Upside-down middle finger

Dearest readers,

Over the last four years, I’ve only missed one or two weeks when I don’t send out something substantial for you. I’m writing this week to beg your patience as I start a new job and finish edits to As Public as Possible: Radical Finance for America’s Schools, the book version of this newsletter, which is supposed to come out later this year.

Between the new classes to teach and the intensive editing process, I just haven’t been able to put together the quality stuff I’d like to, so I’m being honest: I need a brief break from intensive weekly writing. So my posts over the next little while might be sort of abbreviated.

For example, I thought I’d send along a smattering of pension stuff.

First, there’s this recent report by Jean-Pierre Aubrey with the Public Plans Database on state governments’ role in teacher pensions. It’s got some interesting insights (like how we don’t really know much about states and teacher pension) and citations.

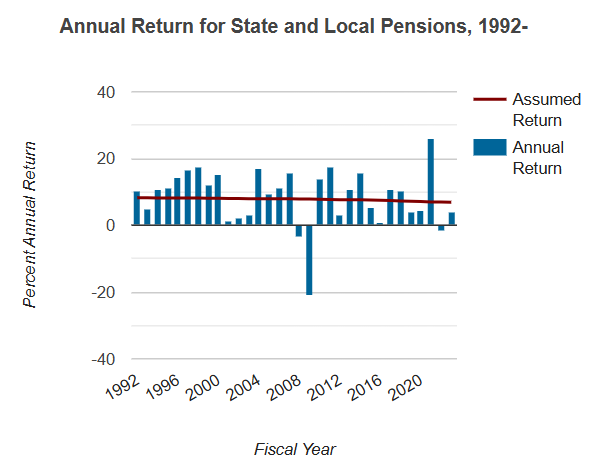

Combine this with a darkly funny graph I came across tracking annual returns vs. the assumed return for state and local pensions between 1992 and 2022. The upside-down middle finger from 2008, along with the tower in the post-pandemic recovery, really stood out to me.

What do we really know about pension investment, I wonder? Look at how the assumptions don’t change while the returns spike up and down. So much depends on this dynamic and yet we talk very little about it.

Finally, on my radar to read is a law review article from ten years ago about pension de-risking, which is at the heart of some of my thinking about green fiscal mutualism. Enjoy!