Many good things to read

The tipping point on energy in China, maybe the US?

Hello dear readers,

Tim will be busy in New York this week as it’s UNGA and New York Climate Week. Relat.edly, the last few days have been quite busy in terms of reports — some of which we’ll unpack here.

The theme of China exporting clean tech and clean tech manufacturing to the world – per the report by Tim and colleagues at Johns Hopkins NZIPL – is big. It sparked a big piece by Bill McKibben about superpowers behaving badly (US) and China’s equivalent of a Sputnik moment and Marshall Plan. Tooze has also weighed in on the Hopkins report. A video seminar on the NZIPL report digs into some of the implications, including how middle income countries need to insist on tech transfer and local content – leveraging their market access, in most cases – to maximize developmentalist and not extractive outcomes from these Chinese FDI projects. At Phenomenal World, Tim interviewed Mathias Larsen on the reports key takeaways and BRI 2.0.

There have also been at least ten million pieces in this vein lately covering either the US's role or the broader global landscape. A few are below.

-Kate and Tim

Blockbuster slide deck time:

Ember released one of its blockbuster reports and slide decks, “The Electrotech Revolution”.

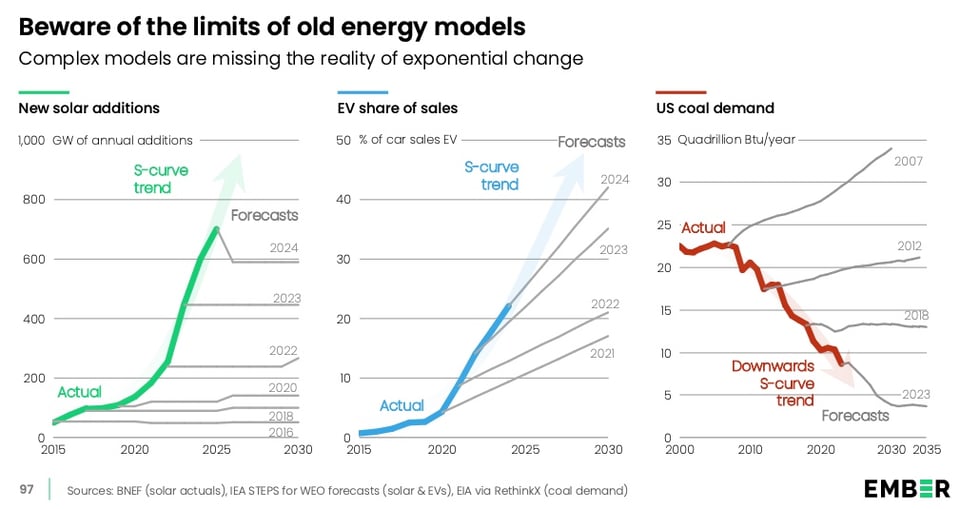

A couple of our favourite charts. First, past projections versus reality:

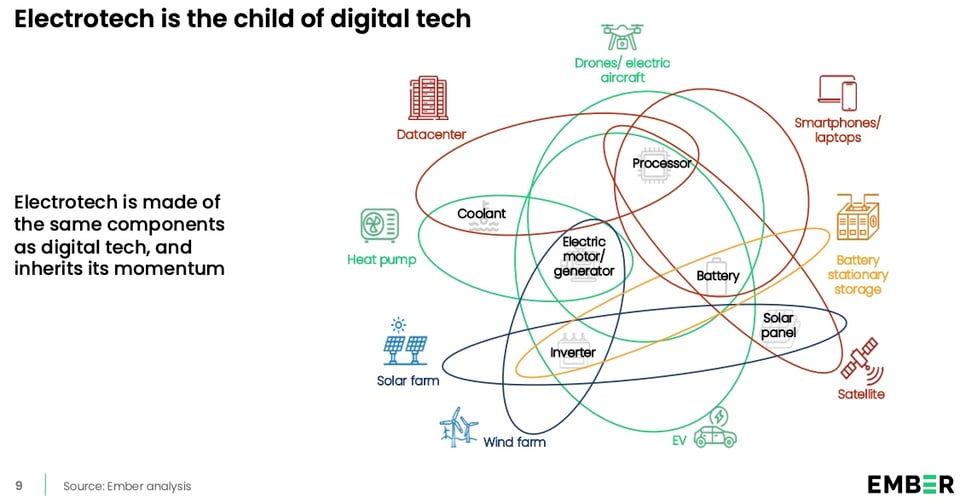

Also, the ecosystems - showing how carefully Chinese industries have been developed:

What is an electrostate?

Noah Gordon and Daevan Mangalmurti at Carnegie Endowment wrote about what being an electrostate actually means beyond just China, the super-manufacturer and now also the R&D centre of the clean energy world. The counterpart to petrostate suggests a major export power; but Gordon and Mangalmurti point out that for many countries, being a consumer electrostate is a perfectly adequate state to attain because importing a bunch of solar panels is very unlike being dependent on petrostates.

A consumer electrostate, they write, has big advantages:

Electricity is significantly more efficient than combustion. It is cleaner, with benefits for air quality and emissions reduction. And it is ultimately more secure. The sun may not always shine and the wind may not always blow, but neither can they be halted by an embargo or balance-of-payments crisis.

One thing that any kind of electrostate needs, though, is electrification: a pre-condition to decarbonizing the entire energy system. An FT story in May titled “How Xi made China the world’s first electrostate” told the story of China’s own energy and electricity transformation, including introducing a competitive electricity markets regime earlier this year.

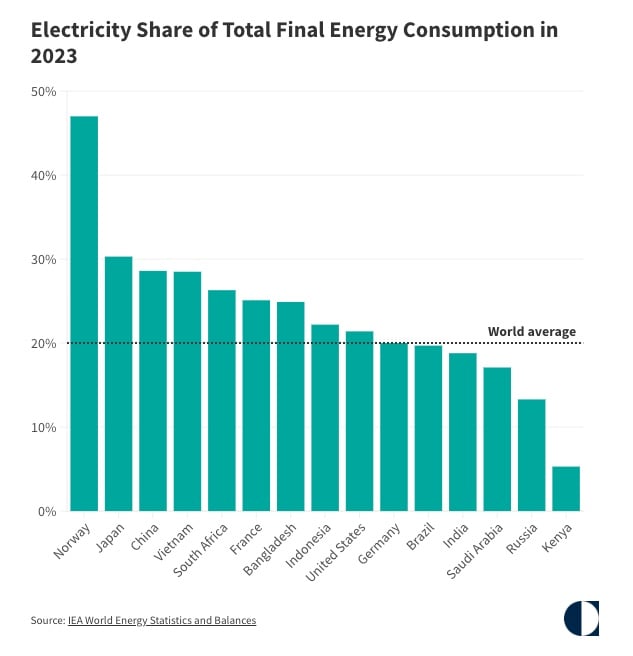

From that story was that electrification had stalled in Europe and the US in the last decade at around 23%, while China had grown to 30%. However, the Carnegie report informed me that other countries, notably Japan, had actually electrified quite a bit (presumably this comes from the OPEC embargoes):

Western VCs discover China’s tech leadership

A very interesting story in Bloomberg News today by Alastair Marsh, titled “Chinese Road Trip Exposes Uninvestible Assets in the West” from conversations with eight western venture capital firm people who travelled to China in June.

Much of the story is about the VCs being blown away by the scale and sophistication of Chinese manufacturing; struck by the "relentless price wars eroding shareholder equity" and the "revelation" of domestic corporate Darwinism, and generally astonished at their own astonishment/prior lack of knowledge.

A lot of this is what we and others have been saying for months, if not years – but we won’t harp on. Here are some of the interesting points:

Western clean tech "uninvestible" as a result; it’s "game over" for western battery manufacturing; Western investors "live in a bubble"; "catching up to that is futile: it’s not going to happen."

Clean tech export boom has only just begun: Chinese companies struggling with price pressure are about to go harder on exports

Their newfound appreciation for how Chinese tech innovation follows a different path to attention-grabbing techniques in the west: instead they start with incremental improvements, before they start doing "crazy shit".

Systemiq's Spazzapan attributes this all solely to energy security rather than developmentalism (we also subscribe to Liz Thurbon’s view that developmentalism is actually a big driver).

China is rapidly onshoring entire value chains counter to the cat-and-mouse game of the Biden era, when China re-routed products through countries like Korea, Mexico and Morocco that have (had) free trade agreements with the US.

Chinese outbound tech transfer: “if you want to build something like a Northvolt in Europe, you should invite these guys over and do it with them.”

Perhaps most interestingly:

"The VCs Bloomberg interviewed don’t have mandates to invest in China directly. Instead, their goal is to avoid allocating funds to Western startups that can’t compete with Chinese peers. They plan to use climate week in New York to talk about little else."

Avoiding investing in something should be… easy?

Green industrial policy for Africa:

A big report from African industrial and economic development scholars (including Olumide Abimbola, Amir Lebdoui, Saliem Fakir, and Nimrod Zalk) on Green industrial policy in Africa. It recommends states on the continent take advantage of this moment of upheaval in world affairs to expand into green supply chains (and to green existing ones). Key among this is enacting AcTFA, the continental free trade agreement.

Green industrialisation for all

Two of our favourite researchers, green industrial policy expert Isabel Estevez and extractives expert Thea Riofrancos, put out a report on global green industrial policy for the Climate & Community Institute. They set out principles and argue that developmental, social and environmental needs can all be considered and integrated. This is a real breath of fresh air as the discussion on industrial policy and Global South developmentalism can tend to get stuck around climate issues, and vice versa; with the agendas often seen as conflicting.

Secure, Competitive, Global… US?

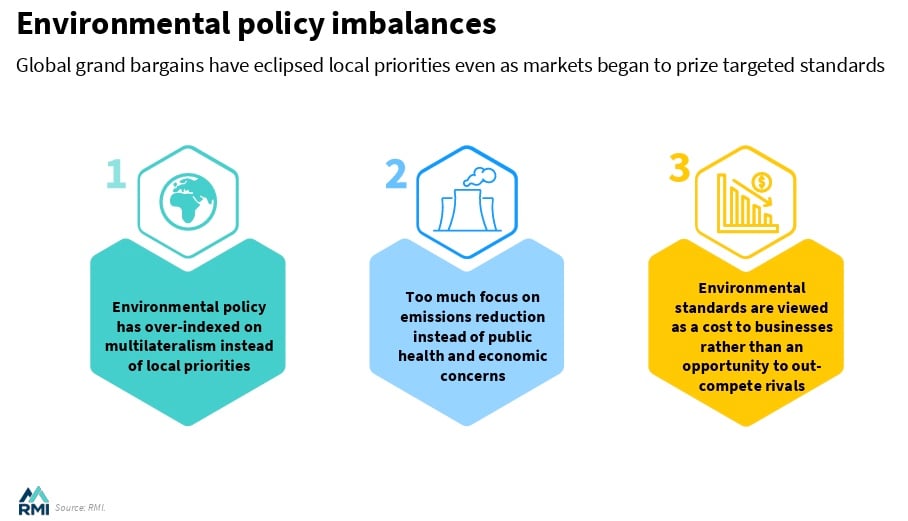

As for charting a political viable path for the US, Polycrisis contributor Lachlan Carey at RMI and colleagues have bravely proposed a way to align climate, social, and international goals within the US with a report called “Secure, Competitive, Global”. Will it be as effective as the manifesto set out in “Making Climate Policy Work”, whose ideas helped lead to the IRA? Will it go some way to countering the increasingly sprawling and unhinged definitions of “abundance” (surely a more nebulous word even than “polycrisis”)? The latter is important as the report was funded by The Breakthrough Institute, who are not always friends of climate action (but, like the abundance crowd, are almost always friends of nuclear energy).

We can’t answer any of these questions because we haven’t read it in full yet, but there are some promising ideas that get somewhat granular about how to identify benefits and incentives in policies and measures that are often ignored or neglected. The schematic below gives a flavour of where they’re coming from:

A few other links:

The New Geopolitics of the Green Transition - Bentley Allen in Noema

The coming ecological cold war – Nils Gilman in Foreign Policy

Finally (really:

An excellent and less climate-y view of what to look out for from UNGA and NYCW from security and everything expert, Rachel Ziemba.