The case for a 100% tax bracket for billionaires

I was looking through my photos, stumbled upon this image, and realized that I had to get out a seasonal newsletter today with a wish for 2025.

Please consider forwarding this newsletter (or my other newsletters) to a friend or sharing it on social media. For a shareable link and the newsletter archive, visit:

Archive • Notes from an Everything Historian • Buttondown

History, culture, science, and monsters from Dr Surekha Davies, historian of science, art, and ideas.

Rising income inequality has been hitting the headlines in surreal ways. Luigi Mangione’s alleged murder of the United Healthcare chief executive Brian Thompson led to an outpouring of “sorry, not sorry” hot takes on the internet and pointed critiques of a system designed to make a few people and giant corporations obscenely wealthy at the expense of everyone else. A person’s wealth and circumstances have much to do with what society enables - and with the stories spun to justify what it enables. This was not just a feature of the past, notably the age of the Atlantic slave trade, but of the present, which has its own fairytales.

My seasonal soapbox statements:

Extreme wealth is never earned; it is only enabled.

Minimum wage is a story about what a society thinks a human life is worth.

Societies decide what different sorts of people should earn and the rights they deserve, and write stories about who matters in order to justify these decisions.

Before you throw up your hands in horror at my insinuation that the super-wealthy didn’t earn their billions, remember that people have no trouble criticizing the excesses of rich people in the past. The French Revolution’s most enduring meme is “let them eat cake!”, words allegedly uttered by Queen Marie Antoinette and now quoted to signal an eye-wateringly rich person with no clue how regular people live.

And the label “robber baron,” used in the nineteenth century to describe greedy industrialists who paid workers a pittance to do dangerous jobs, recognizes that a few hoarded the wealth created by many. Financial and legal systems let them do this.

If I could wave a wand and enact a global policy change, what might it be? I’m not a trained economist, so I’m just spitballing here, but it’s important to imagine how a less obscene, less robber-baronesque future might look if we are to have any chance of creating one. So here’s my wand-wave:

Income above one billion dollars should be taxed at one hundred percent.

Why this number? Societies run on stories, and the fairytale around the category of the billionaire is as pervasive as it is nonsense. It’s the mythology of “success,” “genius,” and “greatness.” In fact the “billionaire” word should trigger an alarm bell that says, “someone here has a vast amount of wealth that other people earned but didn’t receive.”

Who are these “someones” who didn’t get to keep their earnings today?

They are low- and minimum-wage workers. They are Amazon and Starbucks workers. Public-sector workers. Teachers. Nurses.

It’s everyone with medical debt. Everyone who paid fistfuls of money and lost their house to pay for bills their health insurance provider refused to pay. (Healthcare should not be a for-profit enterprise. What we pay in taxes should provide healthcare for all, not line the pockets of CEOs and shareholders.)

Am I advocating financial hardship for a different bunch of people - the billionaires? Am I being mean? Nope.

1 billion dollars looks like this: $1,000,000,000.

Compare that to a salary of, say, $100,000 - already huge.

One billionaire’s salary = ten thousand salaries at $100,000.

So if they “only” got to keep, say, one billion dollars before the rest was taken away, they’d still have enough for a great annual salary for…. TEN THOUSAND YEARS.

But since they’re unlikely to live that long even with cryo-anything, let’s use another metric.

One billion dollars is like a ten-million-dollar-a-year salary for A HUNDRED YEARS.

And remember, they’d get ANOTHER one billion to keep the following year, and the year after that, so … … … my tax recommendation that no one gets to keep more than a billion dollars a year doesn’t go far enough.

The word “tax” is also a problem. “Tax” suggests you’re giving away something you earned for the government to spend on whatever (public transit, education, medical research, and anti-poverty programs, one would hope).

But here’s the thing: the higher your income, the greater the subsidies that the planet, public services, and other people have provided to you.

Roads. Bridges. The environmental cost of doing business (fossil fuels, water, stuff that has to be mined out of the earth). So shouldn’t a company, its shareholders, and senior management be paying more towards roads and bridges than someone earning, say, $50,000 a year or less?

A great deal of wealth in the Global North is the product of centuries of colonial as well as domestic exploitation. The legacies of empire continue in today’s extractive relationships between richer countries and poorer countries in the Global South (whose wealth was strip-mined for the Global North). While people pulling ordinary salaries and worrying about their bills, healthcare, college tuition, or retirement can’t make a huge difference individually, do you know who could?

People whose circumstances and/or values (like being willing to pay workers poorly) mean they amass more unearned wealth each year than they could use in TEN THOUSAND YEARS. Because society lets them.

In the words of an Oxfam report from 2023, “every billionaire is a policy failure.”

So yes, there’s a case for a 100% tax rate kicking in at the one billion dollar mark - frankly it should kick in below that, but let’s get there a step at a time.

And you know what? If minimum wage in the US had kept pace with GDP, it would be far higher than what it is right now. And those ultra-wealthy people would be less wealthy and pay less tax because they wouldn’t have taken sooooo much to begin with.

My wish for 2025 is for more people to realize that people aren’t paid what they’re worth: they’re paid what society decides they’re worth.

There are fairytales that keep the pay of service workers and educators and nurses low while letting today’s robber-barons amass more money than entire countries. Those fairytales are dangerous, and they dehumanize us all - even the billionaires.

Notes and further reading

My calculations are approximate. I tried to keep things simple enough for number-phobes to keep reading.

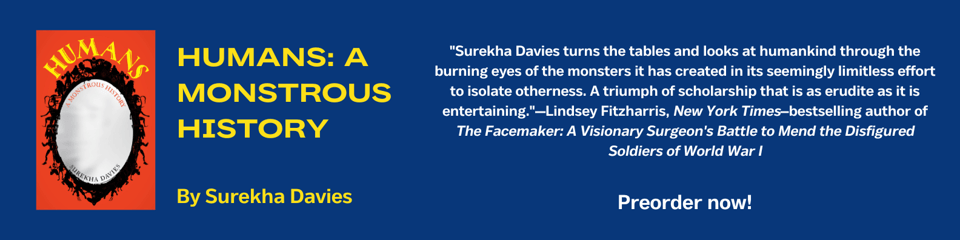

The history of the category of the human underpins the structures of the modern world. To learn more, pre-order my next book, HUMANS: A MONSTROUS HISTORY (out Feb. 4), ideally from an independent bookstore (you can do this online), today!

Jake Johnson reporting on Oxfam’s Jan 2023 analysis for the World Economic Forum meeting in Davos, Switzerland that month (includes a link to the briefing paper’s executive summary).

Elizabeth Kolbert this month, in The New Yorker, on climate justice and the case for financial reparations.

-

My favorite line from this newsletter: “ Minimum wage is a story about what a society thinks a human life is worth.”

Human life — but also what the work, often physical, of given individuals is worth; always in tension with the supposed “genius” of those at the top doing the “managing +” of that work.

-

This is BRILLIANT and truthful. Exceptional take on how the mega-billions don't take the responsibility to pay proper tax nor distribute income in a fair and just manner. I'm a nurse and it frosts my behind that my skills save lives but I can't get a fair wage in my state of Indiana. It's like insurance companies and big pharma, and hospital mega corps think, "Well you're really great, you hit all your marks on review. So, here's a 2% raise and a coffee mug with our logo." GREAT... and they wonder why nurses are leaving the bedside.

Add a comment: