Energy security and other co-benefits, quantified

The world may be going to hell in a handbasket but at least there’s a lot of good research and reporting to read. We’ll have more in our Phenomenal World essay in a few days’ time. This week, Tim was on a JFI panel about “Green Industrial Policy After 2025” with an excellent line up including Isabel Estevez, Adriana Abdenur, Kyle Chan and Sara Jane Ahmed.

-Kate and Tim

Energy security is security-security, in numbers

Researchers at Kiel Institute have written a report that is a kind of quantification of Pierre Charbonnier’s war ecology:

A one-euro reduction in oil consumption in the EU results in a security dividend of 37 cents (central estimate). • Based on the security dividend alone, a significant carbon price (central estimate of 60 euros per ton of CO2) on oil consumption is justified – in addition to its climate, terms-of-trade, and local health benefits. • Ambitious EU climate policy that reduces demand for oil and natural gas should be seen as an important pillar of the European security architecture, complementing military spending, diplomatic efforts, and continued support to Ukraine.

In the climate mitigation academic research, there’s an area of analysis of the “co-benefits” of energy transition. A literature review in 2020 found that air pollution dominated this literature, and also found that — not surprisingly — policymakers seldom pay attention to co-benefits.

Another “co-benefit” is the price stabilising effect of renewables - something that Roosevelt Institute authors Lauren Melodia and Kristina Karlsson described clearly in 2022 after the Ukraine war sent fossil fuel prices soaring. A new paper, in Nature Energy by Daniel Navia Simon and Laura Diaz Anadon, quantifies the price stabilising benefits of clean energy as an “insurance value”. The authors specifically focus on the social welfare value from energy price stability, rather than energy security or health benefits. The authors caution that increased volatility in fossil fuel prices themselves arising from energy transition could offset some of these benefits. This underlines the need for a robust set of policy tools to manage the “mid-transition” — as Isabella Weber described to us a while back.

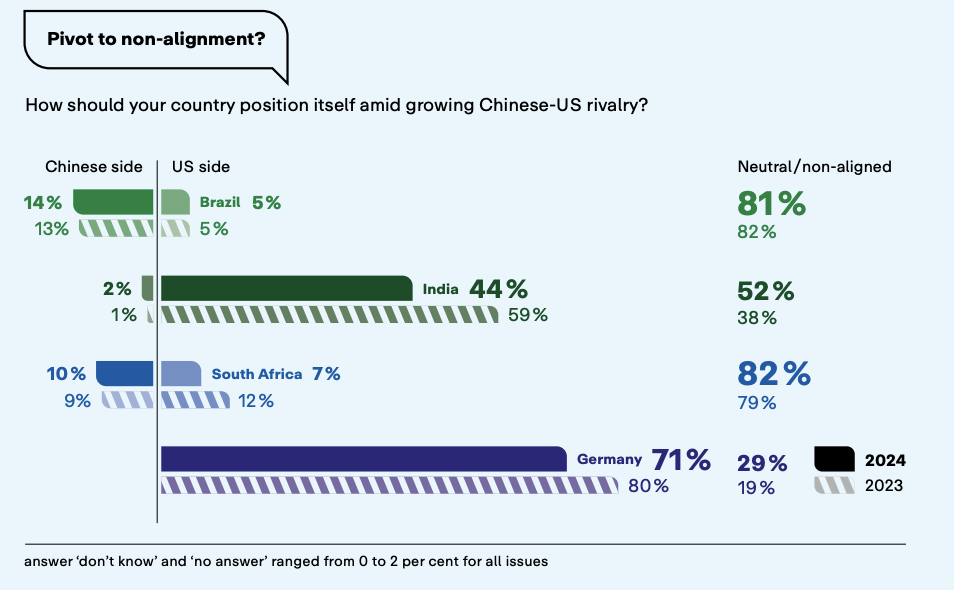

Emerging middle powers in non-alignment shock

India was cooling on the US even before the Trump 2.0 inauguration; Brazil rates climate change as one of its top 3 priorities; South Africa has high hopes for BRICS and all three are supportive of non-alignment rather than siding with either the US or China. A survey by German thinktank Körber-Stiftung of policymakers, judiciary, security people and journalists in four countries has some interesting results. The accompanying report suggests some possible implications for Europe, which wasn’t especially popular with middle power respondents, either:

By the end of 2024, the trade practices of both the United States and China will be seen as unfair by a majority of respondents in all four countries. The European Unions is also criticised: 80 per cent of respondents in Brazil, 60 per cent in South Africa and 56 per cent in India consider its trade practices to be unfair. A fair conclusion of currently negotiated free trade agreements (FTAs) could improve the EU’s image.

We’ll wait.

Things to read:

Finally, the FT has had a couple of very good “Big Reads” this past week, including Europe helped China to make cars. Now the tables are turning, and, for fun read - How Wall Street got Trump so wrong.

More reading:

Quinn Slobodian is in Vanity Fair

Adam Tooze reviewed Malcolm Harris’s book with a very pessimistic lens

Marlene L. Daut explained the French extortion of Haiti

Adrienne Buller’s The Break Down is coming to print form

Sehr Raheja and Rudrath Avinashi wrote about DR Congo, Indonesia, and critical minerals exports bans

Bruegel has published an entire book about the embedding of climate change in global policy

Asia’s LNG promises to Trump may prove empty - Bloomberg’s Stephen Stapczynski

Paul Krugman interviewed Nathan Tankus

That’s all for this week. Enjoy the rest of your weekend!

Add a comment: