Exhorbitant privilege, exits, and elections

This week we are looking at the recent elections in Canada and Australia; what Europe has to face up to as the inevitable new hegemon; and India’s transition minerals moves in Latin America.

Firstly: a reminder that we’ll both be at the Beyond Neoliberalism conference in Cambridge, UK, at the end of May. Its agenda is to look at where post-neoliberal ideas in the transatlantic and global south are heading in finance, industry, globalization, labor and welfare, and the green transition. Registration for the conference itself is all full up unfortunately, but you can waitlist for the public plenary at 6pm Thursday May 29, and sign up for the conference newsletter; and we plan to bring some interviews and analysis from the panels.

Last week’s IMF World Bank meetings did not achieve much. And indeed, the mood was all “foreboding and stunned resignation” as Heather Stewart put it in the Guardian. Kristalina Georgieva pinned a chainsaw badge to her chest and praised Argentina. Climate change and gender was little spoken of. The US is not quitting the institutions, but sticking around to shape agendas to its liking. There’s a wrap from Bretton Woods Project, which looks ahead with a small amount of optimism to the Financing for Development conference in June.

Meanwhile, our essay “April is the cruellest month” charted the extremely rare phenomena of simultaneous price declines across US stocks, bonds and currency, and then looked anew at how other countries are responding with 4-D moves: diversifying, defending, decarbonizing, de-dollarizing.

Trump’s election losses abroad

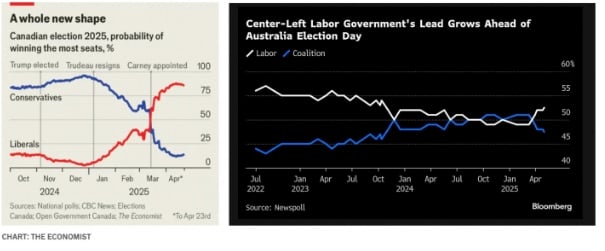

Elections in the last few days in Australia and Canada both favoured centre-left governments, countering the pattern in 2024 elections for incumbents to be rejected – which was broadly attributed on electorates unhappy with cost of living pressures. In both countries, a revulsion at Trumpism looked to be decisive in turning around what had earlier looked like a tough election (for Australia’s Labor party) and a very likely defeat (for Canada’s Liberals).

It’s hard for me (Kate) not to have a reflexive cringe about Australia’s standing on the world stage: a rich but small, resource-dependent, fossil fuel-exporting, settler-colony with needlessly expensive housing. Canada has some similarities.

But, Tim says: in rare times like these, greatness is foisted upon some countries. Especially if they are small, liberal, open economies with an existential interest in securing their position. A strong domestic mandate means that Carney and Albanese can do a lot for multilateralism and leading a global rebellion against Trumpism. Carney has already said "Canada is ready to take a leadership role in building a coalition of like-minded countries who share our values… We believe in international cooperation. We believe in the free and open exchange of goods, services and ideas. And if the US no longer wants to lead, Canada will."

We expect Carney to go on a world tour, perhaps Berlin, Paris, London, Tokyo, Seoul, Canberra… and Beijing (just to rub in America’s face that Canada is serious about non-alignment).

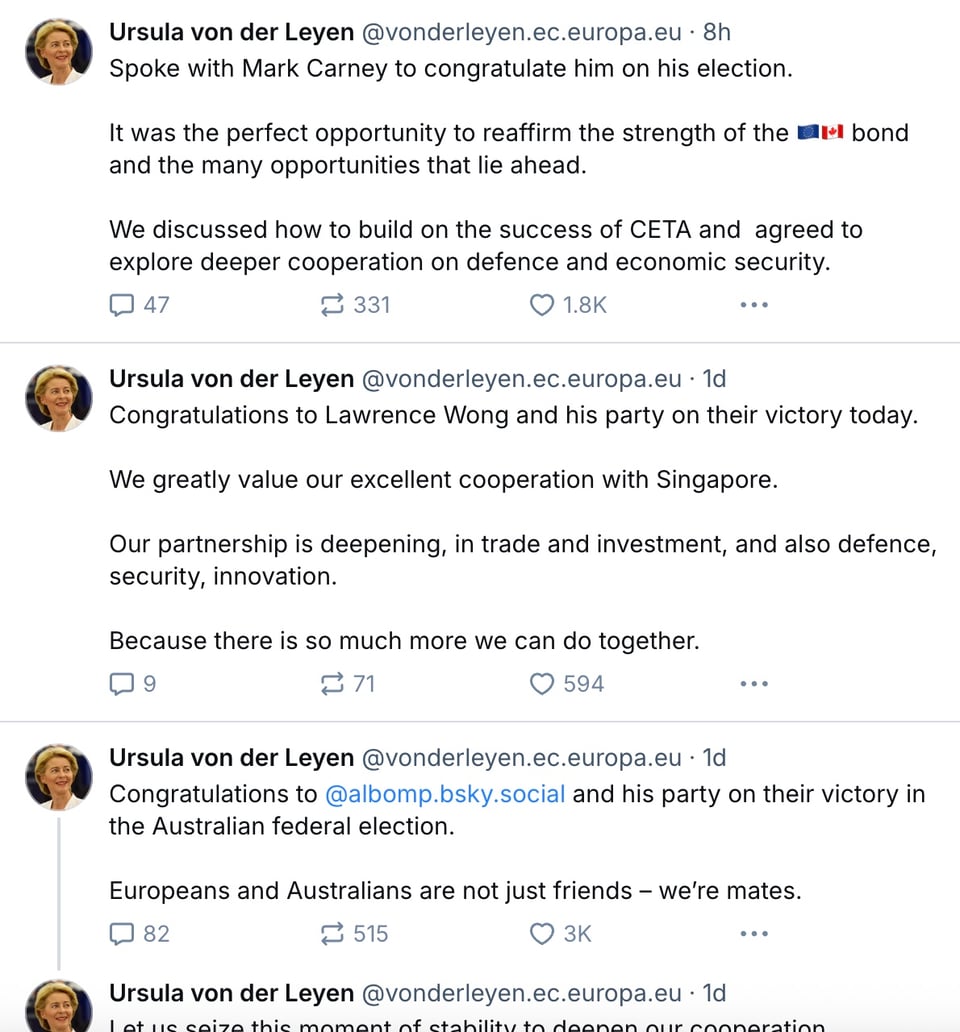

Ursula von der Leyen sounded particularly keen to deepen relationships with both Canada and Australia, and with another small existentially exposed to end of rules-based order country – Singapore – whose incumbent People’s Action Party also won their election:

The Euro as global reserve currency

This year, we have written two essays on a new narrative - US down, Europe up - that are being hotly debated in economics and geopolitics: The End of American Exceptionalism and the Beginning of the Europe Boom in its Metal Era. The FT’s Tej Parikh is coolly sceptical on both counts. One - just one! - reason is that Europe would have to massively step up as a replacement hegemon in the international monetary system:

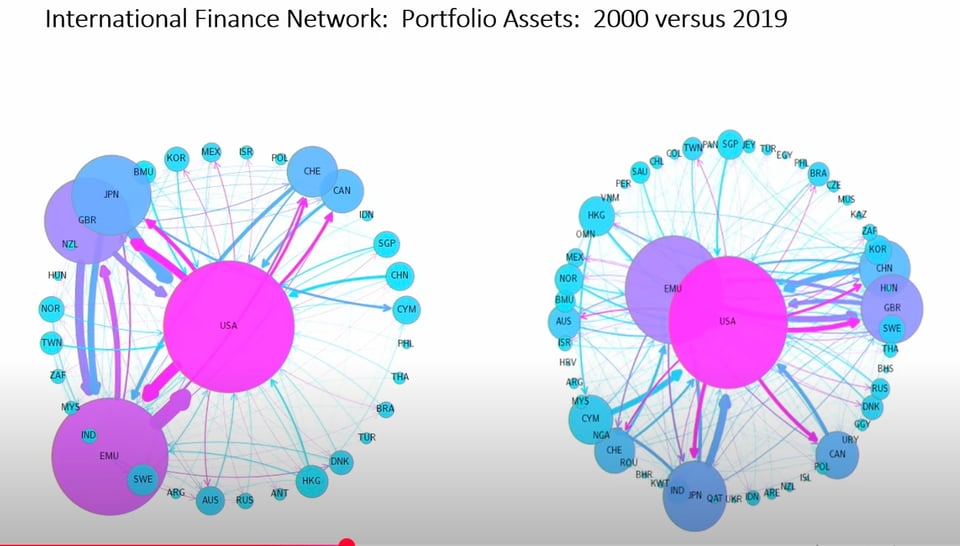

Hélène Rey, one of the star macrofinance economists of the past two decades, spoke at a conference held by Bruegel and the Dutch central bank about the role of the euro in fulfilling hegemonic functions in the current dollar-based monetary architecture for Payments, Reserves, Collateral, Trade, Settlement.

Her presentation included these infographics showing how international merchandise trade has changed since 2000 from a US-hub structure to a US-Euro-China hub.

India-Latin America mineral deals

India is getting serious about securing its own supplies of metals for the energy transition. It is courting Brazil, Argentina, Bolivia and Chile for transition minerals, particularly copper and lithium. FT reports “During Boric’s visit, Chile’s Codelco, the world’s biggest copper miner, agreed a deal with India’s state-run Hindustan Copper. It also said it would supply copper concentrates to the Adani Group, owned by one of India’s most powerful tycoons and a Modi ally..Máximo Pacheco, Codelco’s chair told the Financial Times in New Delhi…“India will absolutely soon become a big buyer of Chilean lithium”. This is a welcome move, mainly because India has traditionally gone abroad to get oil, gas, iron ore and coal.

BRICS

The BRICS foreign ministers met in Rio last week, but they lost ground on what had previously been agreed: supporting South Africa to become a permanent member of the UN Security Council. New BRICS members Egypt and Ethiopia objected to their fellow African country acquiring such status, according to Bloomberg, although Brazil Foreign Minister Mauro Vieira was hopeful consensus could be reached before the heads of state meeting in July.

Other links:

Larry Summers being right again, minutes 4 to 20.

You Xiaoying explores China’s history and future as a “trilateral cooperation” development partner.

Martin Wolf on Odd Lots – his account of how the US was never properly on the gold standard is superb.

Brad Delong, exasperated that anyone would try to read coherence behind any of this.

Energy watch:

We still don’t know exactly what happened with the Spain blackouts; but it wasn’t inertia (if you want to understand inertia and why it isn’t, here’s a good thread).

Thanks for reading!

Please share this link, forward the email, follow us on Bluesky and LinkedIn.

Add a comment: