Elections everywhere & Summer Bookclub

Hello to our new readers, this is the 6th edition of our dark-mode weekly Dispatch. Excitingly, we’ve had over 100 requests to join our Summer Book club so we are resending last weeks dispatch. If you want to join, we have a plan! Jump to the bottom for details and discount codes. Please email us <asahay@gmail.com> if discord link stops working and remember to fill in the When2Meet.

Elections everywhere

Our end of 2023 piece flagged issues after year of crises and how every election is now a climate election.

MEXICO

Mexico has just elected its new president, Claudia Sheinbaum, and she is the first woman + Jewish + incredibly popular! She is not a “climate scientist” as often reported, but an energy engineer who has focused on the transition, and contributed to the IPCC’s fourth and fifth Assessment Reports (the most recent is the sixth).

For all the firsts though, she is the heir of predecessor Andrés Manuel López Obrador, so what will change? Well, the first thing is dominance; the landslide gives Claudia Sheinbaum a strong mandate for presidency and ample political room to manoeuvre. Her left-wing party, Morena, won a two-thirds majority in the Chamber of Deputies, and this is likely in the Senate too. Morena also won 7 out of 9 governorships, 23 of 31 states, as well as Mexico City where Sheinbaum led an urban greening miracle- biking, transit, watersheds.

A Climate Scientist Is Voted President of an Oil Country. Now What? asks Somini Sengupta at the NYTimes. For now it is a difficult question to answer. She’ll make a Big renewables push, expand public transit, but given her fiscal austerity policy, getting more revenues out of state-owned oil giant Pemex will be her biggest headache.

SOUTH AFRICA

Is there a country with a more acutely felt form of polycrisis than South Africa? A historic election in which the hegemony of the ANC – the party that vanquished apartheid – has eroded. It now has to form its first-ever coalition government, and decide which internal wings of the party to disappoint.

Whichever grouping comes to the fore, the incoming government will have to address challenges of inequality, a years-long energy crisis where the number of days of loadshedding continue to skyrocket, and an official unemployment rate that has stubbornly been above 30% since the pandemic’s end.

INDIA

We’ll write our next polycrisis newsletter on the momentous loss of BJP’s majority. In short, the election marks the end of a cycle of de-democratization. India’s opposition is back as a force in many regions. It means not just a reinvigorated party system but the creativity of social movements from below. BJP's hubris finally met economic reality as they failed very similarly to 2004’s “India Shining” election campaign.

"These policy initiatives have always been led by the elite; to think that they have ever had a grassroots constituency is a mistake." Ravinder Kaur had told us in our Indian election preview. Modi’s unchecked power will decline which is a good thing for India and the world. Read excellent pieces by Devesh Kapur, Yamini Aiyar and Christophe Jaffrelot.

Did US Shale beat OPEC+ or join OPEC+?

You really can’t solve for climate without understanding oil markets and petrostates: they are lumpy, cumbersome things that shape the world. Oil has shaped both our careers – Kate covered commodities at the FT; Tim analysed oil companies profitability when campaigning for oil divestment as a student.

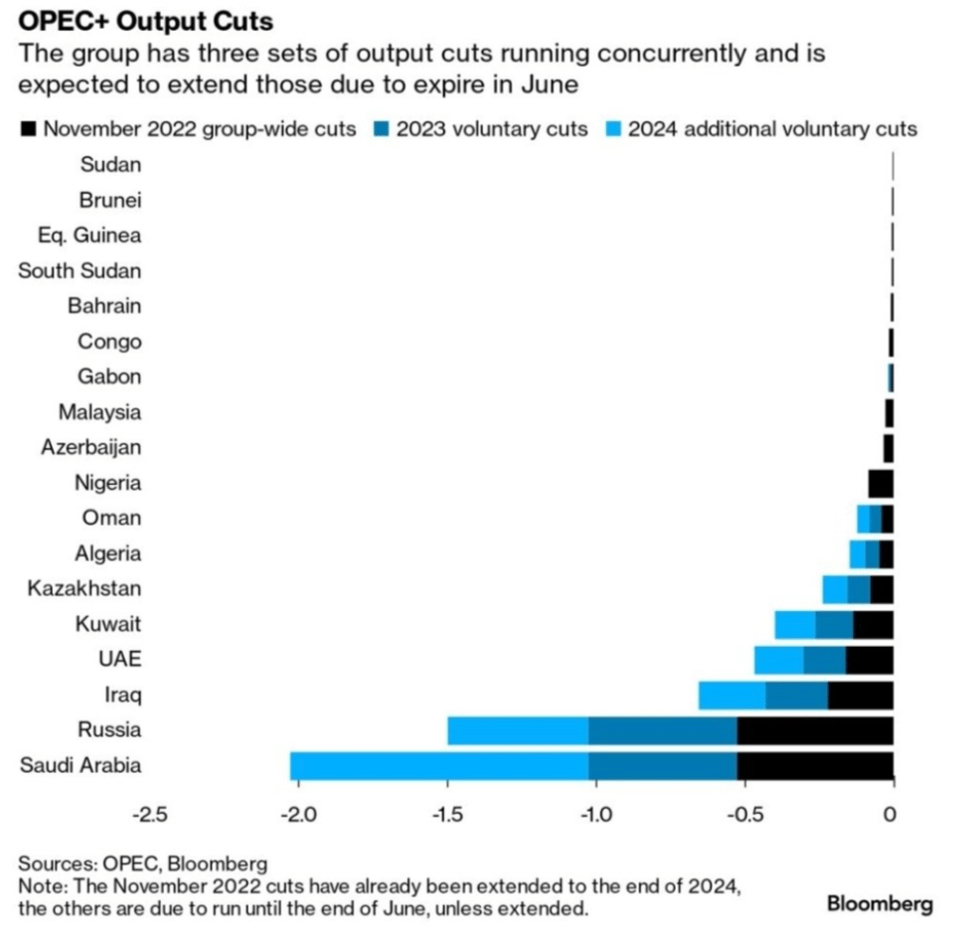

Across 12 months starting from this September, the OPEC+ group of oil producing countries plans to gradually remove its production cuts, which could add around 2 million barrels per day of production, or almost 2 percent of current demand. This is potentially a huge amount, when marginal shifts in production and consumption can have profound effects on pricing.

It appears that, after trying for a couple of years to keep prices towards $100 a barrel, OPEC+ is giving up on the goal.

Pundit-land is full of “U-S-A, U-S-A!” jubilation, characterising the OPEC+ decision as a defeat arising from either the Biden administration’s new measures to use the Strategic Petroleum Reserves (see “Joe Biden, master oil trader” in The Economist), or from the boom in US shale oil production.

But more interesting than US triumphalism – at least, for us – is what OPEC+ decisions say about their members’ views on the future of oil and the energy transition. Unlike other parts of the oil industry, OPEC+ countries at least have a degree of transparency about their attempts to control the market. The most powerful members, the UAE and KSA, have for decades been thinking about the end of oil demand growth, and have divergent strategies. Bloomberg’s chief EM economist Ziad Daoud told Odd Lots in March that the UAE: “is basically pushing for, actually it is expanding, its oil production capacity… it wants to produce more today so that it doesn't end up with stranded assets when oil prices drop in the future.” Whereas Saudi Arabia, due to its larger population and higher dependence on oil exports, needs a high price per barrel and so it wants to “restrict [supply] in order to get that high price and allow it to fund its domestic investments.”

The shift away from restraining production means Saudi Arabia is relinquishing the strategy. It used to be that OPEC only had to think about keeping prices as high as possible without smashing demand. But for about a decade now, it’s had to contend with a US shale oil sector that would madly drill even when it wasn’t really a profitable play.

But the big question is, will US producers expand or discipline production? These are uncharted waters for at least two reasons. The first is that the US shale industry has changed dramatically. Big fish have been eating up small fish: dealmaking in US oil and gas has surged to almost $200 billion in the past year alone! Exxon, Chevron, Occidental Petroleum, ConocoPhillips have swallowed up rivals. These big oil companies have their own capital, not that of excitable Wall Street investors, and are unlikely to have the same inclination to keep pumping even into falling prices.

The second is the knowledge that oil demand really is declining as we discussed last autumn at Polycrisis. Even if the oil majors believe their tough talk of a few months ago, demand destruction from EVs and electric two-wheelers is now here. All bets are off when oil producers fight to be the last man standing and when carbon becomes not the wealth but the unburnable wealth of nations.

ALSO….

EU elections have kicked off! (Thurs 6 to 9 June). Our friends at Le Grande Continent have an observatory to follow the elections.

From Tooze’s Chartbook:

Q: The war in Ukraine hangs in the balance. Who ought to be most concerned?

A: Europe.

Q: If Putin wins, whose strategic model will be most disrupted?A: Germany.

Q: The American election hangs in the balance. Who ought to be most concerned?

A: Europe (see above).

Q: And if Trump wins, who, in Europe, will be most disconcerted?A: Germany.

Q: The future of the green energy transition is in the balance. Whose industrial base is most in the crosshairs of Chinese competition?

A: Europe.

Q: If Chinese EV sweep the board, who, in Europe, will be the biggest loser?A: Germany.

Q: The European economy looks as though it may be sliding towards stagnation and lags far behind in key areas of innovation. Who has suffered particularly grievously from the triple shock of COVID, Putin’s war and the gear shift in Chinese growth?

A: Germany.

Where is Germany…?

Among other things, it’s defending the debt brake…

Stuff we liked:

Reka Juhasz and Nathan Lane’s new paper on the political economy of industrial policy - NBER papers

Alex Turnbull unpacking the question everyone is making assumptions about: Should the US or Australia (or Europe) make solar panels? (*applies to many other countries, too).

RMI on how renewable energy is really, really, massively more efficient than fossil fuels, with today’s energy system wasting two-thirds before any value is created.

NACLA’s reporting on Mexico’s controversial Section 5 of the hi-speed train through the Yucatan, Tren Maya.

Adrienne Buller’s new longform interview + essay project, The Break Down, has launched! Episode 1 features Brett Christophers (author of our first Summer Book Club book) and episode 2 features Adam Hanieh, author of Crude Capitalism, on the geopolitics of oil and plastics.—-----

POLYCRISIS SUMMER BOOK CLUB!What is our plan? We propose a HYBRID virtual and IRL book club.

Which books are we reading?

a. June - The Price is Wrong, Christophers

b. July - Planetary Mine, Arboleda

c. August - Sinews of War and Trade, Khalili

d. September - Fossil Capital, Malm

How can we purchase/obtain the books?

Verso has generously given us a discount codes for you to buy either an EPUB or a physical copy of the book.

Polycrisis-30: 30% off any of the listed books

Polycrisis-40: 40% off if you buy 2

Polycrisis-50: 50% off if you by 3 or more

If you can get them from your local library all the better. If you are broke or can’t obtain the book quickly for other reasons, just send us an email.

How to participate? Because we are spread out all over the world, there are two ways of participating

a. Tier 1: Your minimal commitment is to read the book of the month and attend a monthly zoom session. The zoom session will be 90 minutes long. A moderator will give a 10-minute overview of the book and then we will have an open discussion.

b. Tier 2: Participate in the Polycrisis discord discussion group this summer. We expect a vibrant and freewheeling discussion of reactions to each book during the month we read them together. Please use this link to get to our Discord server. If you haven’t used Discord, set up an account - it's very easy and even noobs like us were able to do it in a couple of minutes (though their CAPTCHA is weirdly hard)! This will give us fodder to organize the discussion themes in the zoom session. Our friends Henry Williams and Joe Weisenthal have convinced us that the Odd Lots Discord has worked out splendidly in forming a virtual community.

BONUS: We have an initial set of people who are keen to organize a POLYCRISIS MEET UP IRL! This will be sometime this summer in a watering hole in New York, Washington, London, Delhi, São Paulo, and perhaps even Sydney. We’ll self-organize and schedule the meetups in Discord channels.

4. When will the zoom session take place? Since many are on different continents, we are going to find a critical mass and alternate timezone friendliness. We have proposed a few days at the end of June for the first meeting. Please fill out this When2Meet.

Looking forward to getting cracking!

Tim & Kate.

Add a comment: