Kenya and disappointment. Book club update.

Hello and welcome to our NINTH weekly dark-mode/test Polycrisis Dispatch! There are also a bunch of folk on our Discord server (thanks Henry!) and we just had our first Zoom book club session. Next up is Planetary Mine.

This week we wrote a lot about Kenya’s tax protests but it became quite long, and then the disastrous US presidential election debate happened. The longer Kenya will likely be published with Phenomenal World next week. We’ve also included here some notes ahead of our Carnegie Endowment panel early next week with David Wallace-Wells & Noah Gordon. We hope you enjoy this email, and if you want to give us feedback, hit Reply or email us (Kate and Tim) directly.

KENYA: DEBT, AUSTERITY, AND DISAPPOINTMENT

Kenya’s prime minister William Ruto has achieved something difficult for the leader of a poor country: an audience with G7 heads of state, a visit to the US to address Congress, and airtime in the elite international media for something other than war, corruption or other crises. His messages often aligned with Mia Mottley’s Bridgetown Agenda in advocating for financial justice, climate action and strategic agency. And they seemed to gain traction; the two countries are co-leads of an international tax taskforce, and the “Nairobi-Washington Vision” released as part of Ruto’s DC visit last month sets out an agenda that includes “International financial institutions step up with coordinated packages of support so high ambition countries don’t have to choose between servicing their debts and making necessary investments in their futures.”

Reality is not there yet. Last week, popular protests against new taxes, mostly on everyday items, gained momentum. Authorities responded violently and by Tuesday had killed 23 people and injured dozens.

On Tuesday, President Ruto blamed the clashes on "criminals" who "hijacked" the protests. The next day: "I concede," he said, in an address withdrawing the finance bill.

MY instant reaction: President William Ruto could have withdrawn the Finance Bill a few days ago and saved lives. But he was obstinate, and I watched police shoot protesters dead for no reason at all pic.twitter.com/W3H4oXzlpt

— Larry Madowo (@LarryMadowo) June 26, 2024

“It is a total admission that the young people of Kenya were right,” CNN’s Larry Madowo said from Nairobi.

Ruto imposed austerity reforms that hurt ordinary Kenyans, with plans to introduce new levies on everything from bread and cooking oil to sanitary items. Some of these were rolled back last week but many day-to-day items were still set to become more costly for Kenyans before Ruto’s reversal on Wednesday.

A New York Times story almost gets to the cause of the unpopular tax proposals: Kenya’s struggles to repay its external debt:

“Thousands of creditors have replaced the handful of big banks in places like New York and London that used to handle most countries’ foreign debt. One of the most consequential new players is China, which has been lending billions of dollars to governments in Africa and around the world.[…]

“But [the IMF and World Bank], in turn, want the government to take steps, like raising taxes and cutting spending, to stabilize the country’s finances. In a nod to the toll such belt tightening would require, the recent agreement with the I.M.F. noted that the country also needed to strengthen its social safety net.

The question that is not considered by the NYT or by the IMF’s staff-level agreement signed earlier this month is how it will strengthen the social safety net while servicing debts, cutting expenditure and broadening the tax base. Now that increasing revenues from taxes has been mostly removed from the table, the austerity cuts to government spending will be even harsher. But Kenya will avoid defaulting on its debts and thus retain access to global bond markets, at least in theory.

Avoiding debt restructuring has a high cost; in February, the government issued a 10.735% bond to help repay the $2bn bond that matured this month – which was issued a decade ago at the relatively low level of 6.875 percent. Morgan Stanley analysts pointed out that almost half of countries issuing debt at above 10% rates end up defaulting – but who’s to say that not defaulting, and paying such rates is actually worse for the people of Kenya?

Brad Setser noted that markets actually expected a restructuring of Kenya’s debt – but instead of seeking any concessions from creditors, the government and IMF agreed to just go hard on austerity. “Choices have consequences.”

Instead the IMF’s latest Article IV report was supportive of the Ruto government’s Medium Term Revenue Strategy for fiscal consolidation as a means to getting its debt-to-GDP ratio down to 55% by 2029.

BOOKCLUB!

We had our first one this week; for Brett Christophers’ “The Price is Wrong”. Email us for access to the zoom recording, and also see Jeremy Wallace’s review, or get onto our Discord to discuss.

In July, we’ll read and discuss “Planetary Mine: Territories of Extraction Under Late Capitalism” by Martin Arboleda.

Verso has generously given us a discount codes for you to buy either an EPUB or a physical copy of the book.

Polycrisis-30: 30% off any of the listed books

Polycrisis-40: 40% off if you buy 2

Polycrisis-50: 50% off if you by 3 or more

If you can get them from your local library, all the better. If you are broke or can’t obtain the book quickly for other reasons, just send us an email.

CARNEGIE PANEL NEXT WEEK

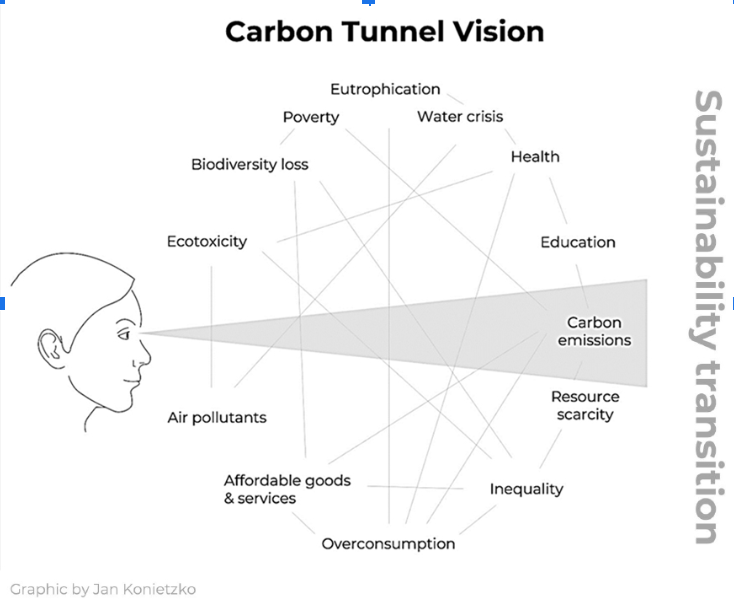

Details are here. Noah Gordon, our moderator and host and Carnegie Endowment for International Peace’s acting director of climate, shared this excellent diagram which we have to reproduce:

Kate will share her thoughts about the varying responses from those facing peaking and declining oil demand amid growing climate impacts - including “stranded countries”, the recent Hajj disaster, Guyana and what US shale gas developments and BP’s backtracking mean. Arising from many factors chiefly EVs, and two-wheelers displacing oil from cars, trucks. Also China’s energy security strategy (SPR and electrification).

The accepted wisdom used to be that “all those people in India, China, Africa are going to want [ICE] cars”. Not so much now.

It used to be that the cure for high prices is high prices – and, vice versa — but we’ve only seen it against a background of inevitable demand growth. For the first time ever, ever, ever, the IEA warning of a massive oversupply by end of this decade. For as long as we can remember. their refrain has been to warn of under-investment, under-supply.

Responses from producers? There are several types, each quite distinct and driven by the needs & function of the producing entity.

Sovereigns with power and lowest cost of oil production: Saudi vs UAE. Difference between them is that Saudis have a large population, Emiratis a small one (and have been able to better diversify their economy). So even though their cost of production is similarly low, Saudis need a larger “fiscal breakeven”, ie for the price of oil in the future to be higher than ~$50 to pay their citizens a universal basic income and maintain the social peace. The Saudis are therefore not investing much into increasing oil production capacity but into MBS Vision 2030 program of diversifying into health/education/tourism.

The less powerful sovereigns (African, LatAm) can’t afford to be strategic and just want to sell as much as quickly as they can. They are unhappy with OPEC+ strategies that are dominated by KSA/UAE (several countries have quit OPEC recently) and many have other domestic political economy/investment problems that oil revenue hasn’t addressed.

Corporates (US majors): lots of access to cash (their own), have lately (post-1973 at least) had an undisciplined/uncoordinated/free market approach; unlikely that continues. Compared to other price and revenue booms, this one is seeing a big reduction in investment in future production. , This is in contrast to their rhetoric that oil demand is growing; they know what is happening. IOCs/corporates can afford to be in run-off mode – they don’t have citizens/polities to maintain; only shareholders who can easily re-categorise their investments as dividend rather than growth.

Tim will examine developments in the Carbon Hockey Stick of Doom and the Solar Hockey Stick of Hope like 11c/watt cost of solar modules.

11 cents / Watt is the cost of Solar modules

Concept: Solar Hockey stick of Hope to counterpose the Carbon Hockey Stick of Doom [Images can be found in Polycrisis piece]

China's technological dominance, of squeezing costs with process efficiencies. Result not of brute subsidies but 2010s industrial policy that created extreme competition and genuine process innovations as local bureaucrats subsidized city-based innovation & production clusters, China now holds a lot of process patents (van Reenen).

Positive Implications:

what it means that energy is now literally a dirt cheap commodity , cite Jenny chase’s examples of Europeans using solar panels as garden fencing!

Air pollution reduction: Solar plus batteries is finally squeezing out Coal in China, and in many other geographies, especially in Asia. Its big target is Gas. Will gas suffer coal’s fate?

how it is helping countries that are in deep electricity crisis with lots of disruptive load-shedding like South Africa, Lebanon, Pakistan etc to get electricity rapidly built out with imported chinese. Does that mean they get closer to China?

how big BRICS energy poor countries like india and Brazil are now among biggest solar installers

Dark side of the hockey stick of hope:

Human rights abuses in xinjiang where coal intensive poly silicon is made

Deterrence effect as nobody in their right mind anywhere else in the world wants to build fully domestic solar supply chains (unless they have a 5-ish year(?) horizon; but then tech developments are potentially an issue)

Geo-economics of hockey stick of hope

Big question - can the West de-risk from China? Can they preserve domestic manufacturing capacity?

US response of tariffs

China's tariff jumping by locating factories in SE Asia. true cat and mouse game since 2010 to change the fundamental fact of Chinese dominance. US and EU erected tariffs against Chinese solar in 2012 and since then Chinese manufacturers have set up shop in SE Asia. Vietnam, Cambodia, Malaysia, Laos.

Thankyou for reading! We intended to keep this email for only a couple of dozen recipients, to see if we could sustain it, and to give us time to develop the tone and format. So it’s a little faster and looser than our Phenomenal World newsletters. If you’d like to invite others to join, please forward this email or share this link.

Kate and Tim

Add a comment: