Two public school solar financing policies: public and private

The other day policy researchers from the Center for Public Enterprise (CPE) got in touch with me. I'd met one of them on twitter and at that time he told me about their new tools for calculating savings using Inflation Reduction Act programs, which is awesome, and I spread the word.

This time he was interested in hearing about what's happening in Pennsylvania around solarization of schools. Specifically, he wanted to know whether school districts were using power purchase agreements (PPAs) to finance their solar panels, and if there might be interest in an alternative financing mechanism called a state energy financing institution (SEFI) for similar projects.

I didn't know. But I knew enough to search around and recommend some stuff. I found this report on PA school district financing for solar panels with PPAs. And I told the CPE team that state rep Liz Fiedler from South Philly was sponsoring some legislation to help schools finance more solarization, particularly now that Democrats had a slim majority in the state house.

I connected the CPE people to experts I know on these issues from Philly Democratic Socialists of America, who in turn knew folks from Fiedler's office. It was fascinating to watch the dialogue take off, particularly because I noticed that there were ideological differences between the PPA approach and the SEFI approach. They're not exactly mutually exclusive, but the SEFI is more public than PPA, which I thought I'd write about here.

Middle man in the middle

What's a PPA exactly? From the report:

In a PPA, a private investor pays the upfront cost of the solar installation and owns the array.

The school district signs a contract to purchase the power generated by the solar array from the investor over a specified length of time, typically 20-25 years. Because the school does not take out a loan or provide upfront capital in the PPA model, it is an “off balance sheet” transaction. The investor (or tax equity holder), as owner of the array, is able to sell the SRECs and receive the 30% federal tax incentive (see “Solar Investment Tax Credit” below).

Public school districts don't have a ton of money they can pay up front for solarization. They're...public schools. So private investors offer a service. They say to the district "let us get this, we'll pay for the solar arrays up front, but then it'll be ours, and we'll be your solar energy provider going forward."

The district says okay. Thus a middle man is created. This middle man can mess with the energy prices going forward. They're a private company after all, so they have to make it worth their while and get their profits from the public school. It's not awesome but the district can save money and keep carbon from going into the atmosphere so they take the deal, which can look like this:

In most cases, the investor increases the price per kilowatt hour of solar electricity over time, through an escalating factor built into the contract. For example, in the East Lycoming School District, the rate that they pay to the investor (PPL Renewable Energy) for the solar energy increases by 3% annually. In other cases, the investor offers the host site a fixed electricity rate over the term of the PPA, without any escalator. As an example, the Colonial Area School District pays a fixed rate of $0.09 per Kilowatt-hour (kWh) while the Bald Eagle School District pays $0.049/kWh.

The report has a ton more examples of how all this goes down. In each case, the district enters into a contract with the private investor and a private provider owns the arrays and the energy, in some cases leasing the equipment and energy back to the district, creating savings.

But it doesn't have to be this way. The district could actually get financing for the solar arrays so that it owns the arrays and doesn't have prices increase like that. Enter the state energy financing institution (SEFI).

SEFI ftw

The PPA has a cast of characters around the district: the investor, the provider, etc. Rather than for-profits, the SEFI gathers public entities together to create a pool of financing for the district at federal and state levels.

At the federal level, it involves the Department of Energy's Loan Program's Office (LPO), as well as the infrastructure bills the Biden administration got passed in 2022. The LPO had a policy the enabled it to lend directly from the federal Federal Financing Bank called Title 17, but this was only for "experimental technology." The IRA opened this up to any kind of project, according to the Center for Public Enterprise, "so long as its co-financed with" a SEFI.

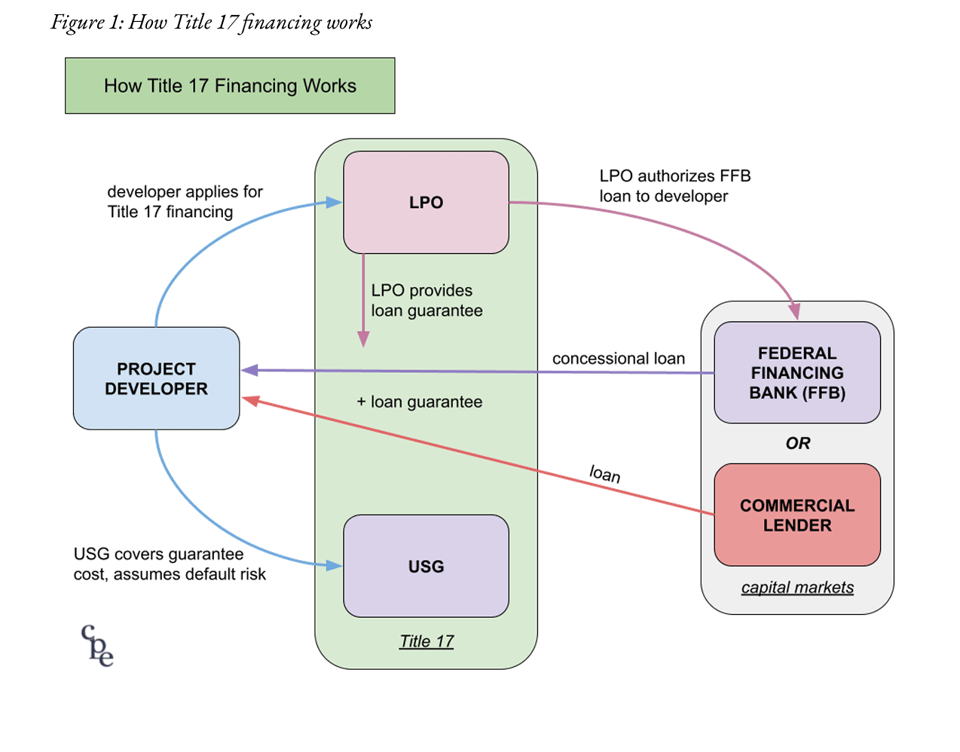

This SEFI carveout enables the LPO to tap its $40 billion loan guarantee authority to augment state government investment in a wide range of clean energy generation and energy efficiency programs. The LPO can team up with a designated SEFI—a state agency such as a green bank, infrastructure bank, or a financing board with a climate-related mandate—to offer a concessional loan and loan guarantee to energy project developers (financial supports referred to here as “Title 17 financing”)

The SEFI is just a pool of capital housed in the state government with contributions from the state government and open to flows from the LPO at the DOE. If you're a visual learner, Advait Arun from the CPE has this diagram in his brief on the SEFI policy:

So the SEFI path draws from almost entirely public money to finance the school district's solarization project. It cuts out the middle man who raise prices and creates a public flow of monies through the state and local governments, guaranteed and supported by funding from the IRA. It seems like a much better deal: less carbon in the atmosphere, more savings, lower energy costs. Plus it's all public.

Apparently there's a lot of interest in the SEFI path in Pennsylvania state government. So it was cool that the CPE people were connecting with Fiedler. Hopefully there's more SEFI than PPA for PA's school districts!