China China China

Also: the insurance-climate nexus

We’re back, after a brief hiatus during which we fell into insurance-climate essay angst (Kate) and report finalization angst (Tim), and new semester teaching (also Tim).

You can email us (Kate here; Tim here); follow us on Bluesky (Kate, Tim, Polycrisis account). And do join our discord channel!

-Kate

China’s outbound green industrial manufacturing FDI

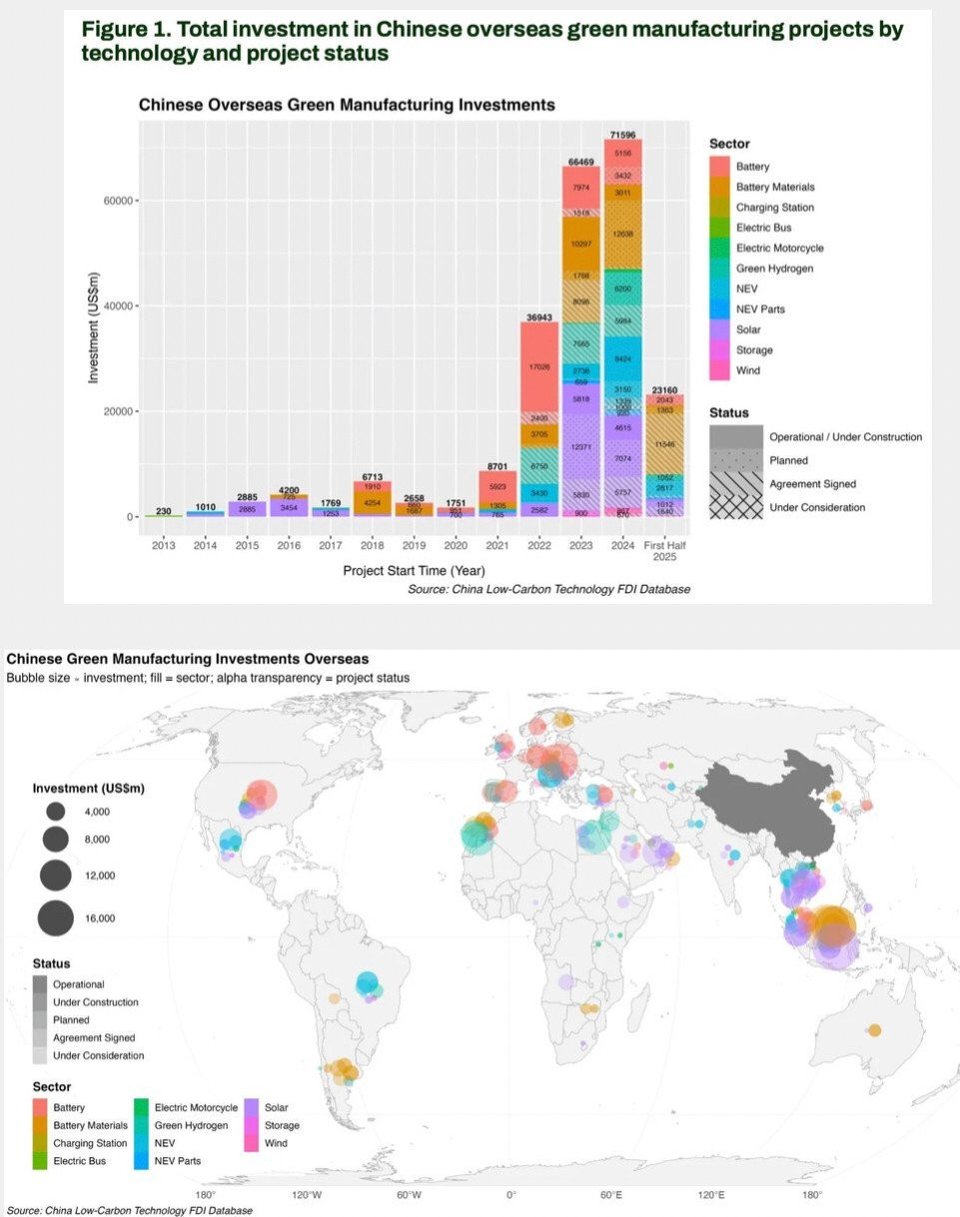

Tim’s new report really is interesting: it finds that Chinese companies have invested an extraordinarily large amount into green manufacturing in the last few years, in countries that are not China:

Jonas Nahm’s thread did an excellent job of highlighting key points and their significance:

Chinese firms have committed $227bn across 461 green manufacturing projects since 2011 - with 88% of the investment occurring since 2022. This dwarfs the $200 billion Marshall Plan (in today’s dollars).

While America retreats from green energy leadership, China has built an end to end control of green supply chains: solar, batteries, EVs, wind turbines, green hydrogen. Over 75% of these projects are in Global South countries eager for this industrial capacity.

The geographic shift is telling: MENA jumped from almost no Chinese green tech projects in 2021 to almost 20% of new deals in 2024, worth nearly $50 billion. Gulf states now welcome Chinese solar and electrolyser manufacturing that the US won’t support at home.

Key hubs are emerging outside western influence: Indonesia for battery materials; Morocco for EU-bound cathodes and hydrogen; Brazil for Latin American manufacturing. China is creating alternative supply chains that bypass the US entirely.

Bill McKibben wrote about the report, picking up on David Fickling’s point that the spending was bigger, if adjusted for inflation, than the Marshall Plan:

The Marshall Plan, of course, was what America spent to rebuilt the world in the wake of World War II, and it was a key driver of what became the most prosperous economy the world has ever seen. The American century was built in no small part on making sure that our allies (and enemies) in the Second World War recovered and were fitted into our trading system. Now the Chinese are doing the same thing, except somewhat bigger and faster.

More on China

As the Trump White House rampage continues, it is hard not to think about China an awful lot. The last few weeks saw a flurry of meetings between Xi Jinping and other world leaders; the country’s military gear has just been proudly beamed out for the world to see. And, after dwindling since 2019, funding of Belt & Road Initiative projects abroad shot up in 2025, a Griffith University study by Christoph Nedofil shows.

Xi is also talking loudly and frequently about the need to protect multilateralism and foster South-South cooperation; the Chinese government is making a series of overtures to other countries, notably in Africa. Meanwhile the US is cutting aid programs that save millions of lives and, in what Adam Tooze likens to a scene from Veep, voted in March against a UNGA resolution for an International Day of Hope and another of Peaceful Coexistence. One reason given by the US was that the resolution supposedly was a subtle endorsement of China’s “Five Principles of Peaceful Coexistence”. Tooze says this empty posturing is a “politics of denunciation more becoming to a downtrodden developing country than a former unipolar hegemon”, adding:

By contrast [to the US], China’s blend of realpolitik with ideology and national interest cannot help but seem rational and balanced as well as being backed up by an unparalleled national record of development and huge resources.

China’s green techno-industrialism: podcast

You can hear us both talking about China, the green tech electrostate superpower, and what it means for the world on the brilliant Tech Won’t Save Us podcast with Paris Marx. You probably already know that China’s energy security and (perhaps more importantly) its development and growth strategy have combined to create vast amounts of cheap solar panels, electric vehicles and batteries. But the implications of this for climate change, oil markets, and the relative technical prowess of the world’s rich countries are each rich stories in themselves, which Paris explored with us very deftly: thanks, man!

It does not stop there

None of this should be interpreted as declaring some kind of moment of unmitigated triumph for China on the world stage, however. It’s still a problematic actor abroad, with troubles at home. Here are a couple of examples:

Pushback on involution: Chinese EV makers told to stop cutting prices to below cost, amid growing alarm about “involution”.

Tech transfer reversal? Despite the green FDI and the various official initiatives, there aren’t many signs China’s CCP is enthusiastic about sending tech and knowhow abroad. There’s a report that Mexican BYD plant due to fears of tech leakage to the US. “Authorities feared Mexico would gain unrestricted access to BYD’s advanced technology and knowhow, they said, even possibly allowing US access to it.” Late last year the EU required tech transfer as a condition of Chinese companies receiving grants in a large clean battery fund.

Climate & Insurance: The musical essay

Our entry point is not financial crashes, “too big to fail” nor even financial assets generally. We start with the "climate-insurance" topic as it’s currently framed, and what it really does & should signify. Attempts to remedy and align financial incentives are useful, but they are often dancing around the edges of bigger questions about housing, the state, inequality — and how all that evolves as the climate becomes harsher.

This is one of my (Kate’s) pet topics over the past decade and consequently we spent way too long on it. The final result is not exhaustive; I’m not Madison Condon! We did, however, make the link between insurability, industry practices, the state, inequality, risk modelling, and capital markets.

We also made a bingo card meme, which will probably be appreciated by precisely 3 people, but still worthwhile.

Other things worth reading:

Bidenomics should have gone harder - Melanie Brusseler in the FT

“Instead of reviving the IRA’s clean energy tax credits, the US should redesign its power sector by building publicly owned energy infrastructure.”

Trump’s resource nationalism is the worst of both worlds - Thea Riofrancos, also in the FT

ie: More rare earths production, with little protection for the environment, and directed towards military rather than clean tech uses.

The Coming Ecological Cold War: decarbonization as the crucible for a new economic order, and other very Polycrisis-type points; by Bergruen Institute’s Nils Gilman in Foreign Policy. And read Bentley Allan in Noema on the way forward “New Geopolitics of the Green Transition”: “It was naive to believe that science and advocacy alone could transform a global energy system forged over centuries by war and empire.”

Can China’s green revolution be replicated? By Karoline Kan at Bloomberg

That’s it for this week!

Thankyou for reading, and please share this newsletter with others who you think might enjoy it.