The money-changers at Temple

Organizers at Temple University got in touch with me recently to ask what I thought of their campus's supposed 'budget crisis'. I did a little digging around and there are tons of documents and resources. Temple's unions in particular are doing a great job pushing against the current crisis narrative put out by the administration, which centers enrollment declines as an intractable problem that'll lead to cuts.

This 'crisis' is happening everywhere in education, from pre-k to graduate school. As federal COVID money dries up, inflation remains sort of stubborn, markets are funky, people are thinking about education differently, and the post-pandemic era settles into its new political-economic normal. How should organizers in higher education respond when administrators start slashing?

This post is about one little thread I haven't seen mentioned elsewhere when it comes to Temple and other higher education movements' budget struggles: endowment payouts.

An easy $100 million

I found a continuing disclosure form on EMMA looking at the university's finances in 2023. The document is great because it breaks down all kinds of enrollment, tuition, and other financial things in clear terms. No bullshit.

Temple has more than $2 billion in its endowment accounts. I have questions about this endowment, its portfolio, and what the administration and Board of Trustees can or can't do with these funds as they cry crisis.

They do, in fact, spend this endowment money.

In fiscal year 2023, the University’s endowment spending rule was 4.25% of the average market value of the endowment assets over a rolling twelve quarter period. Endowment spending for fiscal year 2023 was $32.3 million.

When I looked into this number for University of Chicago, they actually have a moving threshold between 4-5% for their payout. Let's say Temple's leadership wants to grow their student base not through cuts but through support of their programs and faculty and staff, as graduate students and adjuncts have suggested. If the administration agreed to increase that 4.25% spending rule by 75 basis points, .075, up to 5%, that would provide $100 million in non-committed revenues.

This isn't just a dream, it's feasible.

Andy Hines told me that 5% is well under the Pennsylvania state legislature's traditional 7% threshold for endowment payout, and even further below the COVID variance on this ceiling, which was up to 10%. This state law lets Temple pay out 7% of their endowment, which, if the administration went for it, would be $140 million.

Megan Morris told me there's precedent for increasing endowment payouts, like the case of University of Virginia in 2008.

In terms of the people who have their hands on the levers that could make this decision, here's some information:

The University’s operating funds, endowment, and retirement funds are invested in accordance with the University's board approved investment policy. The Strategic Investment Group (“SIG”) currently manages the investments for the University’s endowment and retirement funds and Arthur J. Gallagher & Co. provides ongoing oversight to ensure SIG compliance with the University’s investment policy, including asset allocation and use of the appropriate benchmarks.

If I were a campaign, I'd do a little power map for the members of this SIG as well as the people in Gallagher & Co who advise on this policy. You could do a petition for the membership demanding that Gallagher & Co. and the SIG approve a 5%-7% endowment revenue stream increase to avoid crisis and further enrollment drops.

The movements could also demand that this $100 million be put into a special pot that'll get spent through participatory budgeting processes, involving the campus in how it gets spent. This might be a great idea for Temple University who's recent instability in its leadership could buy some goodwill through the process, and also when it comes to framing this demand.

Bringing the community together

There are obvious limits and tactical considerations around a campaign pushing for increased endowment payout. Endowment managers think long-term. They want a healthy endowment and they're not well-disposed to increased payouts.

They're also conservative and will immediately retort: if we do this payout now, how do we know the spending will be sustainable over time? Can we really be asked to infuse this cash, threaten the viability of the fund, if there's no plan for long-term financial health of the institution? It's like a savings account.

I think the participatory budgeting approach here could be smart in this way, since the response to these endowment managers would be that this bigger payout isn't just a one-time infusion, but rather a moment for bringing the Temple community together to fund the future of the institution democratically.

The campaign would have to speak the language of endowment growth: using this payout will actually help the endowment get bigger, not smaller. But I think that'd be easy to do and I'm wondering if this could be a tactic for other campuses facing budget crises.

Expense fetish

As a coda, here's something curious that movements might find interesting. In the continuing disclosure form, the auditors take Temple to task about for how they report certain things in their budgeting and it's a rare moment of spiciness in the otherwise dry world of higher education accounting:

The University’s budget presentation differs from accounting principles generally accepted in the United States of America (“U.S. GAAP”). Most notably, board-designated transfers to board-designated funds are recognized as “expenses and transfers” on the budget basis presentation; under U.S. GAAP, transfers between categories of net assets without donor restrictions are not reflected as revenues or expenses. Also, the budget basis presentation reflects tuition discounts as an expense (as opposed to a reduction of revenue) and does not reflect depreciation, the impact of certain revenues received or expenditures made pursuant to certain grants and contracts, and realized and unrealized gains (losses) on investments.

So the auditors are telling Temple that they've got an expense fetish. Namely, the auditors are saying to Temple (i) you're reporting transfers as expenses and revenues, but that's against accounting principles, don't do that; and (ii) your administration has presented tuition discounts as an expense--not a reduction of revenue, like you should be; and (iia) your presentation of tuition discounts as an expense doesn't take into account depreciation, impacts of grants and contracts, and gains/losses on investments. Not good folks!

Context, notes of interest, etc.

Temple is a state-related institution, which means the funding for the Commonwealth System is considered non-preferred (meaning "not under the absolute control of the commonwealth" the general assembly used to pass four separate bills by a two-thirds majority to provide funding for each university. Now it's a single bill.

The Governor is proposing giving state-relateds about $633 million in 2024-25. Temple got $158 million in the last budget--how does this get determined? Is there a formula? Ed Fuller told me that they set a dollar number per student that hasn't changed since it since, aside from periodic increases.

Here's the appropriations law and the Governor's new plan.

The governor’s new plan would put funding for the state-related schools in the Department of Education budget, which only requires a simple majority for passage.

In addition, Shapiro is proposing “a predictable, transparent, outcomes-based funding system that will apply to schools in the new system and our state-relateds.”

The measurable outcomes in this plan would “benefit all Pennsylvanians,” Shapiro said in his speech. These include:

Increasing the number of first-generation college students enrolled.

Ensuring more students stay in Pennsylvania after graduation.

Emphasizing students go into the fields the state needs, like agriculture, education and nursing.

Developing transparency and increased accountability for tax dollars.

This system of outcomes-based funding would be developed over the next year with input from the General Assembly and higher education leaders, Shapiro said. Then next year, Shapiro said he’ll come back to lawmakers seeking $279 million to directly offset costs for Pennsylvania college students.

Budget. Looking at Temple's budget I see some things I wonder about.

For instance, I don't understand why there's no mention of the endowment, which has made pretty big gains over the last few years, in this budget, which is quite dour. The budget page says the endowment isn't big (it's about $900 million), but how much could we hope to get from such an endowment? Is there a tension between the budget crisis and the potential payouts?

The endowment at Temple is largely supported by gifts to the university. The school recently received a $5 million gift from Citius Pharmaceuticals Executive Chairman Leonard Mazur and his wife Helena, and the school received a record-breaking $104 million in gifts in fiscal year 2021.

They were very proud of big increases in 2023 too.

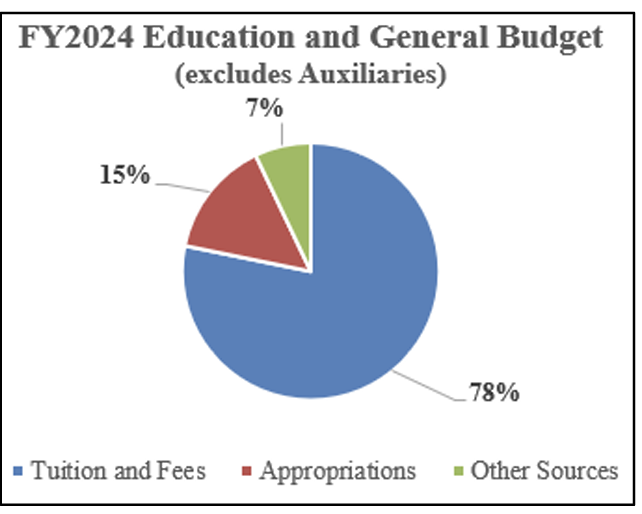

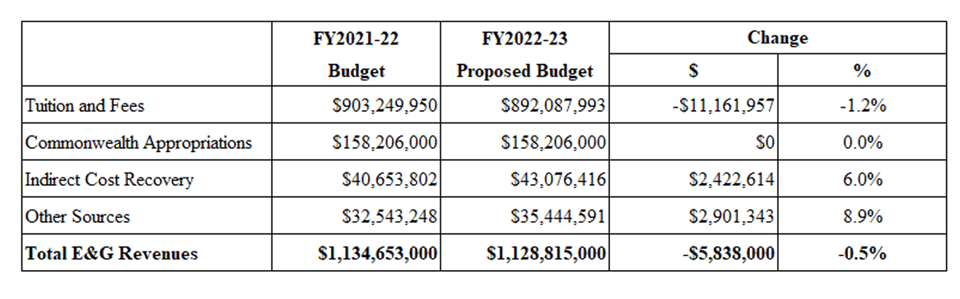

A more specific set of revenues is here:

There are a couple categories here that are interesting, like "indirect cost recovery."

"Indirect cost recovery funds (i.e., ICR or "overhead") are monies received by the university in reimbursement for services rendered in support of grants and contracts. ICR funds are paid to the University by the granting agencies as reimbursement for indirect support provided to the grants and contracts.

Overhead reimbursement is tied to the expenditure of direct costs associated with research awards (primarily federal contracts and grants). The amount is based on the indirect cost rate, which includes the cost of facilities (such as research space, maintenance and utilities, and the library) as well as departmental administration and support."

In 24: "Revenues from indirect cost recovery from grants and contracts will decrease by $4.6 million or 10.6%. This decline is attributed to the Lewis Katz School of Medicine" - Okay, so why? What happened at Lewis Katz?

Interesting to note that yearly debt service in the 24 budget is almost $20 million. How long has that been, and why? A recent bond statement says a million was paid for issuance costs.