Tariff chaos; cat-and-mouse supply chains; tech transfer

Welcome to the 3rd edition of our weekly newsletter-in-development. If you want to share feedback, please email us both or Tim and Kate individually.

This week’s email came together quite frenetically, as the US tariff hikes are a big story with many elements that are core to our writing over the last 18 months. We’re currently reworking the newsletter below into a traditional Polycrisis/Phenomenal World essay newsletter, which should be in your mailbox tomorrow. Enjoy the lo-fi preview!

Trade wars

American protectionism has now entered its chaotic era. Biden launched a new round of tariff war on China this week, with a swathe of green goods targeted including the dramatic 100% duty on Chinese electric vehicles.

Do these tariffs hang together as coherent industrial policy? Trade policy? Foreign Policy? Climate policy? Are the tariffs a sign of the prevailing mood turning sour as more green manufacturing projects post-IRA subsidies now get cancelled? The takes on Biden trumping even Trump’s tariff war with China are flying thick and fast.

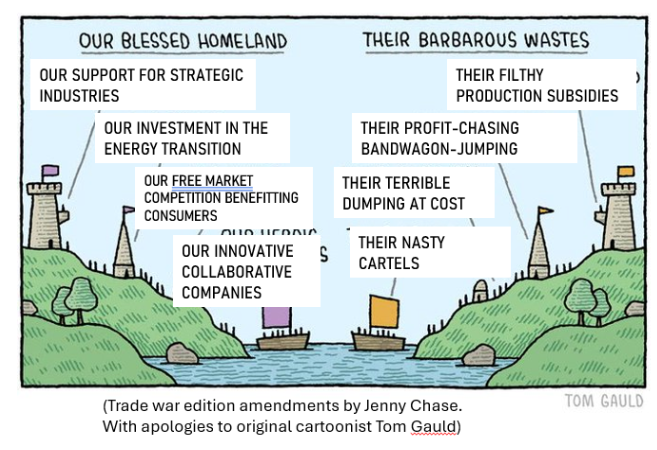

The Polycrisis take: everyone needs to drop the narrative of “Our Glorious Industry / Your Subsidised Chaos” and start saying we are in a green structural transformation. This is not narrowly about cars but about the underlying conflict in the world order.

Why now?

First and foremost, the increased US tariffs are a performance in advance of the November elections. “We are imposing 100% tariffs on Chinese Autos” has an undeniable campaign speech ring to it. Elizabeth Pancotti at Roosevelt lays out the politics starkly: “What gives? As MIT economist David Autor put it, ‘There are few things that would decarbonize the US faster than $20,000 EVs. But there is probably nothing that would kill the US auto industry faster, either,’—an industry that drives 5 percent of GDP and 10 million American jobs.” Simply put, Democrats losing the presidency in November would spell the end of US climate action.

Why performative? Because Americans are barely buying Chinese EVs, points out Ilaria Mazzocco. Existing high tariffs of 27.5 percent (Trump slapped an extra 25 on top of the standard 2.5 percent US tariff) plus the IRA’s anti-China tax credit design, have meant that Polestar (owned by China’s Geely) is the only company exporting Chinese EVs to the US. Batteries fully made in China are hardly making it into the US either, since the IRA ‘Foreign Entity Of Concern’ (FEOC) rules already bar the $3,750 tax subsidy from going to EVs containing battery metals processed in China, whether by foreign or Chinese firms.

China’s counter-strategy: re-routing

Their performative nature doesn’t mean these tariffs have no weight. They have bipartisan support—first Trump, now Biden—and will be almost impossible to unwind in Congress. Over the last 3 years, Biden officials—Janet Yellen, Jake Sullivan, Tony Blinken—have delivered that ‘Made in America’ message directly to China.

The Biden administration wants to stimulate a domestic and friendshored buildout of the full mine-to-processed metals-EV supply chain. Previously at The Polycrisis we have written about how friendshoring ‘side deals’ were made after Congress passed the IRA in 2022.

Since then, the US Treasury has extended IRA tax credits to key geopolitical allies, like the Koreans, Japanese and Europeans who all received a leased vehicle exemption, meaning the ‘Made in America’ rules don't apply and their firms’ vehicles could still qualify for subsidies. Hence the surge in EV imports from Korea, Japan and Germany since the exemption was finalised in December 2022.

In May came the Treasury’s final Foreign Entity of Concern ruling. Its intention is to reduce US reliance on China for battery components and critical minerals. Automakers won’t be able to receive IRA tax credits if the equity, voting rights or board seats of any company in their battery supply chain are 25% or more owned by a Chinese government-linked company.

Chinese firms anticipated the message of the tariffs and are playing cat and mouse. They are putting facts on the ground, and are already re-routing their auto supply chains to third countries with pre-existing Free Trade Agreements (FTAs) with the US—Morocco, Mexico and Korea chief among them—so that they can continue to sell into the vast American market and access IRA subsidies from the US Treasury. That outbound investment strategy, duly supported by the Chinese government's NEV Industry Development Plan (2021–2035), means that Chinese firms and their local partners in third countries are well prepared to bypass Biden’s latest round of 25 percent tariff on batteries and 25 percent tariff on the critical minerals inside them.

The re-routing strategy has worked successfully in the past. Chinese firms undertook similar re-routing to Southeast Asia to bypass US solar tariffs in the 2010s. Over 80 percent of solar cells imported into the US now come from Vietnam, Malaysia, Thailand and Cambodia

Will China’s re-routing strategy work with the far larger and politically consequential auto industry? US politicians are already planning countermeasures. In a letter to Biden’s trade chief Katherine Tai last November, they wrote that the US “must also be prepared to address the coming wave of [Chinese] vehicles that will be exported from our other trading partners, such as Mexico, as [Chinese] automakers look to strategically establish operations outside of [China].”

Technological backwater

There is no doubt among observers that the Cambrian explosion of Chinese EV firms over the past 5 years—there are now over 200 EV manufacturers in a Darwinian life and death competition for margins and market share—has led to Chinese EVs vastly improving for consumers. They are faster, better, shinier, more entertaining, and cheaper than their Western counterparts.

For Elon Musk it is an open and shut case: “The Chinese car companies are the most competitive car companies in the world…Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

For the US, this is too big to get wrong. American automakers survived new rivalry from Japanese and Korean imports in the 1970s and 1980s, but this time the business model of the entire industry is shifting. It’s not just the vehicle technology but the entire ecosystem. For Bidenists, ‘There Is No Alternative’ to walling off US production.

After all the Biden administration’s chatter about following in Alexander Hamilton’s footsteps, the US may have to do what every developing country that wants its industry to catch up has done: form joint ventures with leading firms and throw their best engineers at the shop floor to absorb their technology.

The US followed that technology transfer playbook for chips, but not for autos. CHIPS Act subsidies attracted all the world's best manufacturers to set up fabs in the US (see South Korea’s Samsung in Texas and TSMC in Arizona). The current US auto policy of infant industry protection without technology transfer is a recipe for bloated and lazy domestic firms making unaffordable, unattractive green goods.

US car companies are not oblivious to that risk. While the government walls off production, US firms are acquiring Chinese knowhow by simply licensing the superior technology of lead firms BYD and CATL. Ford (in Michigan) and Tesla (in Nevada) are partnering with CATL to make batteries. CATL says it has structured its licensing deal with Ford so that it is compliant with the Foreign Entity of Concern rules. Tesla already uses BYD cells in Germany, while Ford and GM use BYD batteries.

The story is similar in Europe and Latin America. Countries like Hungary and Germany, Brazil and Chile have no intention of falling behind in the technological race and have already spent a lot of political capital attracting FDI from Chinese firms.

China’s response: TBC

The tariff war is ultimately about geopolitics, not the cat and mouse game of supply chains. No one knows if China will respond performatively or powerfully. The Ministry of Commerce response was “China will take resolute measures to defend its rights and interests.” China’s geopoliticians will have to calculate the extent to which forbearance is in their interest, and where to draw the line which, once crossed, means China responds far more aggressively.

Everywhere else it’s just: TINA

What will it mean for other countries in the US sphere? The US already has established form when it comes to extending its technological containment internationally; see its efforts to get allies to lock out Huawei’s 5G infrastructure. What if the US tells its allies and neutral countries to stop using Chinese green technologies, dramatically hindering global decarbonization?

We are less worried. The differences between 5G infrastructure chips and green technologies are many. The US containment of Huawei 5G technology was only partial, and good US-friendly alternatives existed in the telecommunications technology. By contrast, almost everyone else is a laggard on green technologies, with Chinese firms not just leading but revolutionising green industries. For now, there is nowhere else to go but China, and if the US were to insist other countries refrain from buying Chinese, it would face isolation. Like Germany’s Chancellor Scholz this week, we expect countries to offer a “different perspective”.

Add a comment: