Innocence is over

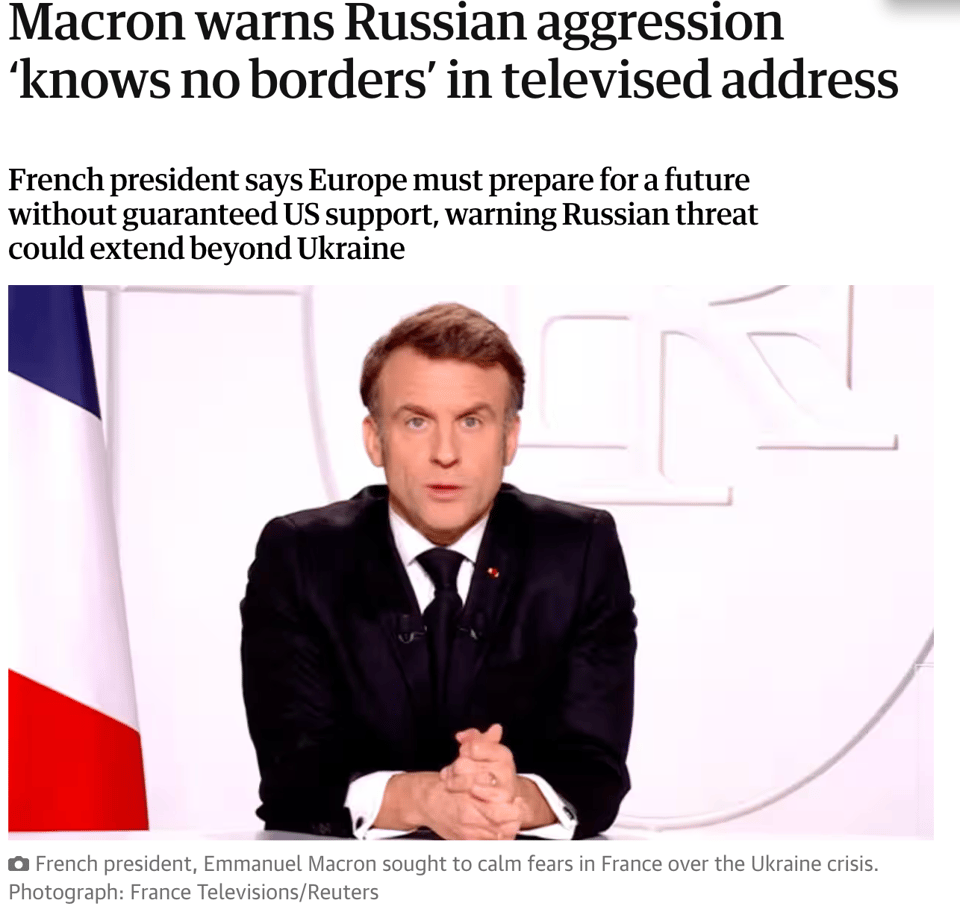

“Europe’s future should not be decided in Washington or Moscow… the innocence of these 30 years since the fall of the Berlin Wall is over.”

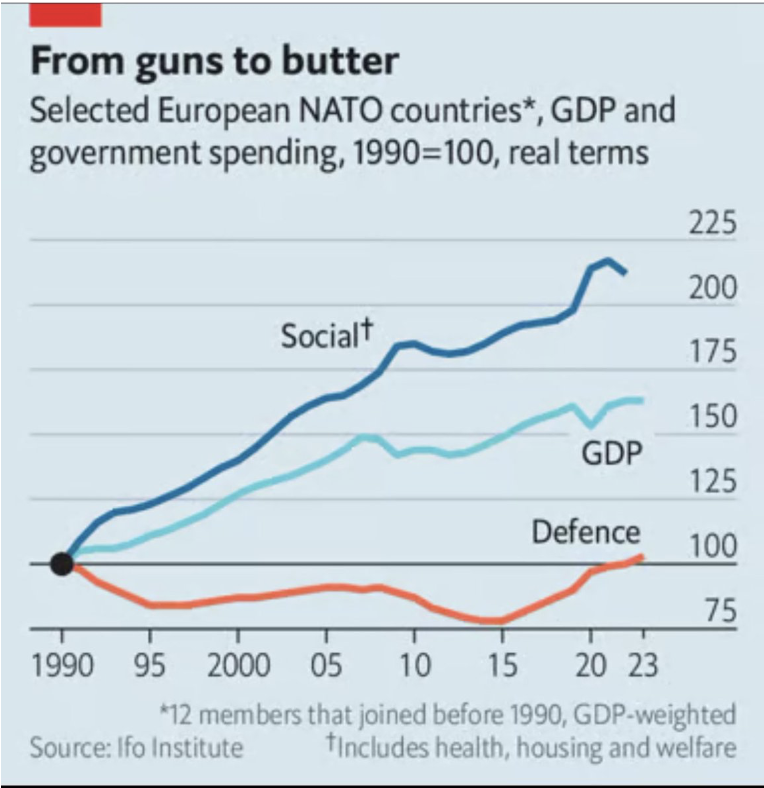

Yes, we’re quoting Macron, again. Events in the US are bewildering, terrifying and exasperating all at once. We still plan to focus on the Global South this year, but Europe’s Metal Era is hard to ignore right now. The ramifications of a complete reversal on fiscal spending by Germany’s CDU party are enormous and there is quite a bit of unnecessary worry about the economic risks involved; and a lack of vision about how the investment could be directed in a productive, peaceful and climate-aligned way.

Europe’s Zeitenwende for real

Our latest Polycrisis essay, published last week, looked at Europe and its sudden pivot to rearmament as the transatlantic alliance collapsed. We wanted to identify the contours of this historic time: what it means not just for Ukraine and the European project but also industry, the economy, and, of course, the EU’s climate goals (which leaders have continued to insist remain intact). Right now, the simplest, worst, and so far most popular take is that climate investment will be cut to allow for defense spending. It doesn’t have to be so zero sum, however! There is military Keynesianism, yes – admittedly, it requires careful coordination to work; but it’s possible.

We wrote:

“Europe is now fully and self-consciously security-constrained. This reality collides with two other foundational constraints. Europe’s self-imposed fiscal limits are infamous (we have argued they leave the continent poorer, weaker, and less green); and its energy constraints exploded into view following the Russian invasion of Ukraine, as gas prices soared and spread throughout the economy.

Secondly, there is the very obvious complementarity between European energy security and European security security.

Lacking enough oil and gas to power itself, for seventy-five years the continent has been squeezed by the three centers of hydrocarbon power: the US, Russia, and the Gulf Kingdoms. By interrupting the flow of energy—the US oil embargo in 1956, the Arab oil embargo in 1973, and the Russian gas embargo in 2022—these powers have inflicted pain on European citizens and treasuries, forcing change in European foreign policy and security arrangements.

TL;DR – Europe needs energy independence and it manifestly cannot achieve that with fossil fuels.

Our PW piece came out Friday morning. That evening, Germany’s new coalition of CDU and SPD announced negotiations to unleash the long-awaited fiscal bazooka.

The debt brake will be suspended for all military spending in excess of 1 percent of GNP.

A “off-balance-sheet” special infrastructure fund will set aside 500 billion euros for investment in energy, transport and housing.

State governments are now allowed to spend instead of suffering crushing austerity.

A commission will be convened to discuss the long-term future of the debt brake.

Germany is breaking the self-imposed fiscal rules that made it poorer, weaker and less green (as we argued)? Government borrowing and spending power unleashed even at the state level? This in our view is extremely significant, perhaps more so than the American bedlam.

How did Mr Market digest the news? The impact on equities was immediate on Monday morning: Europe markets streaked ahead of the US. Investors piled further into European military industrial stocks which opened with a gap-up.

German bond yields jumped quicker than they have in decades – however, this is not an ominous sign of fears about inflation or debt sustainability. Here’s Tooze in the new “Surplus” magazine (translated from German by Google):

“In total, the new debt could amount to one trillion euros. This is a huge sum; but the markets did not react with the panic that spread among some German conservatives. On the contrary, the prospect of new German debt is extremely welcome on the markets. Because German government bonds are usually a rare commodity. Even if Germany were to take on one trillion euros in debt in the next ten years, the country's debt ratio is only likely to increase from 60 to 85 percent, which is still far below the average of the USA or the eurozone. However, one trillion euros in new German debt means that investors must be offered slightly higher interest rates. German government bonds currently have the lowest interest rates in the world. This in turn drives investors to invest in other European assets such as French, Spanish or Italian government bonds. These are a bit riskier – but they bring a better return. The sudden availability of "high-quality" German debt securities puts the issuers of such debt securities of "lower quality" under pressure throughout Europe. This effect is reinforced by the prospect that a German government under Merz could agree with the EU Commission in Brussels, led by Ursula von der Leyen, to issue even more European defense bonds. All these would be "high-quality debt securities" that should attract eager investors” - [Google Translate]

HOW DOES IT GET SPENT?

There are many important things to be contested about the direction of this newly unleashed fiscal power. One is: will it help to fight fascism as well as Russia?

Isabella Weber considers:

For an anti-fascist economic policy to counteract the rise of the AfD, it is also essential to present clear policy solutions that make a better future conceivable. Opposition to the status quo must not be monopolized by the right-wing extremist visions of the AfD. Progressives must address people’s existing concerns and the major challenges of our time simultaneously and comprehensively. A new climate populism must play just as much a role in this as a sustainable industrial policy, fair taxation, and an investment program for public infrastructure. The debt brake needs to be reformed, but if it is reduced to ramp up military spending while bridges, hospitals, and schools continue to crumble, it will only play into the hands of the AfD.

Then there is the question of whether this be a comprehensive and coherent vision, rather than social democratic parties just trying to piggyback green conditionality onto militarization.

We wrote:

Aligning climate action with military armament risks fomenting nativism in an era of increasing climate-driven migration and far-right ascendency. Yet “energy security” is an intrinsic component of Europe’s new “security-security” goals. If “security” is going to dominate the next phase of the European project, how will climate and social agendas be fought for?

The energy transition and transatlantic fracture can be a basis for new alliances based on something other than fossil fuels, as Pierre Charbonnier has argued. For countries such as Brazil, India, and African countries rich in tropical rainforests and minerals, “What do we offer these countries so they side with us? Europe should build its foreign policy on a coordinated response to the climate question.”

Finally, as Adam Tooze points out, whether the German fiscal latitude will actually pass the legislature — it needs 2/3rds of the Bundestag — is still in question. It appears it will require some support from either the Greens or the conservative-liberal FDP – neither of which have much reason to do so. The Greens want a further reform of the debt-brake, and well, more green.

Dollar safety

Meanwhile, it finally happened: the US administration upending everything from foreign policy to governance norms has led to open talk of the dollar losing its “safe-haven” status. Deutsche Bank, via Katie Martin:

“We do not write this lightly,” wrote currencies analyst George Saravelos. “But the speed and scale of global shifts is so rapid that this needs to be acknowledged as a possibility.” What was once outlandish is now becoming plausible.

Whenever these prospects of post-dollar centrality are raised, the immediate question is always: “and then what?”. What replaces it? There is never a clear answer. Another snippet from Katie underlines that no-one knows nothing:

Mansoor Mohi-uddin, chief economist at Bank of Singapore, recently travelled to clients in Dubai and London. To his surprise, not one of them asked him about short-term issues like tech stocks or tweaks to interest rates. Instead, he says, “people were saying, ‘What’s going on?’ The free trade, free markets, globalisation era is over, and nobody knows what’s going to replace it.”

US soft power: no endgame

Maybe you’re wondering; what’s the endgame here for international relations? We know there’s a kind of playbook for domestic politics in Project 2025. What’s the logic for cutting aid for developing countries and pissing off every other ally?

The administration has no interest in soft power; only coercion. It will use any and all tools to get other states to do its demented bidding (apart from a select few, like Russia, who are too masculine, or too whatever, to mess with).

But coercion only gets you so far. Some countries will call your bluff; and you can’t be everywhere at once. Plus, economic coercion, which in theory does scale, makes no sense. Nicholas Mulder has set out how using threats of sanctions against (traditional/former) allies in this administration is not going to be any more successful than attempts against adversaries in the previous Trump or Biden administrations.

Some of these past efforts centred on financial shenanigans: attempts to find a coherence based on Scott Bessent and trade policy, despite the insanity of the bilateral surplus/deficit talk. But the recurring problem here and now is that there is no logic on a strategic or even a tactical level. The “madman theory” doesn’t quite hold up – partly because acceding to the madman doesn’t actually guarantee a reprieve. Why pay the bully if he’s going to beat you up anyway?

Online enough for US foreign policy?

Quinn Slobodian in mid-February said most characterisations fell short because there are actually three competing logics:

This is because we are witnessing something new: the convergence of three strains of politics that have never simultaneously been this proximate to power. Those projects come from different but related places: the Wall Street–Silicon Valley nexus of distressed debt and startup culture; anti–New Deal conservative think tanks; and the extremely online world of anarchocapitalism and right-wing accelerationism. Within the new administration, each strain is striving to realize its desired outcome.

The third one has a big problem: only the extremely online will understand it. Even the highly online are just hopeless normies when it comes to the lore that is influencing Vance.

As Jamelle Bouie and others have pointed out, you can’t describe what is actually happening without sounding like a conspiracy theorist – at best:

You will sound insane saying they make the choices they make because "Europeans are soy boy apostates, whereas Russia is a nation of Based civilization fighters", but if not their exact worldview, at a minimum it is the worldview of people they spend a lot of time reading from and talking to

— zatapatique (@zatapatique.bsky.social) 4 March 2025 at 21:06

The rest of the thread is well worth reading, if only for some heuristics and signifiers.

We will return next week. Stay safe!

Add a comment: