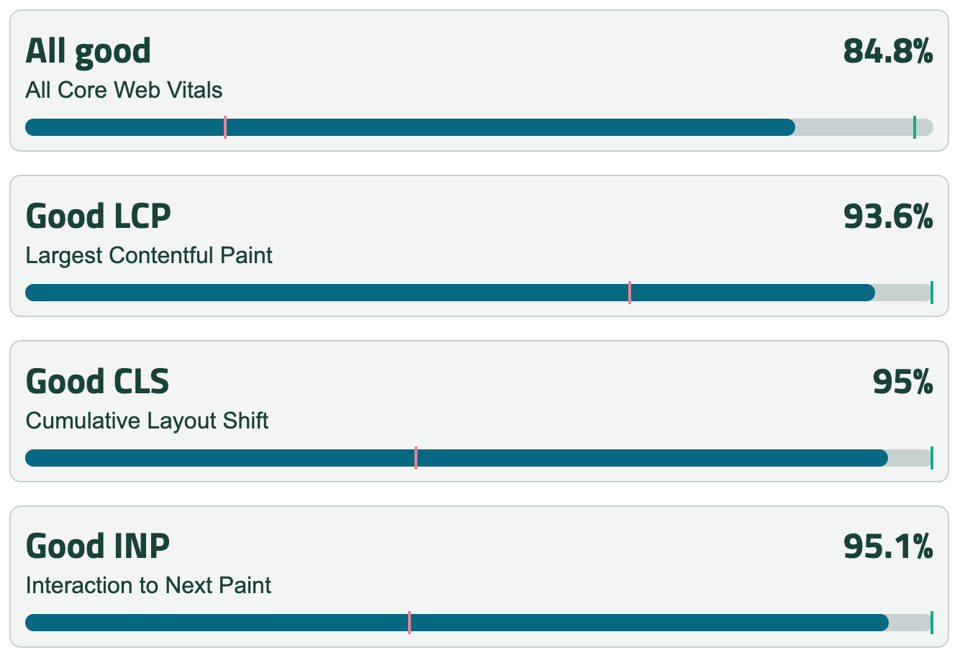

Aggregated performance across all themes

Here are the median, min, and max performance numbers on mobile for all the Shopify themes measured on mobile devices:

(For a more accessible version, see it live on the website: Aggregations).

(For a more accessible version, see it live on the website: Aggregations).

Most improved themes

For mobile devices, these themes had the most improvement in passing all Core Web Vitals:

- Meka

- Handy

- Artisan

- Sydney

- Flawless

For desktop devices, these themes improved the most:

- Express

- Minimalista

- Boundless

- Stockholm

- Mode

When themes on these lists have a small number of origins/market share, some of the improvements could be due to the underlying population of websites changing.

Highest market growth

As a reminder, the market share numbers calculated in Theme Vitals are not the same as number of installs. Here, we’re calculating market share based on the number of origins (websites/domains) in CrUX. CrUX only shares data for websites that reach a certain threshold of popularity. This threshold sometimes changes. To learn more, check out the methodology page for CrUX.

Growth in number of origins

The themes that already have the largest market shares usually have the highest growth in number of origins. Dawn returned to the top 5 this month:

Mobile

- Dawn

- Trade

- Concept

- Sleek

- Enterprise

On desktop, the top 5 themes are:

Desktop

- Concept

- Sleek

- Trade

- Enterprise

- Stretch

Percent growth in origins

Raw growth is interesting but usually focuses too much on the existing themes with high market share. Here, I show which themes are growing the fastest on a percentage basis:

Mobile

- Stretch (453%) - this is a new theme which only had 13 origins in March then 72 in April

- Flux (58%)

- Wonder (44%)

- Outsiders (36%)

- Ignite (30%)

Desktop

- Ignite (35%)

- Sleek (30%)

- Wonder (28%)

- Madrid (27%)

- Nimbus (25%)

Closing

The Theme Vitals site and this newsletter are meant to be a helpful resource to the Shopify community. Consider sponsoring or upgrading to a paid subscription to help develop new features.

As always, if you have ideas for new features or other improvements, let me know!