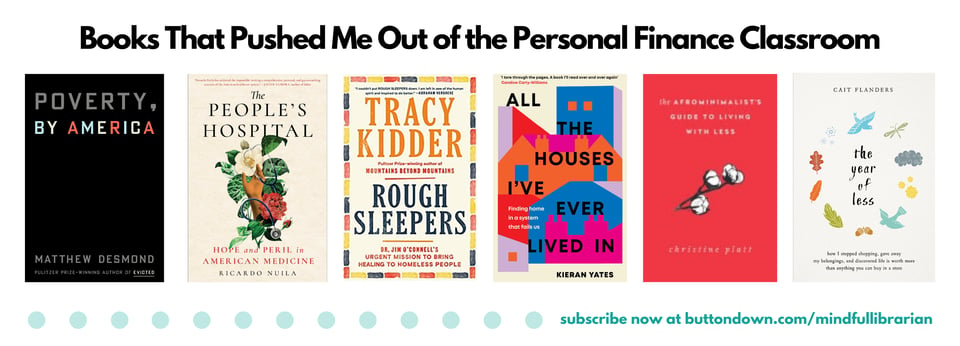

Books That Pushed Me Out of the Personal Finance Classroom

or "know better, do better"

Today I’m writing on a specific, personal topic that I hope will give my readers more insight into who I am as a reader and writer. And yes, there are book recommendations sprinkled throughout.

As many readers here know, I spent the past 3 semesters teaching personal finance classes to high school students, and as I commented on Cait Flanders’ piece this morning, I will never do it again. Or, at least I will never do it again within the capitalist, classist, and shame-filled framework that is required and prevalent in this space. A huge thanks to Dana Miranda for helping me crystalize why budget culture is so contradictory to my current beliefs.

Poverty, By America by Matthew Desmond

I wrote a lot last fall (not available anymore ~ sorry!) about the intersection of my finances, shame, debt and social media ~ while I was doing so, I realized that I wouldn’t be able to keep teaching personal finance for long. I have been reading so much about income inequality, housing inequality, the race gap in generational wealth, and how people who focus on amassing wealth are actively pushing others further into poverty (thanks Matthew Desmond!), and THAT’S what I wanted to be talking about. I wanted to be telling kids that by focusing on their own wealth and never examining the societal structures that are pushing some of them one way and others another way, the things that are inherently starting some of them at different levels than others, and the overall inherit unfairness of it all, they were perpetuating our ableist, sizeist, sexist, classist, and racist societal ways. But you know, that’s not really what I was being paid to do.

The People’s Hospital by Ricardo Nuila

So I did what I was supposed to. And yes, sometimes I went on a bit too long about how having someone available to co-sign on an auto loan is such a massive privilege that most people don’t even realize. Having parents who are able and willing to fill out a FAFSA for college. Having a fixed address. Having health insurance. Having a choice of clothes to wear. And so on and so forth. Then I would reign myself in and toe the line. But it ate at me. How could I reconcile teaching kids the very things that I had to spend decades untangling in order to release myself from the shame I felt around money and debt?

Rough Sleepers by Tracy Kidder

And also. Also, it was so hard standing in front of a room of teenagers where the wealth discrepancy was so blatant. The kids driving new Range Rovers while I was trying desperately to find a used car we could afford after an accident totaled my vehicle. The student without a fixed address next to the students living in opulence. The students quoting Dave Ramsay at me and the boys (yes, they were all male) spending countless hours on day trading and sports betting apps? How could I talk about money in that space and feel safe, much less make my students feel safe? How could I make them understand that teaching is a noble profession despite the low pay? That I don’t regret a dollar of my student loans because they allowed me to go to school and explore new paths so many times? How could I teach those things without veering into spaces and discussions that pushed me out of my lane and into dangerous territory?

All the Houses I’ve Ever Lived In by Kieran Yates

I realized I couldn’t. Not in that class, not in that school, not in our current environment. I hope I made an impact on the approximately 200 students in those classes of mine. I hope I made at least some of them think about how their privileges and financial decisions impact others. But these classes are not currently set up to prioritize an equity lens. Their goal is to set students up to focus on individual and family wealth accumulation rather than looking at how to approach finances as a communal issue. I simply couldn’t bear to be a part of that machine any longer. And so I left.

The Afrominimalist’s Guide to Living with Less by Christine Platt

I want to, as Dana Miranda does, focus on the WHY behind money decisions. The WHY behind spending. For those of us with privilege, where does our overconsumption come from? My mindfulness and yoga practice have led me into inquiry on the concepts of living my life focusing on non-harm and reducing consumption ~ this is an area of growth for me and I have a lot to learn yet! I have grasped onto the phrase “die with zero” recently and I’m journaling and working through what that means for me. How do I best use any money I have while I am on this earth to both fulfill my needs but also work toward an equitable and just society?

The Year of Less by Cait Flanders

I am a work in progress, my readers. We all are. But as I learn and grow, I know I want to do so outside of the traditional personal finance classroom.

Someday I may share why teaching marketing courses didn’t feel as wrong to me as teaching personal finance did ……… it’s complicated.

That’s all for this edition, my friends!

Add a comment: