Trumproof

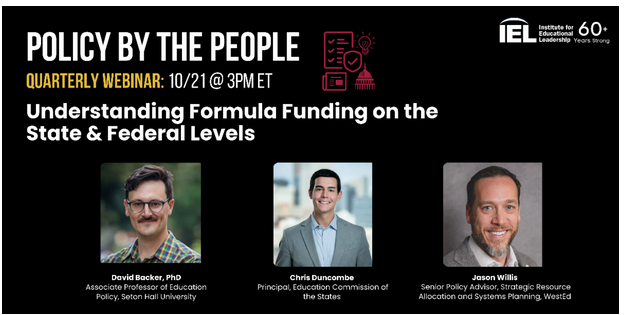

Announcement: Tomorrow at 3pm EST I’ll be speaking on a panel about state and federal funding formulas for the Institute for Education Leadership’s quarterly webinar series called “Policy by the People.” Register here!

Some good reading: The Public Renewables Project just put out an excellent report on how the Connecticut Green Bank has financed rooftop solar for public schools. It comes from some of the sharpest minds in the space, and readers of this newsletter know that I think healthy school finance entails green bank financing for decarbonized school infrastructure. Check out the report!

***

The organization of labor union and movement groups called May Day Strong have put together a letter pushing Democratic governors around the country to tax the rich and “Trump-proof” public programs as the new budget bill wreaks havoc on spending.

This week, I’m sending along some text of these letters and links to sign on. This is important!

Here’s an individual letter to sign, and then there’s an organizational letter for whole orgs to sign on.

I think this is a really good idea: when states and municipalities band together, it can help push things in better directions and ultimately secure the revenue streams we all know are needed to maintain public provision of stuff like education. Below is some of the language the individual letter uses:

To: US Governors

From: David Backer

We are asking you to ‘Trump-proof’ our states by securing the revenue needed and directing it to protect your constituents’ education, health care, housing, access to food and other public services.

While a majority of Americans can’t afford a $1,000 emergency, the recent GOP tax cuts transfers funds dedicated to Medicaid, SNAP, and public services to an increase in federal enforcement agencies like ICE and a massive windfall of tax breaks for the top 5% of high income earners.

Under the Trump tax breaks, those making over $1 million a year will receive the biggest windfall, $114 billion in 2027 alone. The Washington Post is reporting billionaires are requesting to be taxed because they do not want to benefit from such ‘imbalance’ while others suffer.

We ask that you counter the Trump tax giveaway through state policy that makes the ultra-wealthy pay their fair share.

These resources could fully fund many of the services and institutions our families rely upon such as investing in better education for children in our school districts. It can dramatically lower class sizes across the state, ensure students have access to mental health practitioners, fix the public transit crisis, fill gaps in pre-k through higher education and preserve healthcare for hundreds of thousands of working people in each and every state.

Just as some states are collaborating to fill gaps from the federal government on essential services such as vaccine and health recommendations, we are asking you to collaborate with us to advance legal and moral claims to return our tax dollars to the services and needs of your constituents.

Before Trump’s cuts, states such as Massachusetts have early evidence that addressing wealth inequality through a millionaire’s tax is a simple, straightforward, widely supported, and successful way to close the budget gaps caused by state tax systems that privilege the wealthy and made worse by Trump’s cuts. Most recently, even some of the poorest states in the country such as New Mexico, have provided leadership for states to address the impact of the federal cuts with investment in addition to lawsuits and publicly voiced opposition. With the full scope of the federal agenda coming into focus, all of our states will need to do even more.

In addition to redrafting state budgets to be based on the ultra-wealthy paying their fair share, our states must also ask the question if they are to be expected to pay for their own hostile occupation. Federal occupation of our cities not only disrupts the local trend of reducing crime and increasing safety. By reinvesting public funds into military deployments estimated to cost $2 billion this year alone, it also devastates public trust, physically harms our communities, violates basic constitutional principles, and exposes constituents to very real danger and violence at the hands of federal agents.

As the federal government furthers its use of the money sent to it from the states for direct and indirect harm, it would be within the tradition of this country to revisit the question of “taxation without representation.”

Our schools, public transit, medicaid, affordable housing, public services, food aid for hungry children and more would not be in this situation of scarcity were everyone in our state paying their fair share and if the federal government was prioritizing basic needs over its authoritarian agenda.

We are urging all of our Governors to provide the revenue needed to fund children’s education, transportation, and all our families’ needs. Our states can only be a beacon for the rest of the country if we move quickly and concretely to protect the most vulnerable.

Announcement: After working with the press on the promotion of my new book As Public as Possible, they gave me a discount code for readers of this newsletter.

If you pre-order the book now, you can use the code TNP30 to get a discount.

Meanwhile, I’ve got some book event dates set up. Here are the dates and places so far:

12/2/25 @ 2pm - Seton Hall University, South Orange, New Jersey

12/3/25 @ 7pm - HUUB, Orange, New Jersey, with teacher-organizers,

12/10/25 @ 6:30pm - Skylight Room, CUNY Grad Center, New York City, co-release with Celine Su

1/12/26 @ 2pm - School for Advanced Studies in Social Sciences (EHESS), Paris, France, with Nora Nafaa

2/9/26 @ 8pm EST - Debt Collective Jubilee School, online

If you want me to come do a talk, either online or in person, with your group/office/chapter/whatever, I’m happy to set it up. Just respond to this email. More dates to come!