Cafe Bustelo RTD 🥤, Growth in India 🇮🇳, Coffee Prices Down 📉: This Week in Coffee

Good morning everyone. We have big news which is that we recently hit a thousand subscribers!

If you know anyone who would enjoy this newsletter please forward it on or share it online. You can subscribe here 👇

The Big Three

Cafe Bustelo Iced Coffee launches 🥤

Link

The American coffee brand; Cafe Bustelo has launched a new line of so-called Ready-to-drink Iced Coffee Beverages across the United States this week - a departure from their long-standing business of relatively inexpensive Cuba style instant coffee. Bustelo have launched three flavours going on sale in Target, Walmart and Kroger.

The most information I’ve been able to find is from Youtuber Katerinafaith in her recent video where she states that it’s $5.99 for a ‘forty ounce’ bottle. Granted I have literally no idea what an ounce is, let along what forty of them are - but it sounds like a lot!

The drinks come in three flavours - unsweetened, sweetened and vanilla and presumably they’ll be refrigerated.

The launch comes off the back of growth at Cafe Bustelo and in ‘coffee at home’ segment post pandemic. The owner of the Cafe Bustelo brand, J.M. Smucker, posted a 5% growth in sales in 2023 and profit from their at-home coffee was up 17%. Inside of those numbers, the Cafe Bustelo brand itself grew by 22% in 2022 2023.

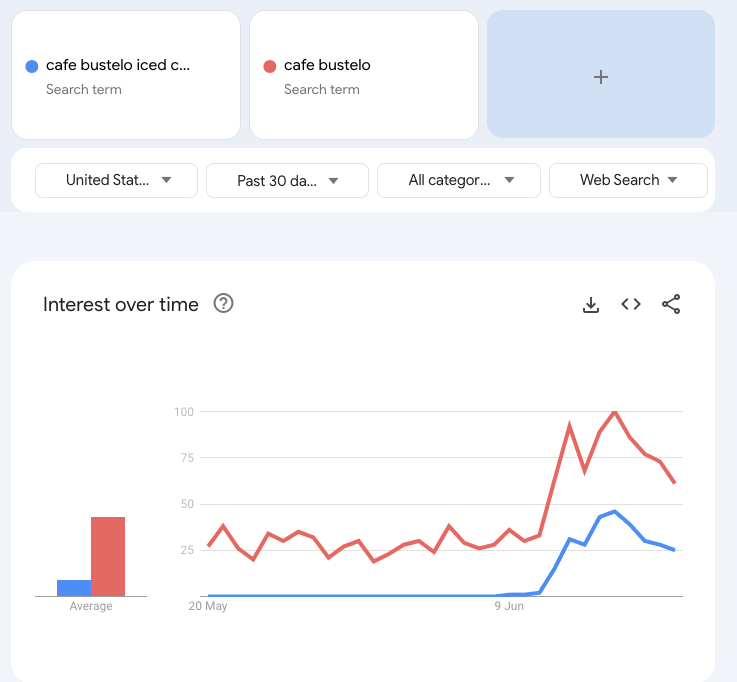

The announcement of the Iced drinks was low-profile for such a major brand but I was alerted because the search term ‘Cafe Bustelo Iced Coffee’ has seen a 2000% increase in the past 30 days.

So-called Ready-to-drink (RTD) coffee beverages have been on the rise all over the world with major retailers like Starbucks and Costa entering the market and we’re increasingly seeing manufacturers launch these products as well.

In fact, just this week Lavazza alos launches their own ice-coffee RTD offering on Amazon. Brands are able to launch these products into a relatively mature but cold beverages market which hasn’t seen much innovation in the past decades.

They also have the advantage that they don’t cannibalise a brand’s existing sales and can be made with relatively cheap low-grade coffee. These products have a shelf life long enough to easily survive modern just-in-time distribution where ultra long shelf life has become less important.

Growth in India 🇮🇳

Costa Coffee posts 49% rise in revenue to Rs 152 cr in FY24, adds 67 stores

New Third Wave Coffee CEO announces ambitious expansion plans

Caffeine Culture: Why this generation is obsessed with coffee

India is in much the same position as China when it comes to coffee with a growing middle class that sees itself as increasingly international. This phenomena is driven by a complex web of changes including general economic prosperity in the India, the rise of Social media (especially in a country with high levels of English language) and a continued tradition of overseas university education.

Costa Coffee is a British high-street brand franchised all over the world, including in India and it’s no coincidence that the brand has been extremely successful in India since so many prosperous Indians have connections to Britain through education, business and the diaspora.

The Costa franchise-holder, Devyani International, added 67 new stores in India which is a whopping 60% increase in the number of cafes. With that came a 50% increase in revenue driven partly by these new locations and Devyani have stated their intention to continue this trend with 60-70 new stores each year.

At the same time Third Wave Coffee have launched expansion plans of their own. Third Wave Coffee is a privately held, Private Equity backed and home-grown Indian coffee chain looking bring ‘speciality’ (i.e. expensive & espresso-based) coffee to India.

Third Wave underwent significant restructuring back in March and is now planning to expand its locations and roasting business with 50 new stores to open and a threefold increase in its roasting output.

Coffee Prices Ease Down 📉

Coffee prices slightly down in Vietnam, volatile in Indonesia

Weakness in the Brazilian Real Undercuts Coffee Prices

Sales of Brazil’s 2024 coffee crop make little progress and account for only 22% of production

The Brazilian harvest for Robusta is very much underway and the Arabica harvest has now begun in earnest. Together with a weak Brazilian Real, this is leading to a slight cooling in both Robusta and Arabia prices across futures markets. I’m not a forex expert but my understanding is that Real prices haven’t specifically fallen but instead the Dollar is unusually strong.

The spot price is still running up to a two year high driven by unusual dryness in Vietnam (an important Robusta producer) but futures contracts for September, November and January have all fallen.

Monitored robusta inventories were at a record low in Feb 21 however they’ve doubled and are now at an 11 month high (5884 lots total). This increased inventory will ease some of the upward pressure on Robusta.

Despite this positive currency situation and overall high prices, Brazilian producers are behind previous years’ sales and only 22% of this year’s harvest has already been sold.

In other news

Starbucks Launches Its Own Production House, Starbucks Studios

Snapchill Recalls All Cold Brew Cans Due to Toxic Growth Risk