The horizon of fiscal mutualism (part 3)

Quick links:

Healthy School Finance by Joshua McWhirter, a memo from the climate + community institute. “Organizing for non-extractive forms of debt financing can be part of a broader project to build real public capacity for the coordination and democratic oversight of investment in green facilities that students, teachers, and communities desperately need.”

“Building Democracy, One City Budget at a Time,” by Celina Su, author of Budget Justice and with whom I’ll be in conversation on 12/10 at the CUNY Graduate Center’s Skylight room for my new book. Flyer below.

“People’s Budgets Insist on Care First—for and by Everyone,” also by Celina in Nonprofit Quarterly.

Excerpts and reviews of Mike Glass’s book Cracked Foundations are coming out and you should read them.

For today: This is the third part of a presentation I gave to the K12 Critical Budget Institute. The first part is here. Second part here.

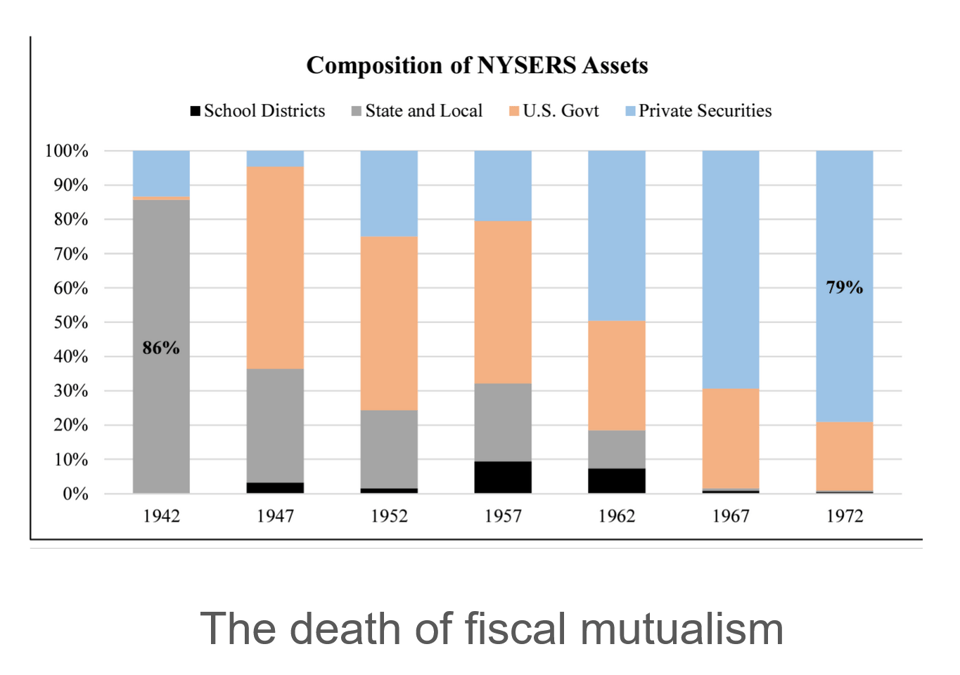

Let's move on to other stuff. This is my favorite piece of research in the last five years. In an essay called “The Frail Bonds of Liberalism,” the historian of Education Finance, Mike Glass, who has a new book called Cracked Foundations that's really great. And the economist Sean Vannatta tracks the history of what they call fiscal mutualism, which is a pension management framework. Pension managers have to manage, in Pennsylvania here the pension fund is something like $68 billion, maybe it's $70 billion by now. These pensions are like in the trillions of dollars, total. This is a huge pool of the people's money. So it's important to talk about.

Glass and Vanatta track the history of the extent to which the teachers pension in New York was invested in school bonds and state and local bonds versus just private securities. Now think about this for a second. The pension fund has to invest the money to make a return to pay out the benefits to all the people who retire. What they're trying to do is they're trying to address the social risk of aging. We need programs for that. The social risk of aging is that we're all going to get older, not going to be able to work. In capitalism, you have to work to live. How are the people who can't work going to live? Retirement systems.

The pension managers are in charge of figuring out how to manage the social risk of aging. The pension managers in 1942 of this pension were 86% invested in state and local bonds. Imagine all of the people's money going into the people's infrastructure. Now, those bonds would have a small return, right? Like two, three percent. But the law of the land in the United States was that they had to do that. That's why it's so high. And the private securities, the blue there, is extremely low, because it was the law of the land, essentially, that you had to plow the people's money into the people’s infrastructure.

Here's something I'm particularly interested in as someone in school finance. In 1947, you see a slight uptick of school district bonds being purchased by the pensions. Isn't that interesting? Imagine the teacher's pension being the underwriter for the debt that your school district has to take out for its facilities and infrastructure? That's a very different underwriter than Wells Fargo, or Bank of America or Morgan Stanley or J.P. Morgan. These are the people who are the underwriters now.

By 1957, it was upwards of 10% of the entire portfolio's investment. It was in the school bonds of its own contributors and beneficiaries. That's incredible. The authors cal that fiscal mutualism. Why? Because the fisc is the public purse. That's where that word comes from. The fisc is the purse. The public purse was mutualistically financing the public infrastructure. Rather than just fiduciary duty, which is what we're typically told is what the pension managers need to do, they need to do their fiduciary duty to get the highest return possible—so we should give it to the weapons companies and the oil companies, and buy the Israel bonds, et cetera. That's where we need to go for our fiduciary duty to get the return of the want. But this is fiscal mutualism, making the people's money work for the people's infrastructure.

Question: I don't understand!

That's fine. That's fine. Just sit with it and talk through it. There's a lot here.

Question: I'm very curious. When you say that the 86% is within its own, like investment in its own people. That part is where I got stuck.

Okay. How is that the people's money funding the people’s infrastructure—like, what does that mean exactly? Here’s an example. We were talking about the School Construction Authority in New York City. It's an independent authority that manages the maintenance and construction of schools. Like, they're responsible for creating the seats to comply with Class Size Law in New York. Okay? So this construction authority is financed by bonds. The majority of which are called building aid revenue bonds, that are issued by the New York City Transitional Finance Authority. Imagine if the teacher's pension, your pension, purchased those bonds from the TFA for the School Construction Authority to finance the school that you work in. That's the example.

So when you look at your bond statement on the front page, you're going to see a list of 25 huge banks: JP Morgan, etc, all the bad guys, all the people I yelled at during Occupy Wall Street, and now I'm relying on for the money to fix up my daughter's school. You're going to see a lists of those banks. When it comes to fiscal mutualism, instead of those banks who are out for profit, it’d be your pension, whose job it is, is just to pay for old people's living, and make a modest return to be able to pay for that living, after they can't work anymore. That's that's what this is, and that's fiscal mutualism. When the people's money, the pension, for their retirement, is financing the people's infrastructure, the school buildings in New York City. Does that help?

Question: Does that mean that the interest would be paid back to the people or no?

Well, yeah! Because when the pension buys the bond, and the bond gets paid back with interest, where does the interest go? To the pension. So then that's a good thing. This is a good thing. Because that's the return to the pension for money accrued from the schools for the schools. So instead of paying the ruling class we're paying yourselves, exactly. You are paying into the fund that's going to help take care of your school building, rather than paying some ruling class bankster, who just wants to make money.

And the decision making authority for these pensions in terms of the discrete decisions about where they're investing money, it looks different location to location, there's a pension board for each one. And then the composition of the board can be elected, it's can be appointed, semi-elected, on different schedules. Every pension's a little different, but typically there's a board, and sometimes there are trustees, and then there's an executive director. It has own organizational structure, but those are the kinds of organizational structures we should be power mapping.

And the people who have their fingers on the button, those are the people we should be targeting for pressure campaigns, because they're the ones that can make this decision. Don't let anyone tell you that it's illegal for a public pension to buy public bonds. It's exempt from the laws governing pension management. You can buy municipal bonds up the wazoo. Now, they may feel like they have to do their “fiduciary duty,” because maybe they're beneficiaries are gonna sue them if they don't get the return that they feel they should get. And I want to note: we're talking very high stakes stuff.

Question: Are there examples of laws being created where it's sort of option of first purchase? Like if there are bonds that are going to be sold and there's competition for that, we want this guaranteed return or if this return that has a high rating because your states may be in this position. If there's competition or purchasing those bonds, is there a possibility of a public agency has first rights, or maybe another state agency like a pension has first purchase rights so they don't have to face that competition, that might mark up a good cost. I don't know if that makes sense.

Yeah, it does make sense, and I don't know if anything like that exists, but it's a great idea. Having negotiated sales of bonds where the investor group with first rights are pensions. We should look into it.

Question: This is just New York City, but it is known that there's corruption in construction. So I don't trust them. When there's any security construction on our building there's many problems. Like work that's not actually done, but money is paid. So that's where I'm getting…

…the ick. You're getting the ick. No, for sure. I'll just respond to this case in New York, and this is something I know the Mamdani transition team's working on. The School Construction Authority’s budget is financed through bonds. But the bureaucracy that oversees the maintenance in the facilities, that’s a different bureaucracy than what finances that bureaucracy. So it's just a little different, but to have the ick is a totally correct feeling. But what I hear you saying is: let's say a teacher's union says, “we're gonna push to get your pensions invested in a more public project.” And then, let's say your teachers say, “yeah, but that's not going to give us as good a return on investment.” Right, which sounds to me like there's still a lot of political education work to do with your base. And understandably so. They're concerned about how they're going to live when they're done working and they want that high return on investment, so that means they feel better investing in Lockheed Martin, or whatever the hell. A lot of teachers are gonna go for that.

Question: So this is an open question, I don't expect you to have an answer, but like, how do you feel about this long process of doing to work with your base to not have that legitimate and rational fear about their future?

These are the questions that are going to come up if you start to poke this piece of the general puzzle. My thought on that is: a reckless driver will get you to where you want to go pretty fast, if you want, but they might crash the car, too. A very slow driver will get you there a little slower, but they're not gonna crash. It's not as dangerous. It's a little more stable. I think that our experience since 2008 has been that maybe we could live with a 4-5 percent return over the long term rather than a 9 to 10 percent return if the capitalists are gonna ruin the world in the global economy.

Then maybe, maybe, if we invest in enough of the school bonds with that small return stably over time, we'll have better infrastructure and education will be better, and, you know, we might have to futz here and there, but we're gonna try to isolate ourselves from the reckless drivers of the economy, and we might have to sacrifice a bit of return on that. Yeah, but that's the debate I think we should have, and it's going to take a ton of political education to get there. But that's why this is a horizon.

Announcement: After working with the press on the promotion of my new book As Public as Possible, they gave me a discount code for readers of this newsletter.

If you pre-order the book now, you can use the code TNP30 to get a discount.

Meanwhile, I’ve got some book event dates set up. Here are the dates and places so far:

12/2/25 @ 2pm - Seton Hall University, South Orange, New Jersey

12/3/25 @ 7pm - HUUB, Orange, New Jersey, with teacher-organizers,

12/10/25 @ 6:30pm - Skylight Room, CUNY Grad Center, New York City, co-release with Celine Su

1/12/26 @ 2pm - School for Advanced Studies in Social Sciences (EHESS), Paris, France, with Nora Nafaa

2/9/26 @ 8pm EST - Debt Collective Jubilee School, online

If you want me to come do a talk, either online or in person, with your group/office/chapter/whatever, I’m happy to set it up. Just respond to this email. More dates to come!