Europe must rage against the dying of the light

Welcome to edition 17 of our Dispatch. This week we are looking at Draghi’s recommendations to keep the EU competitive and safe; plus the fall in oil prices and what it signals. Next week we are taking a break, catch our newsletter on US-China green Marshall plans.

***

Draghi’s prescription

In June last year we looked at Europe’s “carbon budget vs fiscal budget” dilemma. In April this year, Emmanuel Macron declared grimly that “Europe is mortal: it can die”, not long before the broad success of far right parties in the EU elections.

The bloc has ambitious climate targets; and it has delivered genuine emissions reductions over the past three decades. But it prevents itself both politically and mechanically with its fiscal constraints from ever investing in important things. The calls for deep reform have now reached a fever pitch. Mario Draghi’s report on how to do this, written at behest of the European Commission, landed on Monday.

Our takeaways:

1. It is refreshingly jargon free Draghi may be a technocrat-par-excellence, an MIT economist turned central banker, the “sphinx who reshaped Europe”, but his report is not bogged down. It is bracingly direct about Europe’s problems. It is crisply written for a large global audience. After all, the EU makes up a sixth of the global economy; is the largest trading partner for dozens of countries; and its problems are dragging down everyone else. So whether you are European or not, go read the 90-page strategy.

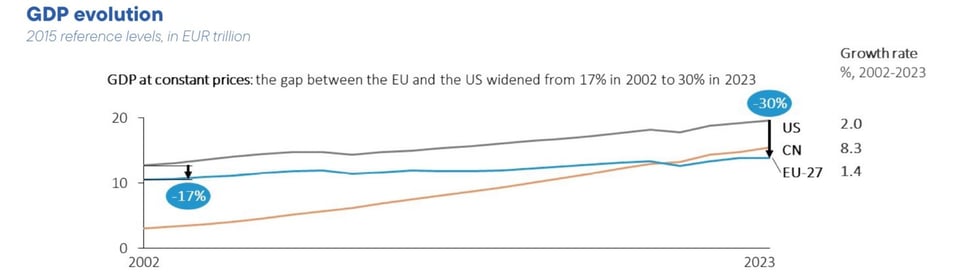

2. It has a singular message: Europe must invest in its future. Investment and growth are the only solutions for a continent slumping towards rising debt burdens, old age and being geopolitically squeezed between the US and China. Productivity is low and the lack of growth - the continent has grown far slower than the US in the 21st Century - produces political demons.

Things are going badly for European industry. Volkswagen is talking about closing factories for the first time ever; the company appears to have wasted €12bn on trying to make good car software. Stories of high energy prices weighing down the country’s important manufacturing sector are back.

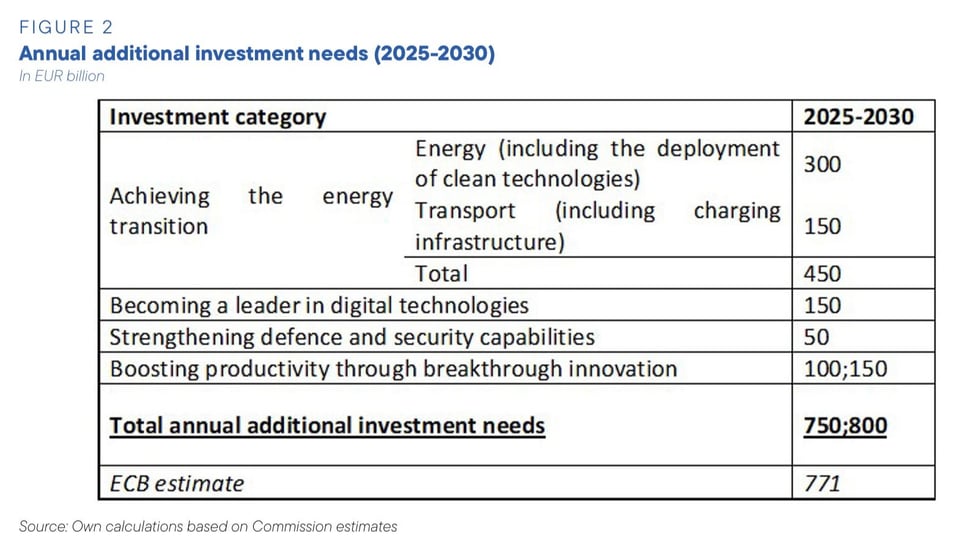

Draghi argues that the bloc needs a joint decarbonization and industrial approach i.e a “new industrial strategy” and must boost investment by 800 billion euros a year. The bulk of the report details the why and the what of the strategy. Almost half the investments is for the transportation and energy sector alone. He wants the EU to invest in charging stations to solve the chicken-and-egg problem of no charging stations = fewer EVs, & fewer EVs = little charging station deployment.

There are familiar ordoliberal bits about removing red tape and streamlining Europe’s famously fragmented trade, industrial and competition regulations. There are controversial bits of EU common debt issuance, joint defense procurement and other changes to give Europe the kind of strategic and fiscal strength that the US and China enjoy.

We see some definite similarities with recommendations of the “Permanent Suez” report Tim co-authored with Ben Judah and Shahin Valee early this year.

3. Draghi navigates the “Make or Buy Dilemma”

Befitting an industrial strategy as opposed to wishlists, Draghi makes sector-specific recommendations on which industries to protect and which to welcome imports. This is not a US IRA strategy that shuns Chinese green goods, but one that embraces China in some sectors where it has an absolute comparative advantage like solar, and is protectionist in others like wind where Europe has talent. Sander Tordoir summarised Draghi’s segmentation logic in a thread:

1 - where we've lost comparative advantage and should accept cheap CN imports (solar)...

2 - Sectors where the EU should not care about what firm has the tech, but about jobs and retaining a level playing field (so welcome inward FDI)

3- Areas where "you want to protect the resilience of the production chain".

In other words, areas where the EU should care about having the know-how because it’s strategic.

4 - Infant industry, where the EU shows promise and wants to develop the technology, but "it could be easily destroyed by state-sponsored competition from abroad and subsidies."

4. Draghi sets a direction for Brussels to meet EU goals, but has little to say on jammed politics: It is a well known secret that Franco-German relations have soured since 2022 and is the principal reason for lack of action on EU’s politico-economic reforms. Germany’s schwarze null-pilled representatives are already denying that their country suffers greatly from lack of investment and growth, and ironically, would probably benefit the most from Draghi’s new industrial strategy recommendations. Center-right opposition leader Friedrich Merz — who may become the next Chancellor — said today: "I will do everything I can to prevent Europe from going down the path.”

However, don’t count out Brussels’ wiles. Today the FT cites an official source for a scoop: “Brussels explores Draghi-backed option of extending up to €350bn in EU pandemic debt to ease pressure on tight budget and save €30bn/year through 2034”.

Oil prices are falling and OPEC vs IEA is on

Another alliance of countries is struggling to maintain unity around the energy transition. Remember back in June the IEA declared the world will face an oil glut over the coming years? And was promptly met with very noisy criticism, particularly from OPEC+’s secretariat, and amplified by the #OOTT crowd?

Now crude prices are sagging around $70 a barrel, and some market analysts are expecting $60 next year. Soft prices led to OPEC+ deciding last week to delay planned production increases which were themselves reversing earlier cuts that sought, unsuccessfully, to firm up prices.

In other words, OPEC+ is losing pricing power, and it will only get worse in the coming months.

The delay to the production increases is just kicking the can down the road; OPEC+ will still have to up production as some member countries grow impatient over missing out on revenue. But these increases will coincide with consumption falling after the US summer, and with non-OPEC producers increasing their output. The group is producing is about 27 million barrels per day, but in the first half of next year it will only need 26mbpd to balance the market; just as the production increases.

“Saudi Arabia is so far getting the worst possible outcome: low production and low prices”, we want to point out that this was written by Javier Blas, who slants towards boosting fossil fuels and pooh-poohing renewables.

What to do in this brave new world of oil demand in secular decline is a question we had a big panel discussion on at Polycrisis last fall. For poorer OPEC+ member countries, it will clearly be tough. But within the most powerful members there are also differences. Riyadh and Abu Dhabi absolutely don’t see eye to eye on OPEC+ policy for material reasons; Saudi Arabia is more dependent on oil revenue and wants to play a long game to shore up future prices. As Bloomberg’s Ziad Daoud, chief emerging markets economist, told Odd Lots in March:

“And I think the two pillars of these different visions are basically have Saudi Arabia on one side and the UAE on the other. The UAE is basically pushing for, actually it is expanding, its oil production capacity. It is pushing for its OPEC quota to increase and it wants to produce more today so that it doesn't end up with stranded assets when oil prices drop in the future. Saudi Arabia is the other sort of end of the spectrum where it has large funding needs, which requires it to have a high oil price.”

Now that everyone is expecting continuing softness in oil price and demand, the IEA’s Fatih Birol took a (deserved) victory lap this week:

“We got some pushback from some corners with suggestions that our numbers were a result of some energy transition wishful thinking,” Birol said. Opec had accused the IEA of peddling a “dangerous”, “anti-oil” narrative.

The main reason for weaker than expected demand is China: both its economic weakness and its rapid deployment of EVs.

****

That is our email for this week! Thankou for reading it. If you have read the 90-page Draghi strategy, may we suggest Steven Randy Waldman’s interfluidity, which has been going for many years and has some wonderful, typically perspicacious pieces on the merits of China’s economy and industrial policy.

Add a comment: