Week 12 - Timing for everything when equity is everything

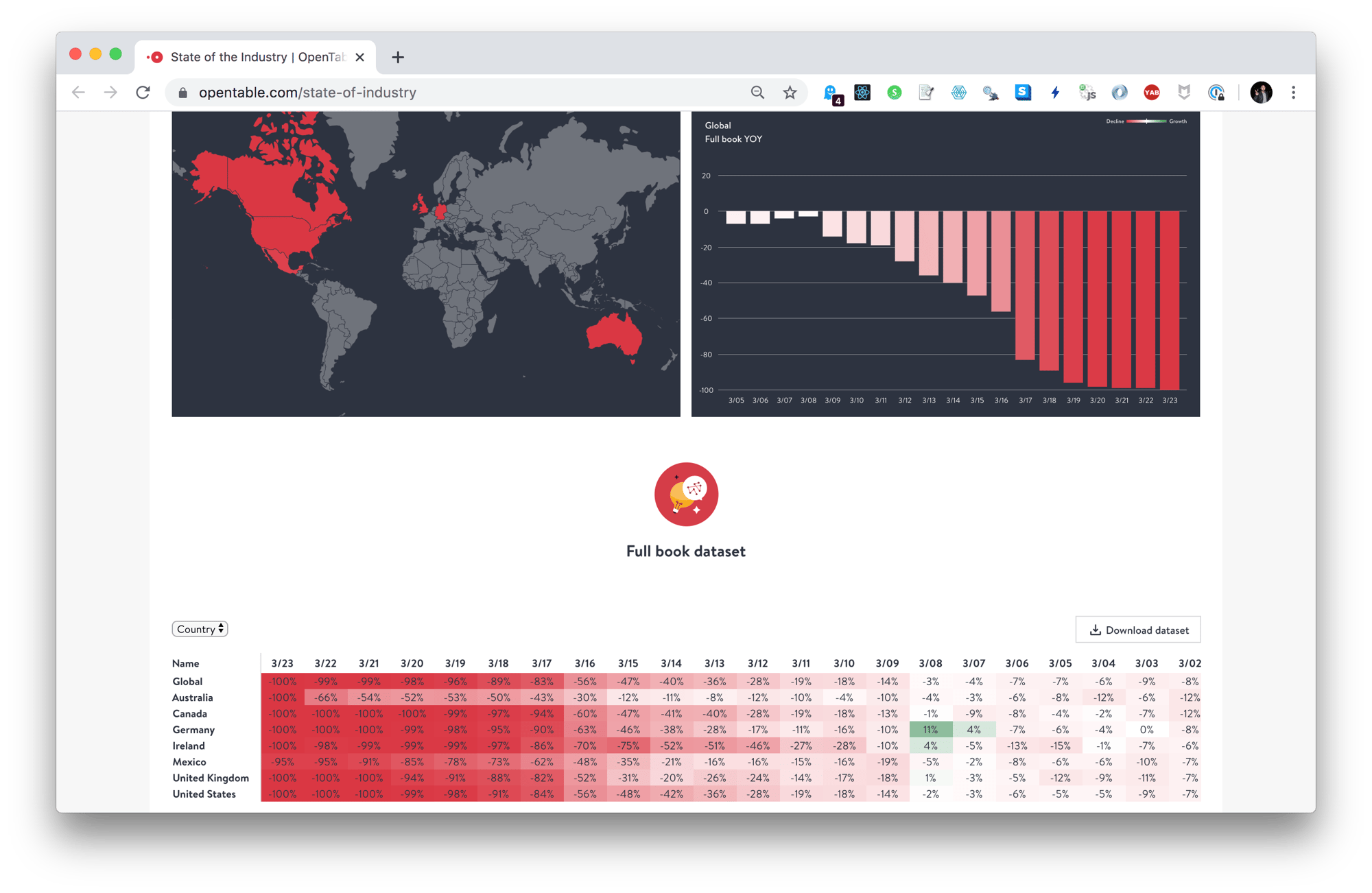

As COVID-19 spreads every week, I seem to learn how it infects industries as well at the same time. Sifting through stories I read this week, I found the data set from Opentable quite illuminating. In the midst of restaurant closures across the country, seeing the cancellations of reservations in real-time was eye opening, especially with data shared from the company. You can check it out here.

I wrote briefly about the collateral effects happening from a labor perspective last week. It seems even executive leaders were finding themselves affected in ways where it hurt the most, their equity stakes.

Misdirect Listing

The pandemic has also thrown into disarray Airbnb’s plans to go public this year, and the company’s board and investors are divided over the best path forward, according to people familiar with the matter.

All its major markets are getting hammered. Bookings last week were down year-on-year around 95% in Asia, 75% in Europe—the company’s biggest market—and 50% in the U.S., according to one of the people close to the business. A report last week by Airbnb-analytics firm AirDNA also showed bookings tanking in big cities world-wide. This week’s numbers are much worse, the person said.

Some board members are unhappy that Airbnb didn’t go public last year, when a soaring stock market put premium prices on even unprofitable startups, the people close to the company said. Employees are concerned the listing could now be delayed beyond the end of the year, meaning many valuable stock options will expire, becoming worthless.

No sense of agency or equity

Coronavirus Rocks Hollywood Talent Agencies

Major players CAA, WME, UTA and ICM face economic hardship and staff cuts as Americans brace for mass cases of COVID-19

For Hollywood’s biggest talent agencies, working from home has been the least of tough adjustments in the stunning fallout from the coronavirus pandemic. Revenue streams at the companies have suddenly dried up as show business has shut down.

Expense reimbursements have been temporarily frozen, three individuals familiar with the matter said, and future expenses are prohibited until further notice. The latter is no great sacrifice, added one person familiar with WME, as martini lunches and jaunts on private jets aren’t possible with California’s current stay-at-home order.

The fiscal conservatism comes at a particularly tense financial time for WME. Senior partners at the agency were informed Friday that an expected stock reimbursement, scheduled for April 5, would be delayed indefinitely. The cash drop was said by insiders to be worth up to 20% of the equity held by senior employees in WME’s parent company Endeavor, which scrapped a planned IPO last fall. Turmoil over the buyout predated the coronavirus outbreak by months, and even stirred conversations about top agents potentially defecting for competitors. WME declined to comment on the matter.