UK election, Carnegie panel, and a lot of things

hello readers!

This is extremely short because tomorrow we have our Kenya newsletter on our Phenomenal World mailing list (if you’re not on it for some reason, here you go. As ever, email us jointly here or separately Tim and Kate.

A lot has happened since we sent last week’s emails; mostly not great. But hey ho, it’s election day in the UK, and you know what that means: yes! British political humour!

Although reflecting on it all is a bit too serious even for the Brits to joke about. Watch it anyway:

This is an incredible piece of work by @JonathanPieNews.

— Mike Galsworthy (@mikegalsworthy) July 3, 2024

From the research, to the sequencing, to the performance.

You want to know why so many people are turning away from vapid MSM and looking to political comedy & alternative news? Look no further. 👇pic.twitter.com/JhecwxLFbG

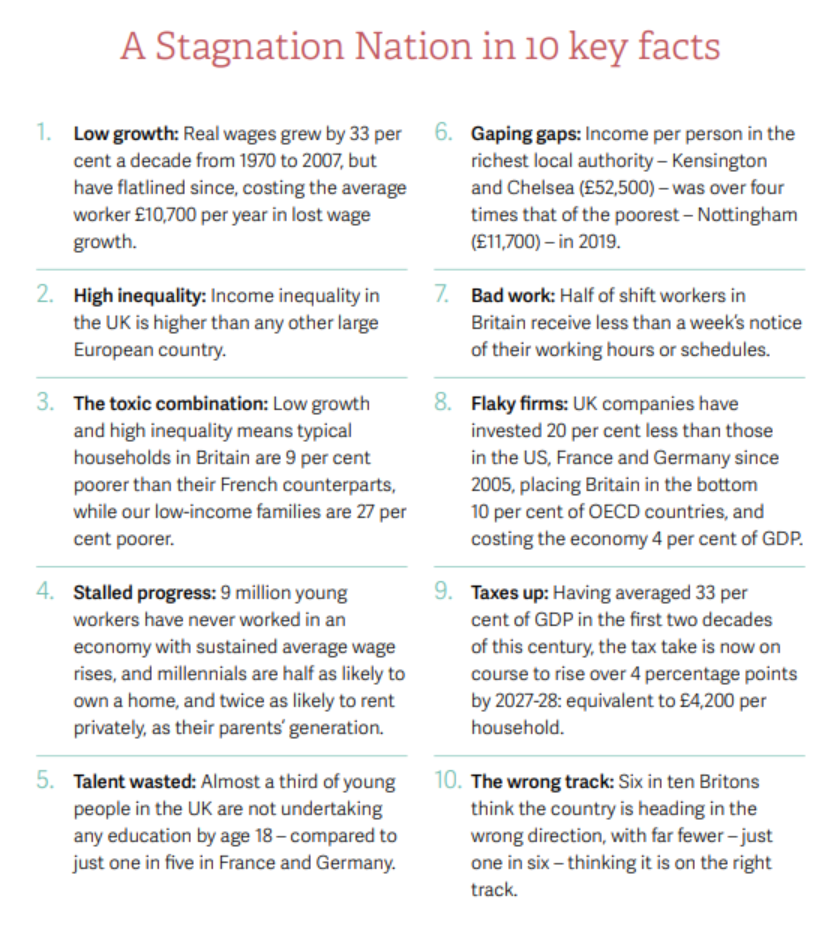

Or here in less humorous but more succinct form, courtesy of Resolution Foundation:

The fourteen years of Tory austerity have wrecked the UK. Today the British people will vote to throw them out, and deliver a Labour landslide. Cash strapped local governments mean buses no longer run, public toilets shut, beach lifeguards are defunded. As Anoosh Chakelian summarised in Bust Britain:

"Decay has also advanced in those sectors where the private sector owns vital national infrastructure. Water companies pollute our rivers and beaches as bills go up. The Royal Mail can’t even deliver hospital letters on time. Energy firms rip us off. Train services are a shambles. While the British public struggles with poorly run services, shareholders and, ironically, foreign governments (rather than the UK taxpayer) benefit. EDF Energy, Britain’s fourth largest household energy supplier – which is building the country’s long-delayed first nuclear power station in a generation – is 90 per cent owned by the French government. Avanti, one of Britain’s least reliable train operators, is part owned by the Italian state."

Our Polycrisis Carnegie panel:

We did a zoom panel with Noah Gordon of Carnegie Endowment for International Peace and David Wallace-Wells of Uninhabitable Earth/NYT on “Our Polycrisis Summer”. We talked about peak oil, solar hockey sticks of hope, water “zero-days”, and the infinity social cost of carbon. It was definitely not a complete bummer, but if you missed it the video is here and below is Tim’s twitter thread:

Our world crisis of ecology, economics, and empire, has continued to metastasize. It is shaking confidence in established worldviews & ruling elites everywhere.@kmac ,@dwallacewells @noah_gordon_ & I had fun chatting about some Polycrisis stories. Watch:https://t.co/tFOe6PcEuW pic.twitter.com/gfF2dYyvQ9

— Albert Pinto (@70sBachchan) July 1, 2024

Cost of carbon. A favourite column of ours by DWW: There’s nowhere to escape the harm from wildfires. “We’re going to be burning for this entire century... This is a global shift. It’s an epochal shift, and we happen to be alive for it.”

Zero water. “Agriculture and animal agriculture are vast consumers of water. No other sector is so important to climate & geopolitics, and yet so underdiscussed by politicians.” Noah Gordon talked about drought. Check out his BBQ Earth podcast.

Oil narratives. Do people know oil demand has peaked? Companies certainly do - and so do the countries at risk of stranding. OPEC & Big Oil are each responding differently. Private oil companies are gushing cash to shareholders, while countries facing 'unburnable wealth of nations' are diversifying.

Solar hockey stick of hope. How will you know that you are living through a Solar revolution? There will be signs… “Solar panels have become so cheap that they are being used to build garden fences in the Netherlands.”

Other stuff:

There were some Polycrisis meetups in Delhi, NYC, Chicago and DC! And, a crypto-spammer got into our Discord :( The next book is Planetary Mine by Martin Arbodela. We do not yet have a date for the zoom, but sometime later this month. “Polycrisis-30” for a discount from Verso!

Central banks, or at least the people who write about them, are beginning to think about how climate change’s effects on food price inflation might affect monetary policy. (About time.)

In writing on Kenya, we wondered if there is any way of systematically tracking IMF/government negotiations? There are staff-level IMF agreements with program countries, but the discussions over whether a country tries for a restructuring or just goes hardcore IMF austerity seem incredibly important and opaque. If you know, please tell us; but in the meantime, the bulletin of the African Sovereign Debt Justice Network seems like a very useful resource.

That is it from us this week. If you like it, or don’t like it — please let us know why.

Add a comment: