Would very much prefer a no bombing version of this

The energy of geopolitics

Welcome to another Dispatch in an ever-more dismal week. We were going to write about in this edition something short about the proliferation of reports and takes noting that renewable energy is starting to look more like a first choice of energy for countries — helped by a combination of China’s turbocharged manufacturing, US dollar aversion, and price volatility due to geopolitical uncertainty. And then Israel launched attacks on Iran.

Tim is zooming to another conference, this time on energy modelling — something about which I have strong views. Last week he was at Mark Blyth’s summer school. We are on Bluesky (here and here), the other place, and Discord.

- Kate

Crisis

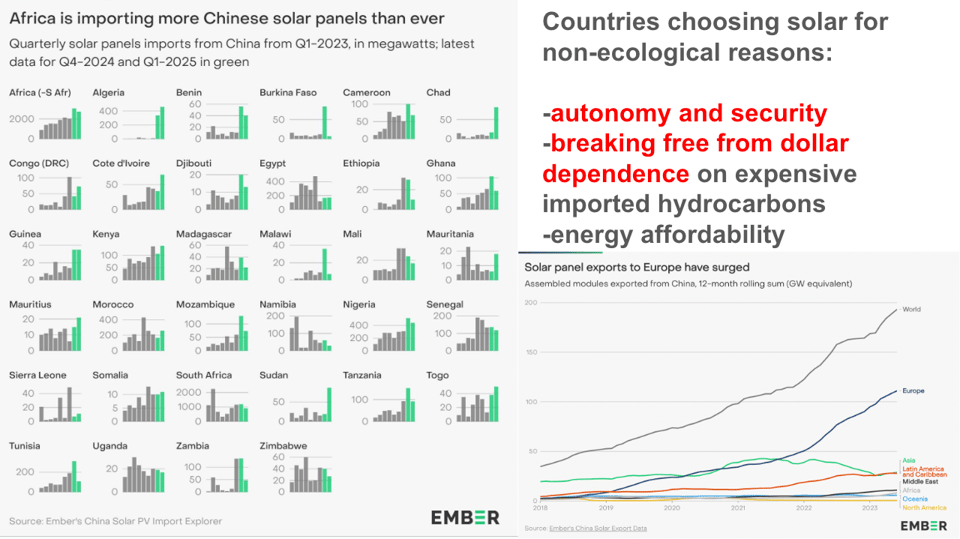

The Israel attack on Iran and what unfolds is very likely to boost the efforts of many countries to reduce their dependency on fossil fuels - something that is already gaining a lot of momentum this year from cheaper renewables + storage:

— Kate Mackenzie (@katemac.bsky.social) 2025-06-13T21:43:14.046Z

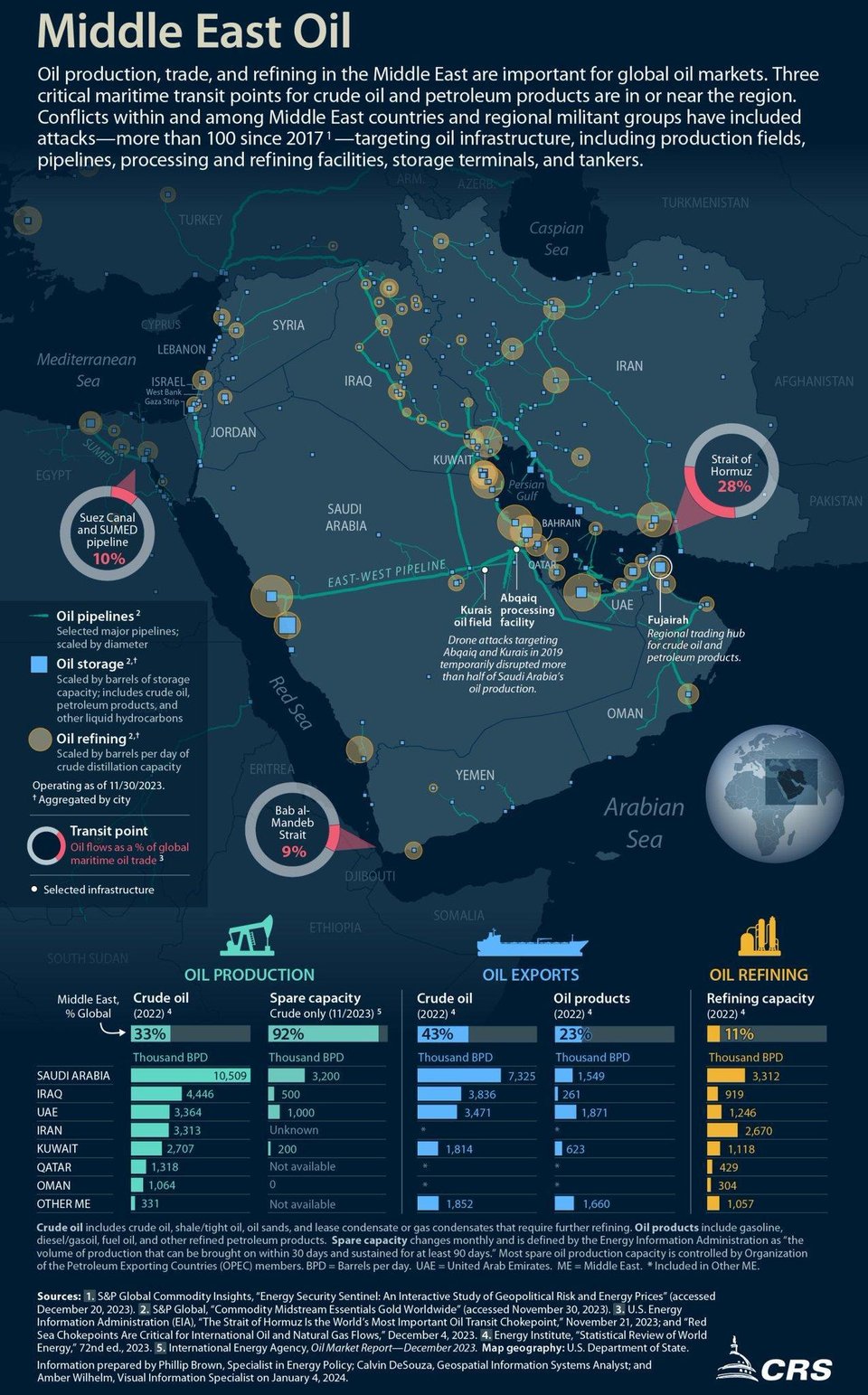

A portion of the press coverage of Israel’s attack on Iran has focused on oil markets. So far, although little has changed in terms of actual supply and distribution, yet prices spiked 12% on Friday and are still elevated (Brent crude is around 4% higher; but reports of a fire in the Strait of Hormuz at pixel time may change things quickly). Commentary suggests that oil traders struggled to figure out exactly how to price this risk; the likelihood of a big interruption to supply is still seen as low, yet no-one wants to be betting that prices will fall (shorting oil while bombs are falling requires “nerves of steel” as Javier Blas wrote).

And yet, the spectre of prices going over $100 a barrel is definitely back, and for the many countries that don’t export oil that will be a huge problem.

Oil and gas dependence is something that likely many national governments were already thinking quite hard about, as Liam Denning wrote earlier this month:

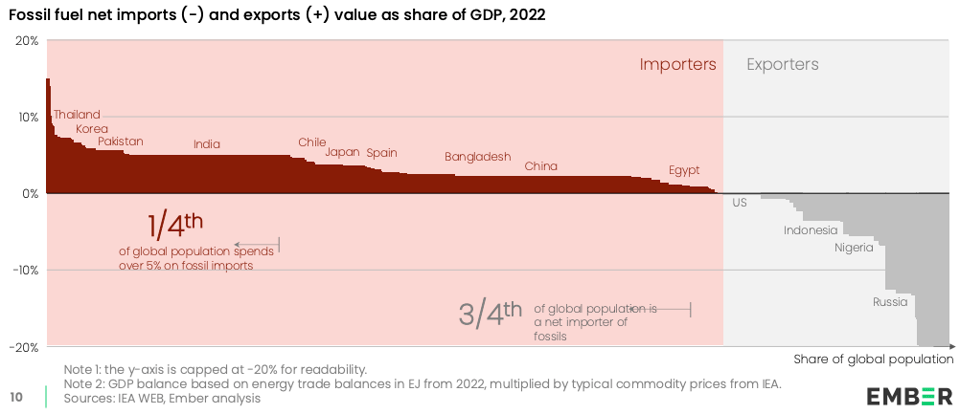

About three-quarters of humanity lives in countries that are net importers of fossil fuels, spending $1.8 trillion a year on them, according to a recent report, “Energy Security in an Insecure World,” published by Ember, a UK based energy-transition think tank. China and India, for example, are already far more dependent on oil imports as a share of demand than the US ever was.

Fossil fuel producers have long regarded this situation as essentially unchangeable, with developing nations bound to raise demand toward Western levels.

As the Ember report illustrates, countries with more than a quarter of the world’s population spend as than 5% of their GDP on fossil fuel imports:

The geopolitical risk premium on fossil fuel imports is only increasing. And as Advait pointed out in Heatmap, the US dollar denomination of most of these imports makes them more painful for developing countries, whose currencies tend to weaken when times are tough.

Tim's presentation at last week's Brown Political Economy of Finance summer school made a similar case to that of Advait and Liam: that a slew of rich and poor countries are going green rapidly for energy security and to lower their dollar dependence — ie., for non-ecological reasons:

The dog that didn’t bark

The 2022 Ukraine spike in fossil fuel was used to underpin a narrative that feckless, net zero-aspiring Europeans had neglected their fossil fuel supply. The UK reconsidered its ban on fracking. This time, so far, it hasn’t happened. Is it because it’s too soon and this new situation is too dramatic? Perhaps it’s in part because oil markets are currently oversupplied. So the probability of a catastrophic event (bombing Gulf oil assets; restricting Strait of Hormuz shipments) is hard to estimate, and even if it happens, the magnitude is now slightly blunted.

The alternatives beckon

States that are contemplating their energy security are likely becoming more aware of ways to cut their exposure to volatile imported fuel prices. Awareness of Pakistan’s solar boom is growing; last month CNN ran a big story about it:

And last week the FT reported that now, cheaper batteries are supporting Pakistan’s huge wave of solar panel installations by businesses and wealthy households, to the point where manufacturers and even a cement factory outside Karachi are using renewables for most of their power, with claims of payback periods of less than two years. China’s vast production is helping here: battery importers say the cost has fallen by a third since last year. Sales, meanwhile, have tripled.

Pakistan’s solar boom is an uncoordinated rush to decentralized power, with attendant dilemmas for the grid (made worse by foreign debts and the domestic electricity sector’s pricing system).

For more traditional energy grid deployment, BNEF found recently that in Thailand, utility solar with four hours of storage was cost competitive with even existing solar and gas plants:

the LCOE of new solar plants became cheaper than the short run marginal cost (SRMC) of existing coal power plants as well as combined cycle gas turbines (CCGTs) in 2024. This means it is now cost-effective to build a new solar plant in order to displace or reduce gas- or coal-fired generation from existing power plants.

BNEF expects a typical solar project with four-hour storage to become cost-competitive against the costs of running existing thermal power plants in 2025.

Meanwhile

Events have a way of eclipsing each other in current affairs. While southern Gaza has again lost internet and some mobile phone coverage, the International Red Cross said that yesterday it treated more than 200 Palestinians injured while trying to get food near Rafah; the local health ministry said 34 were shot dead by the IDF.

That’s it for this edition. Thanks to Meg for the subject line of this email.

Some other things we’re reading:

A big Carnegie Endowment project asks what BRICS member countries actually want from the forum, ahead of its meeting next month. The answers: mostly hedging, and clubs.

Battery minerals: The US doesn’t even have good data on the critical minerals that are used in the battery industry; quite a lot of it comes down to trade codes, as well as communication between government agencies and departments. A report on battery minerals dependence by the Council on Strategic Risks, by Ben Taulli and Joshua Busby.

Linda Kinstler: A Measure of Things Human - a review of / meditation on new books on the destruction of Gaza, by Pankaj Mishra and Peter Beinart.

David Wallace-Wells: Regression on gender is a tragedy, not just a political problem For all the chin-stroking about deindustrialisation and schools; the increasing trend of teenage boys thinking women should not be paid the same as men is just really, really bad.

Also: A bizarre story, beautifully reported, about a sub-tropical Albanian island that is being developed by Kushner into a luxury resort.

And also: For something very different to what we write about, the Today in Tabs newsletter is back and it’s perhaps the best newsletter of all. Here is their take on the Musk-Trump feud.