The flood-tax connection; Modi's Billionaire Raj

Hello and welcome to the 2nd test edition of the Polycrisis Dispatch. We’re developing a weekly newsletter that has some of the features of our longer essay newsletters, but is shorter, more accessible, more newsy. If you’ve just been added, it’s because you’re a friend of the project who we figured would be ok with receiving it — if not; we’ll remove you, of course! This is very much at the experimental stage, so feedback is very welcome. You can email thepolycrisis@gmail.com or contact Tim or Kate directly.

Last week we looked at Europe’s fiscal restraint, protectionism, clean tech dumping fears, and Draghi’s speech. This week we’re starting with terrible climate impacts in two countries whose leaders have already been pushing for global, equitable climate action. That requires finance from the wealthier countries with the historical climate debt and wider financial latitude – but also domestic revenue raising. Taxes could and should be a source of international and domestic finance; but while Brazil is advancing a wealth tax agenda with some early success, Modi’s Billionaires’ Raj India is unlikely to play ball.

…

Floods, anger and taxes

More than 200 people have died in Kenya’s floods in the past week. The entire African continent may have contributed just 4% of total world emissions, but it's paying a deadly price for everyone else’s. Floods in southern Brazil have killed almost a hundred, and displaced nearly 200,000 people.

Leaders of both countries had already been using their voices on the international stage to highlight the connection between greenhouse gas emissions, financial architecture, development, and climate impacts. Lula’s mood was “a mixture of agony and anger” flying over the damage to the Rio Grande do Sul region; which produces 70% of the country’s rice. He again talked of the rich nations' pollution dumped on the bodies of the poor nations as a “historic debt”. Kenya’s Ruto faced criticism at home for “big talk” on climate change that did little to prevent Storm Hidaya’s impact. But the links between poorer nations' debt crisis and the climate crisis are stark: Kenya currently spends a quarter of its government revenue on debt interest payments (UNCTAD’s World of Debt is a brilliant resource on this vicious climate-debt cycle).

Brazil is far less burdened by external debt as it is a resource exporter; but what both leaders have in common is a shortage of funds to adapt to and mitigate climate damage.

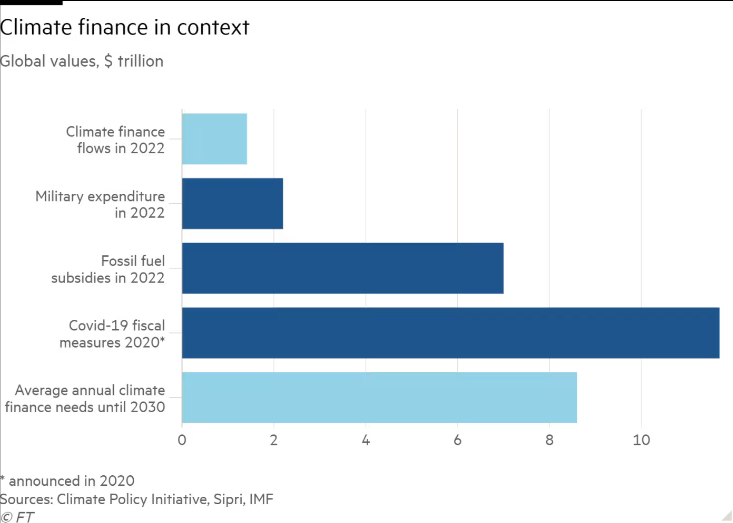

Where will funds come from, given the North’s refusal to abide by even a minimal sense of climate justice?

Kenya is demanding a dramatic increase in climate finance from international financial institutions and bold taxes on big polluters. Expect Ruto’s state visit to Washington on May 21st, where he will likely address Congress, to include some sharper demands post floods. The US wants to be seen as responsive to mounting global south anger as their credibility on Gaza worsens.

The African Union wants control over their own tax revenues, to stop kleptocratic elites and corporations from siphoning away cash into the tax havens of the OECD countries. UNCTAD estimates a full 3.7% of GDP could be recovered from tax havens.

Globally coordinated tax reforms are incredibly challenging to enact – taxes are sovereign, with the exception of a few frameworks such as shipping. The money has to come from somewhere. The US is funding the Inflation Reduction Act spending partly from corporate taxes. African countries in aggregate have a tax to GDP ratio of 17% - about half the global average. Never forget, taxes are climate policy… and the stuff revolutions are made of.

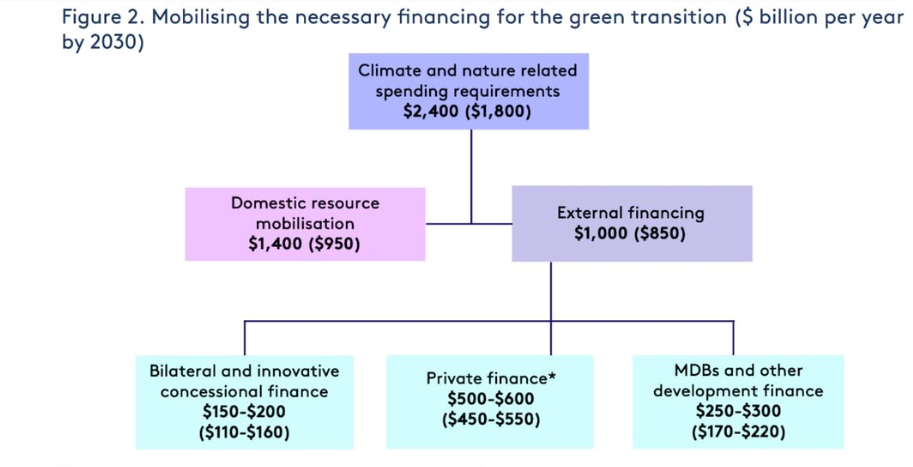

The world’s climate finance needs are estimated at $2.4 trillion a year – but more than half of that estimate is domestic finance:

Source: Independent High Level Expert Group on Finance for Climate Action

Brazil is leveraging its G20 presidency to champion a global wealth tax targeting billionaires. It has won support from France, Spain, South Africa, and progressive members of Germany’s governing coalition.

It’s an impressive list, but you can forget about broad South-South solidarity on that one. Modi’s India now has over 200 billionaires – there used to be just 2 billionaires in all of India in the 1990s when Tim was a kid there – and unlike the former trade unionist Lula, Modi is not interested in taxing them.

The Modi version of “welfare queens”

India has turned into a Billionaire Raj that is more unequal than it was under the British Raj. The Congress party’s election manifesto called for an urban employment guarantee programme and free healthcare in all public health centers. As the great Indian development economist Jean Dreze contextualized “All OECD countries have property taxes, most have inheritance taxes, and some have a wealth tax as well. India has none of those, except for symbolic property taxes”.

But Modi has claimed that such redistribution is just more welfare for Muslims – – whom he reprehensibly described as “people with many children”. His BJP is giving the great Indian middle class a dose of US rightwing strategy, reminiscent of painting African Americans as “welfare queens”.

Sham democracy or not, will voter turnout suffer during a searing heat wave? India and other parts of Asia are suffering their hottest summers on record. A former election commissioner suggested holding elections in the cooler month of February but, hot or not, Modi won’t stop.

Things we are reading:

"It is the best book I’ve read about the full scale assault on democracy in India, and with the general elections scheduled to conclude in June, it’s essential reading for understanding what’s happening to the country right now." - New Statesman review of “The Incarcerations: BK-16 and the Search for Indian Democracy”

Alex Turnbull’s post on hedging for sovereigns and for critical mineral price volatility

FT series on Buffett and Berkshire Hathaway

The price of oil - Gregory Brew’s excellent piece from Phenomenal World in 2022 is circulating again

—-

Thanks for reading this! Feedback is very welcome.

-Tim, Kate & Sargon

Add a comment: