Economic Surplus: Christmas 2021/22 Edition 4

Economic Surplus by The Marshall Society

10 January 2022

"It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest." ― Adam Smith

Welcome to the Economic Surplus, the newsletter brought to you by the Marshall Society! We are the University of Cambridge's flagship economics society. Every week, we bring you our bespoke commentary on economic trends, updates on our exclusive members' events as well as a summary of the headlines you can't ignore! You've probably received this email because you were previously subscribed to the Marshall Society's old email list, but if you have been forwarded this by a friend, feel free to subscribe here!

FTI Consulting – Economic & Financial Consulting (EFC) summer internship scheme – applications still open

Applications for a summer internship in FTI Consulting’s EFC division are still open, but are due to close on 31st January. More information on FTI Consulting’s EFC division can be found here, and applications to the summer internship scheme can be found here. After completing online assessments, successful candidates will be invited to an (hopefully in-person) assessment centre in February, consisting of: (i) a CV interview; (ii) a group exercise; and (iii) an interview with senior management. Good luck with your application!

Marshall's Thoughts -Are we at the peak of the credit cycle? Is a financial crisis imminent?

This week’s Marshall’s Thoughts are written by George Moran.

As 2021 closed many analysts looked ahead to 2022 and were not optimistic. While the leading investment banks predicted continued growth in US equities, many other economists were more pessimistic. US equity valuations seem to be astronomical in many cases and the macroeconomic indicators are suggesting that the US economy could be reaching the peak of a prolonged credit cycle.

The theory of credit cycles is not wholeheartedly embraced by mainstream economists who view it is as too simplistic, but it does stand up well historically. This suggests that economies undergo a cycle of credit expansion then credit decline and so on. During expansion, optimism is high and monetary policy is easy, so banks dramatically increase the availability of credit.

However, a point arises when credit expansion translates into money supply expansion and ultimately into inflation. This encourages the central bank to raise interest rates to cut off credit which pushes down asset prices. Also, as investors flood the markets the availability of lucrative assets fall so investors have to take bigger and bigger risks to achieve a high return. This naturally encourages more leverage and asset price inflation.

Then the economy enters decline. These risky assets inevitably fail and a vicious downward spiral of insolvency, bankruptcy and deleveraging pushes the economy deeper into recession than a standard macroeconomy shock would.

This was exactly the scenario in 2008. Investors made use of superfluous bank credit to take risky bets on the US housing market. And also, in the run-up to the 1929 crash abundant bank credit motivated many people to buy US stocks ‘on the margin’. When the Fed popped the bubble far too late by raising rates bankruptcy was widespread and a negative credit cycle kept the US economy in a depression for most of the 1930s.

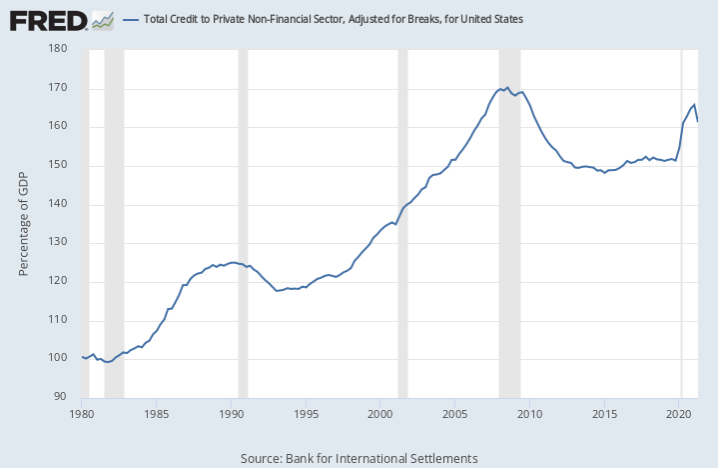

Parts of this picture do not seem too different from the situation at the end of 2021. Quantitative easing and interest rate cuts have pushed bank credit (as a % GDP) up to nearly 2008 levels. As shown above, this has been a reliable predictor of financial crises in 1990 and 2008 as well as the 1929 Wall Street Crash. However, today most credit growth is coming from non-bank finance which does not face the same regulation that traditional banks do post Global Financial Crisis. Problems are always most likely to originate in the least regulated, most innovative financial sectors.

A recent November 2021 ECB working paper applied machine learning techniques to predict financial crises over the past 140 years for 17 advanced economies and found that strong credit growth can make a country more vulnerable to crisis. They concluded that credit growth below 3% is usually harmless but above that threshold, the likelihood of a crisis increases sharply. The latest data on credit has an annual increase of 3.97% for the US.

The rise in bank lending has coincided with soaring asset prices, particularly in innovative technology stocks. The NASDAQ is nearly 60% above its pre-pandemic peak and the Dow Jones 24% and even back in March 2020 many analysts were calling the market overvalued. The rise of retail trading is also characteristic of the expansion phase of a credit cycle where credit conditions are so easy that many ordinary people take on sizable market risk. Typical of a credit-driven bubble, the market now only seems to loosely reflect fundamental factors and has largely shrugged off the announcement of Fed tapering and the omicron variant.

So, in 2022, the market and the economy could be at a precarious point. It is very challenging to predict the peak of a credit cycle, but soaring inflation and rising interest rates are often the catalyst for credit decline. We have already seen soaring inflation this year and interest rate hikes are expected in 2022. There is rarely a fall in bank credit that does not precede a recession. There is some reason to be optimistic. Markets are currently only pricing in gradual increases in interest rates so this may not constrict bank credit too much, although the Fed will more aggressively curtail its asset purchase plans in 2022.

No forecaster can say with certainty there will be a pull-back in asset prices and a financial crisis in 2022. But there certainly seems to be a growing probability and if history is a guide the US and the global economy are in the perfect conditions for a credit cycle collapse.

If you have any questions or comments on this article then please email the author, gm652@cam.ac.uk .

In Case You Missed It:

ECB executive warns green energy push will drive inflation higher | Financial Times. An ECB executive has warned that a transition to a low-carbon economy will raise fuel prices and therefore headline inflation. This will likely force central banks to slow down the pace of asset purchases to meet their inflation goals.

Crypto Prices Tumble Again After $300bn Sell Off | Forbes. The price of bitcoin has tumbled to a three-month low and there are fears that it will continue to slide. This is part of a wider sell-off of speculative assets. It is suggested that market fears have been heightened by a warning of an acceleration of tapering by the Federal Reserve.

The Puzzle of Falling US Birth Rates Since the Great Recession | National Bureau of Economic Research. A new paper by three US economists examines the causes of falling US birth rates in the last decade or so. They highlight shifting priorities of young adults as the main cause rather than any fundamental economic changes. Changes in society mean less priority is put on marriage and parenthood and more emphasis on individual autonomy.

That's it from us for now!

The Marshall Society