Good enough?

COP, trade, Mark Blyth inflation book club

It’s been quite a break for us from the Dispatch as we’ve been working on a few other things that will happen in Q1 2026. But we do have a few cool things for you in the meantime.

First up: HOLIDAY BOOK CLUB is back with Mark Blyth joining us to talk about his new book, “Inflation: A guide for users and losers”.

It’s at 3pm Monday eastern time (yes, a little under 24 hours away).

You can pre-register here.

Meanwhile, we’ve got three new guest essays with Phenomenal World:

Cambridge historian Venus Bivar on plastic pollution, the oil industry and colonialism;

Foreign Policy’s Catherine Osborn reflected on COP30’s successes and disappointments in the context of US absence and Brazil’s own complicated political economy of transition.

Finance and geopolitics expert Shahin Vallée on the urgent need to internationalize the euro and how it could be done.

COMING SOON: Praveena Bandara on the real developments at the G20 meeting this year in Johannesburg; most of which were missed by the (international) media.

A million things have happened since COP30 finished but we think some of the key develoments might have got lost. Plus some energy and AI data centres – including Tim’s take on the geopolitics of AI vs greentech.

You can email us (Kate here; Tim here); follow us on Bluesky (Kate, Tim, Polycrisis account). And join our discord channel for much more frequent updates from both of us, plus chart crimes, arguments about trade and more.

- Kate & Tim

About that COP in Brazil…

We felt that Catherine Osborn’s COP30 report, originally for Foreign Policy, hit a realistic note in its assessment of the UN climate conferences in the new geopolitical era, especially with Brazil being the host – a country and a current government with Global South leadership and a diplomatic powerhouse. There were some notable achievements: for example, getting the Tropical Forests Fund hosted by the World Bank despite the obstreperous US stance towards all international finance. Terrible features (locating the conference in the rainforest city of Belem made it unnecessarily inaccessible and expensive). Early in the summit, Brazilian officials Marina Silva, Ana Toni, Andrea Correa do Lago and even president Lula himself all spoke of the need to pursue fossil fuel phase-out; which was mentioned once before in the final text of the Abu Dhabi COP in 2023. In the end, however, the phrase was omitted from the final text though Lula issued a directive asking three Brazilian ministries to work out a roadmap for a Brazilian fossil phase out plan.

Diplomacy with Chinese characteristics

One disappointment that was not surprising was the “lack of leadership” provided by China. Despite it having no real interest in perpetuating the fossil fuel complex, and plenty to gain from further accelerating the energy transition, China did not give a performance of ambitious leadership nor – apparently – the behind-the-scenes smoothing. Its failure to help get the “fossil fuel phaseout roadmap” across the line and into the decision text was much remarked on. Why wouldn’t China, which exports negligible fossil fuels and has much to gain from energy transition, be on board with this? An obvious possibility is its oil imports from US-sanctioned countries. Another explanation might be that they simply don’t need to advance fossil fuel phaseout language – their green tech is selling overseas quite well without it.

Bloomberg reported that China had a pavilion that “almost literally took centre stage” with attendees queueing up for its free gifts like handheld fans with personalized calligraphy; but its flagship green companies like BYD, Great Wall Motors and Longi Green Energy were “notable COP30 presence[s]”.

Trade was put on the official agenda

The issue China was very exercised about during the COP30 was trade, and in particular Europe’s Carbon Border Adjustment Mechanism. Europeans have seemingly struggled to appreciate that, in devising CBAM to protect their carbon pricing regime and placate high-emitting trade-exposed industries, they’re also putting a very tangible burden on some low-income steel and aluminium exporting countries, landing them not only with an effective tariff but a high administrative burden in reporting (national carbon accounting systems are not simple). CBAM also, arguably, imposes a specific form of climate policy on countries that have a high dependency upon selling CBAM-eligible products to the EU – when those countries might reasonably want to choose other climate policy tools for their own political reasons.

On the other hand, the policy may indeed be incentivizing China to more rapidly green some of its heavy industry processes.

China, India, and Saudi Arabia picked up on the CBAM issue with gusto at COP30 and managed to get “unilateral trade measures” included in the cover text and incorporated into the COP process; something China has been pursuing since COP28. Bloomberg reported that Europe tried to raise the issue of restrictions on minerals exports, in response — pointedly at China’s rare earths controls.

Global green industrialization initiative

Another notable development at COP30 was the Belém Declaration on Global Green Industrialization - to coordinate and accelerate development of clean industries, and bring it into the COP process — albeit the non-core “Action Agenda” track. A big range of countries signed onto the declaration including South Korea, Brazil, the UK, South Africa, Indonesia, Australia, the UAE, Namibia and Tuvalu. UNIDO will convene these countries again in April.

This could matter in terms of “implementation” in the real economy; but also in terms of the comparative targets, achievements and accountability that help push climate multilateralism along. For the core climate action goal of “cutting emissions”, there are fairly clear (albeit contested) methods for measuring progress. Green industrialization, though, can have both domestic and global benefits, and being able to identify and target them methodically could be useful for governments at home as well as internationally.

US LNG moment’s of truth?

This year we’ve been watching LNG, which is often portrayed as high-tech, versatile and clean fossil fuel. The US’s attempts to compel other countries to buy more of its LNG exports have been reasonably successful with Europe, but sponsoring development of an expensive Alaska-to-Asia market will be far more difficult. More conveniently-located supply is coming online, while Europe’s demand has barely risen since 2022 despite losing a key source of natural gas due to Russia’s invasion of Ukraine. Meanwhile, some of those developing countries that were expected to provide new demand are finding instead that Chinese solar panels are less susceptible to market volatility, less dependent on a US dollar reserves, and thus less likely to result in blackouts. Meanwhile Japan, a reliably enthusiastic LNG importer (and re-exporter), is restarting its nuclear reactors.

Reuters’ Gavin McGuire wrote a month ago:

European nations have accounted for two-thirds of U.S. LNG exports this year, which is the highest concentration of U.S. export flows to a single continent since 2022, when Europe's demand for LNG spiked following Russia's invasion of Ukraine.

And although Europe's total LNG import volumes have jumped by 25% in 2025 from last year, Kpler data shows, Europe's total LNG import needs have expanded by only 2% since 2022 as the power sector retooled generation sources away from fossil fuels.

For the US, and the other big LNG exporter, Australia, a lot hinges on how the LNG giant Qatar navigates the expected oversupply over the next few years. Qatar has historically preferred long-term contracts and thus hasn’t developed a strategy for using its might in the spot market. If it is unsuccessful in locking in contracts for much of its new supply — which looks likely — Colombia CGEP’s Ira Joseph and Ann-Sophie Corbeau suggest Qatar’s options include cutting prices, controlling supply, or incentivizing demand. All a bit reminiscent of Saudi Arabia. Once again, we are seeing the touted advantages of LNG (for both suppliers and buyers) evaporating; it behaves more and more like oil with its attendant short- and long-term volatility.

Industrial policy tools!

Tim’s Net Zero Industrial Policy Lab has published a huge project: the Clean Industrial Capability Explorer; a tool for countries to discern their best opportunities in green industrial development.

Isabel Estevez’s new thinktank, I3T, has also released a tool for green industrial policy, focused on supply chains, here.

AI stuff

The US is doubling down on fossil fuels while China goes ahead with green electricity. Both countries are however, very into AI:

Ford is writing off nearly 20 billion dollars in losses on EV and battery factories. And pivoting to…. Batteries to power AI data centers @bentleyallan.bsky.social Why I say that trump’s US is crushing green industry and going all in bet on AI and fossil fuels.… https://techcrunch.com/2025/12/15/ford-is-starting-a-battery-storage-business-to-power-data-centers-and-the-grid/

— Albert Pinto (@70sbachchan.bsky.social) 2025-12-16T13:07:25.831Z

Data centres: after the bubble bursts

Advait Arun’s excellent paper “Bubble or Nothing” at Center for Public Enterprise has seen him quoted in Heatmap (where he’s also a contributor); NPR and The Atlantic. Advait’s work of course goes much further than just assessing the possible risks; it proposes what governments should do to minimize the costs of a very plausible eventual bursting of the bubble.

Finally…

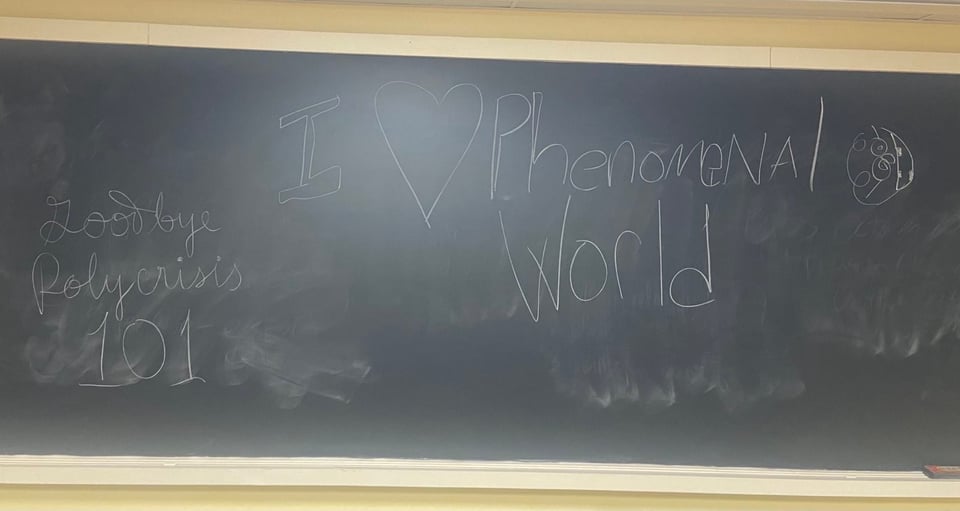

Tim has finished the teaching component of his course at Wesleyan. The students left this on the blackboard for his final class:

LINKS

Inside BP and Shell’s failed clean energy projects Essentially a story of too much McKinsey, too much rushing, not enough broad support across the companies. (Financial Times)

How to monetize the rise of medieval peasant brain and arbitrage your fancy education in the age of gig-work in the new feudal age. (Hegemon)

We will be back with a best-of 2025. Don’t forget to register for the Mark Blyth bookclub tomorrow!