Taco is Dead. Long Live Empanada

EMPANDA — Everyone Makes Promises And Never Actually Does Anything?

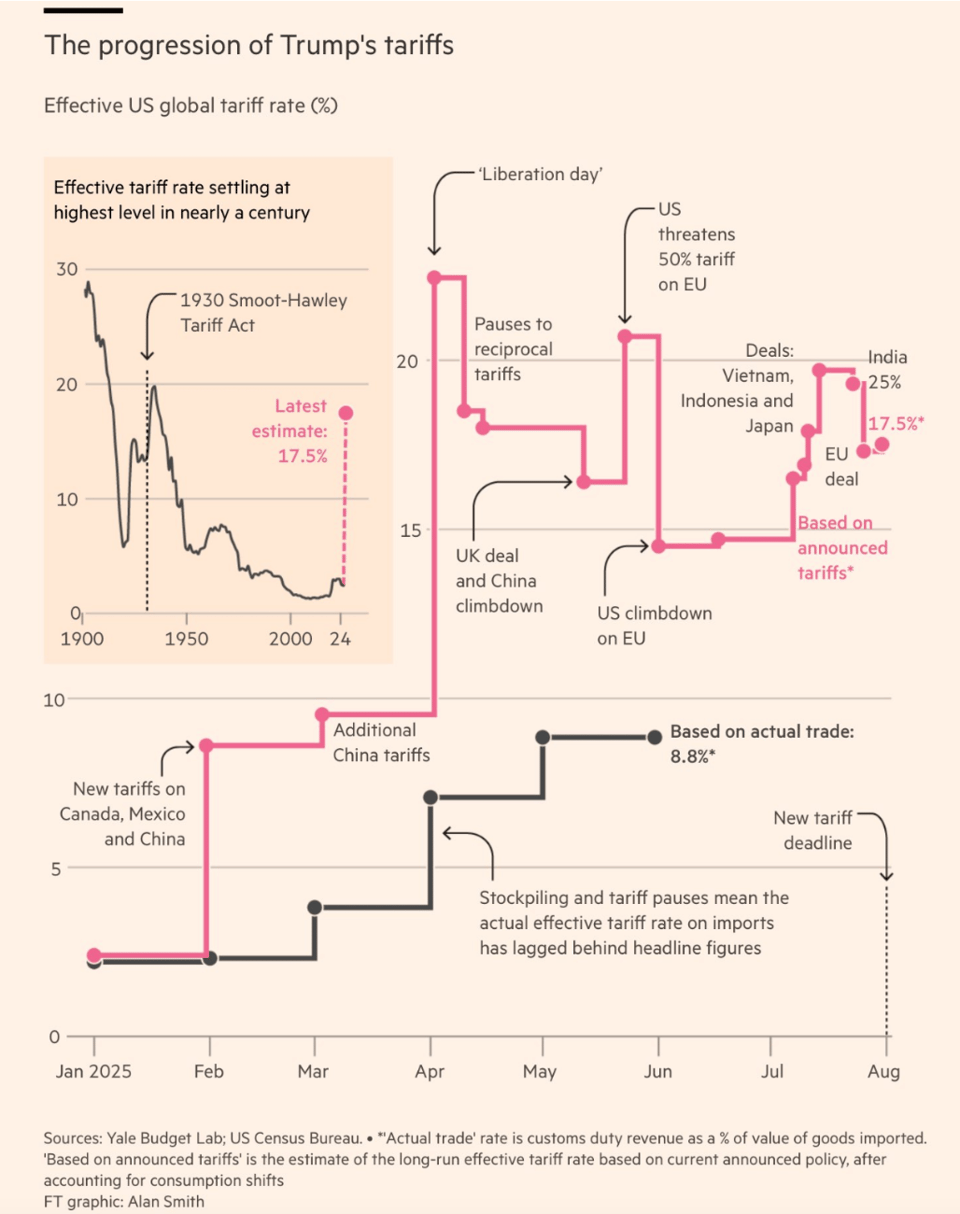

The last two weeks have seen a flurry of Trump tariff deals before the August 1st deadline and not unrelatedly to tariff war, market-shaking news of a slowdown of jobs in the US economy.

There are many interpretations of who capitulated & who won in the tariff deals. It is safe to say that Wall Street’s putdown of TACO “Trump Always Chickens Out” is no longer defensible. Robert Armstrong (who coined, the TACO trade thesis) says TACO is falsified, and has been replaced with WACO — World Always Chickens Out.

Other interpretations and questions remain open. Is the US Monetizing Primacy i.e some version of a protection racket? Did the Europeans Capitulate? Will American allies – EU, Japan, and South Korea – go through with their end of the bargain and buy lots of American weapons, more American LNG, and actually do hundreds of billions of dollars of investments in America? Or is Everyone Makes Promises And Never Actually Does Anything?

TACO is dead. Long live the EMPANADA.

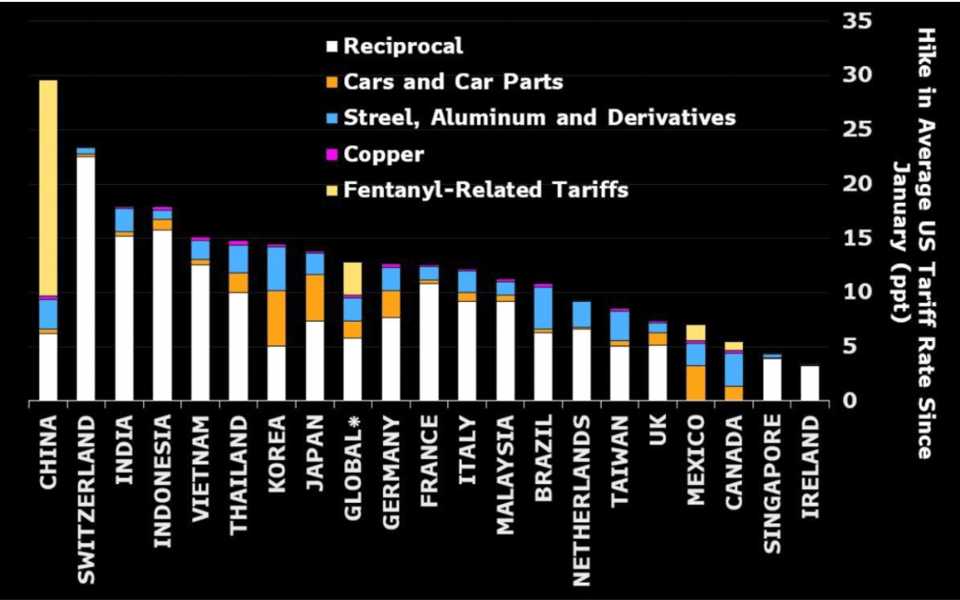

TACO is dead because the deals that Trump has made are with far higher tariff rates than seen since before the second world war. The world undeniably looks very different in a new trading order. Countries, both US allies and adversaries, have been put into one of three tariff tiers. 10-20 % (Japan, EU, South Korea), 20-30% (India, Vietnam, South Africa) more than 30% (Brazil and Switzerland quite inexplicably). How the winners and losers of this new trade order transform domestic and international politics around the world is anyones guess.

Everyone Makes Promises And Never Actually Does Anything?

Japan has, according to Trump, over the coming three and a half years committed to $550 billion of new inward investment into the US, and the EU has committed to $600 billion by 2028. South Korean President Lee Jae Myung said that his deal with the US would create a $350 billion investment fund to help Korean companies enter the US market in shipbuilding, semiconductors, biotechnology, energy.

None of these deals specify any timelines or enforcement; nor are there any formal joint agreements on paper. EU officials have noted that they have no control over private company decisions to invest in the US and would not be directing or enforcing how companies spent. On fossil energy promises too, EU is in EMPANADA land. It will be buying a whole lot less US LNG than the promised $250 billion annually. Energy experts are very sceptical that either EU demand or US supply of LNG or oil will scale upwards from the current imports of under $70 billion.

Most likely, as Warwick Powell suggests, the EU “commitment” of inflated figures “is little more than a repackaging of ongoing capital flows; that is, EU-based firms buying U.S. bonds, stocks or perhaps, setting up plants to avoid tariffs”.

Similarly, Japan’s negotiator Mr Akazawa has told financial press that he anticipated just 1 or 2 percent of the $550 billion fund would be deployed as direct investment, with the rest being loans and loan guarantees. The Japanese are already the largest source of manufacturing FDI into the US, at nearly $300 billion in 2024, making EMPANADA and number fudging the most likely outcome.

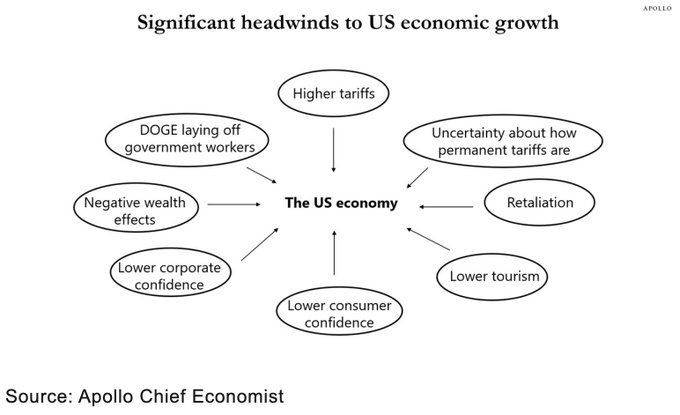

Whatever your interpretation, the US is not exactly winning. Incoming economic data has borne out what we wrote in “April is the Cruellest Month”.

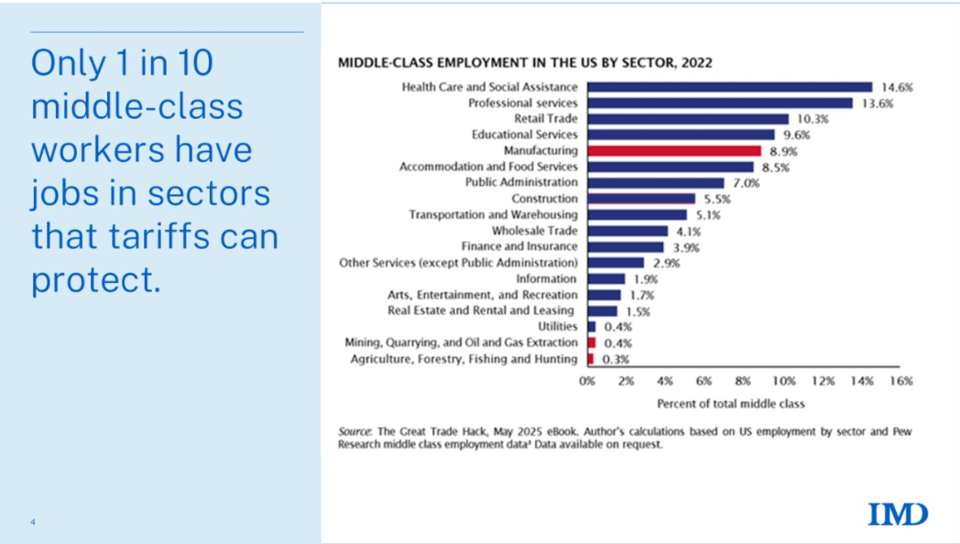

The US economy is now on the brink of a recession: Employment is falling. Consumer spending has flatlined; construction and manufacturing are contracting; the dollar and debt markets are creaking. Will tariffs actually MAGA with reindustrialization and restore American manufacturing workers? Predictably, as input costs have risen, and investors have been plagued by uncertainty, US manufacturing employment has fallen, not risen. Reuters reported that US manufacturing “contracted for a fifth straight month in July and factory employment dropped to the lowest level in five years”.

Perhaps the unpopularity of tariffs is why Trump is floating a new proposal of a tariff rebate wherein the hundreds of billions of dollars that the US Treasury has already collected, would be sent back in stimulus checks of a few thousand dollars to Americans.

SUMMER CONFERENCES AND PODCASTS

— The Beyond Neoliberalism conference that we attended in Cambridge has now uploaded all the panel videos and turned them into podcasts; they made a cool video essay set to inexplicably thriller trailer music tracing the conferences’ panels from finance, inequality to industrial strategy and democratic renewal.

I presented on the green transition panel with Bill Janeway, Helen Thompson, Amir Lebidoui and Hidde Boersma.

I packed in 3 years worth of Kate and my Polycrisis essays in 15 minutes! I had been anguishing about the collapse of the IRA at Trump's hands so apologies for the dourness. I argued that the global green transition was very different now because of the collapse of the liberal 1990s North-South climate paradigm (hands-off neoliberal Wall St-led billions to trillions), and the rise of a new China-South climate paradigm of developmentalist states in search of new growth models. Bill Janeway pushed me to tell the 2-minute version of the Chinese green leap forward post 2020 which I did borrowing Jeremy Wallace’s Polycrisis essay about the CCP’s capital discipline of the old real estate model.

— Daniela Gabor’s three-part dispatch from the just concluded UN Financing for Development conference in Seville, which argues that neoliberals are still firmly in the saddle.

— If you were curious about Tooze's new climate book, check out Kaiser Kuo’s podcast Sinica: “This is the material dethroning of the west as the central driver of world history. This is really what the provincialization of the west really looks like.”

— Joe Weisenthal and Tracy Alloway have a lovely profile in the New York Times of their swashbuckling Odd Lots podcast that dives into many of the macroeconomics and geopolitics themes we cover at Polycrisis. Why do we read the Bloomberg/Financial Times/Wall Street Journal? “Capitalists will lie to you, but they don’t lie to themselves”.

Add a comment: