December 2024 Theme Vitals update

Welcome to the monthly update! Consider sponsoring this newsletter to support the work behind this project. Both individual and corporate sponsorships available!

The Chrome User Experience Report (CrUX) data for December 2024 is now live on Theme Vitals. In this post, I’ll cover:

- Change in the data population

- Aggregated theme performance changes

- Most improved themes for web performance

- Highest growth themes in market share

- New paid subscription option

Change in data population

The total number of Shopify websites included in the data set increased modestly on mobile by 2,815 (0.5%). On desktop however, it decreased by 17,196 (6.1%). It had increased by 6.2% in December so this seems like a reversal of that growth. CrUX data reflects user behavior so that may be the primary reason for the changes.

No new themes that reached the minimum threshold were added this month, but the Effortless theme was dropped.

Aggregated performance across all themes

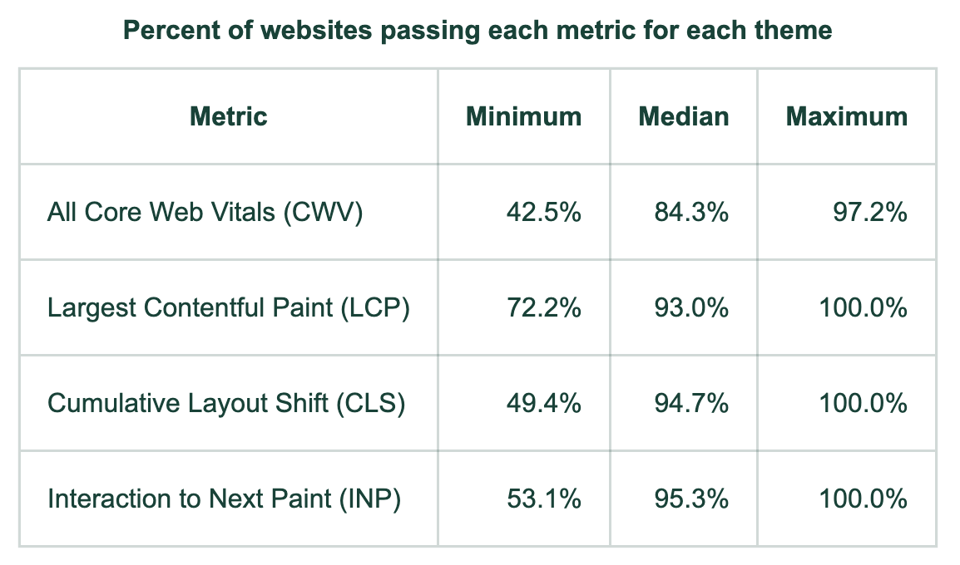

Here are the median, min, and max performance numbers on mobile for all the Shopify themes measured on mobile devices:

(For a more accessible version, see it live on the website: Aggregations).

(For a more accessible version, see it live on the website: Aggregations).

On mobile devices, the median performance improved only marginally for passing all Core Web Vitals (CWV) and Interaction to Next Paint (INP). However, the minimums for all CWV and CLS both improved significantly by 8-9 points.

On desktop devices, we had marginal declines in all metrics except INP.

Most improved themes

For mobile devices, these themes had the most improvement in passing all Core Web Vitals:

- Mavon

- Portland

- Drop

- Marble

- Electro

For desktop devices, these themes improved the most:

- Digital

- Portland

- Sydney

- Grid

- Momentum

Most of the themes on both those lists have a smaller number of origins/market share in the CrUX data set. Thus, some of the improvements may be due to better theme code, but with fewer data points it could also be due to the underlying population of websites changing.

Highest market growth

As a reminder, the market share numbers calculated in Theme Vitals are not the same as number of installs. Here, we’re calculating market share based on the number of origins (websites/domains) in CrUX. CrUX only shares data for websites that reach a certain threshold of popularity. This threshold sometimes changes. To learn more, check out the methodology page for CrUX.

Growth in number of origins

The themes that already had the largest market shares also mostly had the highest growth in number of origins for mobile. Impact edged out Refresh this month to return to the top 5:

Mobile

- Dawn

- Trade

- Prestige

- Craft

- Impact

On desktop, I surmise that the drastic drop in total origins resulted in the most negative impacts to the largest themes. So, we have several new themes in this list compared to the past:

Desktop

- Concept

- Sleek

- Trade (the only larger market share theme)

- Essence

- Release

Percent growth in origins

Raw growth is interesting but usually focuses too much on the existing themes with high market share. Here, I show which themes are growing the fastest on a percentage basis:

Mobile

- Sleek (41% this month and 87% last month) wow!

- Release (31%)

- Rise (19%)

- Concept (16%)

- Zest (13%)

Desktop

- Sleek (30%)

- Release (19%)

- Essence (14%)

- Starlight (10%)

- Concept (8%)

New paid subscription option

I've added optional monthly and annual paid subscriptions for this newsletter. What kind of perks would paid subscribers want? I've been considering adding a monthly office hours for live debugging of web performance issues. I'd love to hear your feedback and ideas.

Closing

The Theme Vitals site and this newsletter are meant to be a helpful resource to the Shopify community. As always, if you have ideas for new features or other improvements, let me know!

Also, to help keep this project going, I’m looking for a marquee sponsor that will be featured on both the website and in the newsletter. See all the benefits on the sponsor page!