Wolkness

Recently, a student in one of my classes did a great presentation on a court case in her school district: Lower Merion (LMSD). LMSD has a certain reputation in the Philadelphia area for being wealthy and white, particularly since it borders Philadelphia. If you ask people in the city and in Lower Merion about this dynamic, they know immediately what you're talking about. I once met a lefty lawyer who grew up in Philadelphia and was a public defender in the city. When he had kids and the time came to send them to school, they moved the family to Lower Merion. He loved the city, had fought for justice there his whole career, but he felt he had to go to Lower Merion 'for the good schools'. I think this trend of professional-managerial class people--and maybe even working class people--moving to suburbs for the schools is one of the cornerstones of racial capitalism.

Indeed, LMSD has one of the highest average property values in the region and their schools are highly rated, have lots of resources, and depending on which statistic you look at, serve a population of students more than two-thirds white. There are a lot of complex dynamics here and it can be hard to explain all of them. But my student's presentation captures almost all these issues and more.

Wolk puppies

"Stay woke" is a contentious phrase right now. It actually derives from a recording of the great blues musician Leadbelly talking about a song he wrote for the Scottsboro Boys, a group of Black men falsely accused of raping and murdering a white woman in Alabama in the 1930s. Their cause was taken up by the Communist Party-USA and was a crucial terrain of contention for Black communists and socialists at that time (particularly because the NAACP didn't want to fight on it). 'Wokeness' has unfortunately come to refer to a superficial identity politics. I mention all this because I can't get the pun of "Wolkness" out of my head with the story of Lower Merion I'm about to tell. Wolkness is a whole other thing.

In 2016, a retired aviation lawyer in the suburb of Gladwyne, Arthur Wolk, sued the Lower Merion School District. He said the district unjustly increased taxes on property owners. Weirdly, the Inquirer covered the story by leading with Wolk's love of puppies. Indeed, Wolk wrote a whole book for his golden retriever Boo called Recollections of My Puppy. I can't find links to this book but his law firm frequently posted pictures of Boo hanging around the office before he died.

Wolk is an interesting guy generally. He participated in a number of famous court cases suing airlines on behalf of passengers. Now he's making some history fighting what he calls malpractice at his local school district, LMSD.

Local control freaks

Remember that schools, particularly suburban schools, are funded by local property taxes. Local school boards have the power to set tax rates in their districts to manage spending for education. This is what "local control" really refers to: wealthy localities determining the extent to which they're taxed to provide public education. In Pennsylvania, districts like LMSD with high property values rely almost entirely on their own local taxation for their schools. (The best line on local control is from a 1990s court case in Vermont where the judge ruled that local control is a "cruel illusion" since only districts with large tax bases have power to control anything, which is why local control is a form of bourgeois power.)

But in some states, Pennsylvania included, districts can't go wild taxing property. There are ceilings put in place to make sure property owners don't end up paying too much. In PA, there's a law called Act 1 regulating how much districts can tax. Districts need a special waiver to increase taxes above a threshold between 2.4%. As students pointed out, this is a perverse policy. It's obviously conservative since it protects property owners from being 'over-taxed', but it ultimately incentivizes districts to build up their reserves in case they can't tax what they need in the future. This very problem actually becomes the heart of the story.

When LMSD asked in 2017 for a 4.4% increase in the tax rate, they had to appeal to the state department of education. The DOE granted the waiver, but the citizens within the taxing boundaries of LMSD didn't approve--at least, that's what Wolk said. Wolk claimed Lower Merion violated Act 1's 2.4% threshold unjustly. Even though the district got a waiver from the state department of education, when Wolk argued this was evidence of corruption the County Court and then the State Court agreed. They said the district shouldn't have taken that much money.

But not every court agreed. The case is still bouncing around. Wolk got favorable decisions at first, but three or four different courts issued several contrary judgements (I can't keep it all straight). The county court said one thing, the state court another thing, then there were different decisions when both parties appealed each of those. The District's appeal, as they track it on a web page specifically devoted to the case, refers to an injunction that is still before a court of Common Pleas. Meanwhile, the district puts more and more in reserves in case they have to pay back tax payers if the courts decide the $55 million that Wolk is claiming was corruptly taxed actually was.

The pivot point in the case has to do with whether and how districts can put money in assigned vs. unassigned surplus in their budgets. Lower Merion allocated the funds from the 2017 tax increase into its unassigned funds category. Wolk say this was 'corrupt', but, as we just said, it makes sense to do these types of things when you're under the constant threat of not having enough money and not being able to raise taxes if you need to.

Milling around

Let's pause here and think about how absurd his case really is in the grand scheme. It gets to some of my favorite soap boxes about school funding, specifically mill rates, which are the formulas that school districts and local governments use to tax property for education. People getting all huffy about tax hikes at the local level (like the infamous tax revolts of the 1970s) usually don't talk about the rates at which they're being taxed relative to their property value. They talk about absolute values and they say they're paying "a lot of taxes." But this is rarely true. In fact, it's usually the opposite. Poorer districts (rural and urban) pay higher tax rates than wealthy districts.

Lower Merion is a perfect example. The district has one of the highest average property values in the region. But look at its millage rate: it is one of the lowest in the region. Why? Lower Merion has a huge tax base so they only need to tax a little bit to get a lot of money for their schools. Wolk might think he's paying 'too much' in tax, but he's actually paying a lot less than his neighbors.

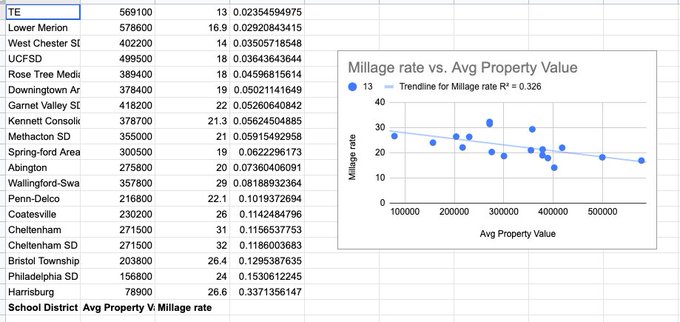

Here's a chart comparing millage rates (third column) and average property values (second column) for districts in eastern Pennsylvania (first column). You'll see that the higher your district's property value, the less you pay in taxes. That's what the downward pointing line on the right means (though in this particular set of districts it's not a perfect relationship, which leads to some interesting questions I'm looking at).

As I've said before, this is what makes school property taxes super-regressive: the districts with the most real estate value can tax relatively less to get relatively more for their students, who need relatively less than neighboring districts. The fourth column features decimal numbers that refer to the relationship between millage rate and property value. You see that these decimals increase as the average property value decreases. Again, that means that Harrisburg residents pay more in taxes than Lower Merion or Tredyffrin-Easttown.

Another interesting postscript here is the densification of suburbs. Lower Merion has been building multi-family apartment complexes. What kind of families move into these buildings? Diverse working class people looking to take advantage of the schools. I have to imagine that wealthy white residents like Wolk don't like this trend. They want single family homes. Guess who can afford those kinds of houses? And guess who don't want their tax dollars going towards education for diverse working class kids? People like Wolk.

Indeed, Lower Merion should be commended for their densification. This housing strategy of building dense apartment complexes in suburbs with high property values is/could be a climate-conscious redistributive approach to planning. When a property wealthy district with 'good' schools builds more dense working class housing then more people can go to your schools and the density lowers emissions too!

All this makes Wolk's case laughable, insulting, and unjust. The headline is: property rich lawyer who doesn't pay much in taxes sues school district as it attempts to provide material benefits to the region's working class and fight climate change. That's what I call Wolkness.