Week 13 - Two Truths (on money) & One Lie (on health)

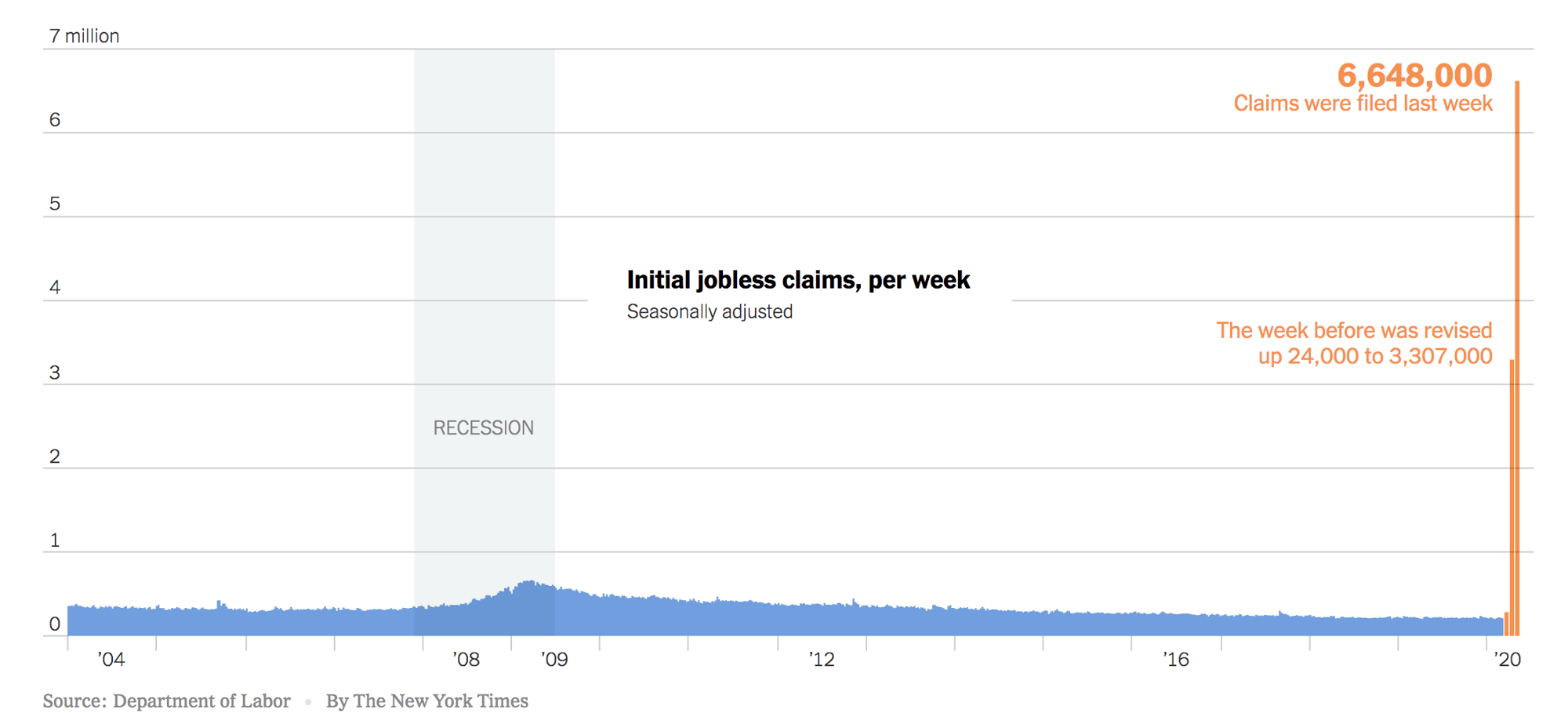

Let's start with one truth that was made shockingly clear this week. Over six million claims were filed for unemployment this week. Six. That doubled from last week alone.

The silver lining in all of this is the social distancing health measures to fight the spread of COVID-19 are working to flatten the curve. A relief that feels short considering there's still financial health top-of-mind for many who have been furloughed, laid off, and left unemployed as the economy stands still.

The second truth that's revealing itself is how financially insecure society is feeling with the accelerant of COVID-19 playing out. Here's what stood out for me around this.

401k to "call 911, ok!"

As the U.S. recovered from the Great Depression and then boomed, a new retirement system for the middle class took root. Employers attracted workers with pensions that, like Social Security, guaranteed income for life. Starting in the 1980s, however, the 401(k)—almost an accident of the tax code—began replacing pensions, pushing more risk and responsibility onto the shoulders of American workers.

Still, even affluent Americans faced a persistent problem with the 401(k) system—one that’s hitting hard right now. It’s known as sequence of return risk. For anyone about to retire, what matters to their financial well-being is not just the long-term return their portfolio can deliver, but also what happens in the markets in those first years after they stop working.

The losses for retirement savers depend on how exposed they were to stocks. The Vanguard Target Retirement 2020 Fund, split roughly 50-50 between equities and bonds, was down 13.9% year-to-date through March 24. Right there—and this assumes no further decline—a $40,000-a-year income for someone retiring now has fallen to $34,440. That’s a considerable change in lifestyle. If you can’t make that adjustment, you can draw down more, but every dollar you pull out now won’t be there to take advantage of a future rise in value. And your odds of running out of money before you die will go up.

According to calculations by the system’s trustees last year, the program’s income and reserves won’t be enough to pay for scheduled benefits by 2035, forcing the U.S. to reduce benefits by about 20%, unless changes are made. The coronavirus pandemic makes those calculations worse, though no one can fathom by how much right now. There will be fewer workers to support the pay-as-you-go system through their payroll taxes. Money will be flying out the door faster than it’s coming in.

Public Pensions In Detention

https://www.nytimes.com/2020/04/02/business/dealbook/coronavirus-public-pension.htmlAlready chronically underfunded, pension programs have taken huge hits to their investment portfolios over the past month as the markets collapsed. The outbreak has also triggered widespread job losses and business closures that threaten to wipe out state and local tax revenues.

Last week, Moody’s investors service estimated that state and local pension funds had lost $1 trillion in the market sell-off that began in February. The exact damage is hard to determine, though, because pension funds do not issue quarterly reports.

Public pension programs have long been endangered by a fundamental tension: With growing ranks of retirees and mature workers, they should invest conservatively, like someone on the cusp of retirement, shifting into high-quality bonds, for example, with durations timed to reflect scheduled future payments to retirees.

As of 2018, state pension funds had on average invested 74 percent of their money in what Mr. Biggs called risky assets, including stocks, private equities, hedge funds and commodities. That was up from 69 percent in 2010, after the 2008 shock, and from 61 percent in 2001, when economists first began challenging the way public pensions operate.

“This was completely predictable,” Mr. Biggs said. “They are holding tons of equities when they’ve also got tons of retirees.”

Where do you turn when you need to make up the difference in cash you need to pay out? Here's what Chicago did:

The other strategy is to turn to taxpayers — the very people and businesses that are now facing shutdowns, layoffs and shriveled balances in their 401(k) accounts.

Illinois chose the path of widespread taxation to pay its retirees’ pensions, including a 3 percent compounded annual increase, a figure well above the recent rate of inflation.

The state doubled its gas tax last year. It tripled a real estate transfer tax, and raised taxes on cigarettes, vaping, electricity and even dry-cleaning fluid. It made marijuana legal and taxable. It approved gambling, so casinos can be taxed, too. Tags for virtually all cars and trucks went up in January.

Chicago raised parking meter rates and put meters on streets that didn’t have them. It raised taxes on restaurant meals, increased a “congestion tax” on single-occupant cars and tacked a $3 fee on ride-hailing services.

The One Lie (Sponsored by Influencers)

https://www.nytimes.com/2020/04/02/style/influencers-leave-new-york-coronavirus.htmlBut some of the posts circulating on social media display behavior that defies current guidelines to cease nonessential travel. A few high-profile lifestyle influencers, for example, have posted about fleeing New York City to smaller towns and other states, potentially endangering local communities and inadvertently encouraging their followers to do the same.

“I think it’s really dangerous and personally idiotic,” said Dr. Darien Sutton, an emergency room physician who has been using social media to educate the public about the coronavirus. “When I see these influencers travel around, I think they’re setting a really poor example of how to appropriately act during a pandemic. You have to hold yourself accountable for the possibility of transmitting this virus to people who are more vulnerable, and there’s no way to be 100 percent sure you don’t have the virus.”

...the idea that any of these people are safer in smaller communities or other states is a flawed one. Many vacation towns have fewer medical resources to deal with a sudden onslaught of sick and contagious out-of-towners, and Florida is full of older citizens, who are at higher risk of becoming critically ill with the virus, he said. “New York City is by far better equipped to deal with this,” Mr. Sacks said. “We have a bunch of top hospitals, we have leadership who are doing the right thing, and top clinicians.”

The primary issue many medical experts take issue with, however, is not the influencers’ decision to leave the city against public health guidelines, but that they’re promoting this message to potentially millions of people.

Stay safe out there

(

(