Schools, guns, and banks

(CW violence) I can't get the school shooting in Uvalde off my mind. Like everyone else, I've been hearing and reading and thinking about school shootings since 1999 after the Columbine shooting. I was in high school and started looking over my shoulder. Then the steady increase of people coming to campus with guns and killing got me more and more nervous as a high school teacher, graduate student, and then professor. But this time is different. Our toddler Thisbe just turned two earlier this month. Something about being a parent makes this time different.

I've started writing a longer essay on school shootings and socialism that should come out later this summer. It's more theoretical. For this post I want to do some digging into connections between municipal finance and the gun industry in Texas.

Obviously the proximate cause--something that could be done immediately about these mass shootings, including the one at the Buffalo grocery store--is banning assault rifles and generally taking on the gun industry through regulation. But gun companies need financing. Thinking as a socialist here, I know that government isn't the only realm of social-political action. Capitalism matters a lot. If the right pressure were put on banks, for instance, could they refuse to provide gun firms the credit they need to do business? Would that help prevent school shootings? It turns out that yeah, maybe. But the connections don't stop there.

Bonds are mostly for education

Here's a graph I found before the Uvalde shooting that I keep thinking about. It might seem unrelated to school shootings, but I promise it's not. In their quarterly report on municipal bond issuance in the United States, the Securities Industry and Financial Markets Association (SIFMA) shows that bonds for education edged out every other category to become the top type of issuance. Three of every ten bonds issued on the municipal bond market have to do with education, just above the beefier category of "general purpose" and double those issued for transportation, utilities, housing, healthcare, and electricity.

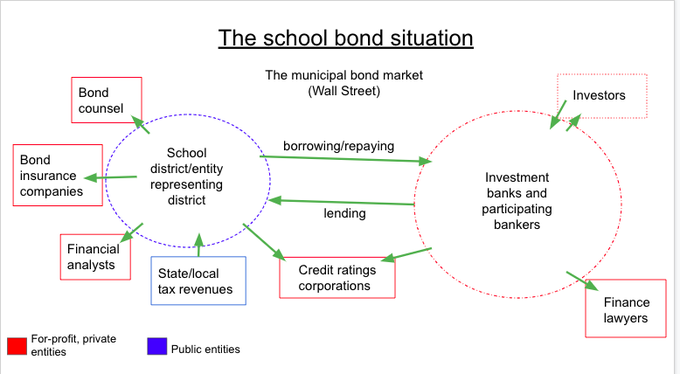

This by itself it is astounding. When local governments take out loans, they do it mostly for educational purposes. Another way to put this: to educate, the US relies heavily on debt. More heavily than any other municipal provision. Not only that, but these numbers also mean that the market for education bonds is really big. There's a lot to buy and a lot to make. Investors can and are making tax-free profits by shoving their millions into loans taken out by educational institutions, who pay the principal back with interest. And there's a whole industry around these bonds: lawyers, consultants, ratings agencies, insurance companies, and depository companies pocketing fees. The biggest player in this whole scene are the private banks who go between the investors and educational institutions, charging very high fees for the service.

Sticking to their guns

What does this have to do with the shooting in Uvalde? More than you might think. Texas has the second largest municipal bond market in the country, second only to California. There are $50.2 billion worth of municipal bond deals happening there. The Municipal Securities Rulemaking Board (MSRB) has a great map showing the size of each state's market. There's a lot of business to be done in Texas, which gets the bankers' mouths watering. They want to get in on those deals.

If almost 30% of municipal bonds in the US are for education, and Texas has the second largest municipal bond market, we can infer that a good chunk of that market in Texas is for education bonds. Just to be crystal clear about this: the banks' mouths are watering over the money to be made doing loan deals for education in Texas.

We also know that Texas is a gun crazy state and its governor Greg Abbott is firmly in the gun industry's pocket. So, in principle, if the banks cared about gun control and preventing school shootings, this particular opportunity wouldn't tempt them. They'd say to themselves "we know there's money to be made in Texas municipal bonds, but we want fewer school shootings, so we'll stick to our guns and not do business there." In fact, some banks did make these kinds of statements after the Parkland school shooting. Bank of America said it wouldn't finance Remington if it kept producing assault rifles for sale on the mass market. Jamie Dimon, CEO of JPMorgan, was fond of decrying mass shootings publicly too.

If banks actually did this, it'd matter. If gun companies can't get credit then they can't do business. If they can't do business, there'd be fewer gun sales. If there are fewer gun sales, there might be fewer shootings. It's one tactic among many and isn't perfect. But at least it'd be something. All told, outcomes have been mixed. It's not not happening. In 2019, Guns Down America put out a scorecard called Is Your Bank Loaded rating how strong certain banks when it comes to the gun industry. The best bank on the list is Citi. It got a B. Most others get Cs and Fs. At least it wasn't all Fs? And Citi is one of the biggest banks in the world.

Then a big test came. Texas passed a law in 2021 that blocks banks from doing business with state and local governments if the bank "discriminates" against the gun industry. The law favors banks that do business with gun firms--and it worked. Citi, the second largest municipal bond issuer in the US, is now ninth in Texas. And sinking. The New York Times recently reported that part of this law requires banks to make official statements declaring that they don't discriminate against guns. Banks had to get on their knees and apologize, kissing the gun industry's ring, to get in good with Texas's municipal bond market.

JPMorgan sent a letter saying they do business with gun firms. Then the real kicker: so did Citi. They stated on the record through lawyers that it did not "have a practice, policy, guidance, or directive that discriminates against a firearm entity or firearm trade association." The Times explicitly says that "The stakes are high for big banks. If a bank states that it is in compliance with the law and is found to be otherwise, it could face criminal prosecution. It could also be shut out of the state's giant municipal bond market...Texas generated $315 million in fees last year alone for financial firms."

Loaded

One of the big questions in the news right now about the Uvalde shooting is whether police are lying. In one egregious case, they blamed a teacher for not locking the front door to Robb Elementary School when Salvador Ramos rushed the building with his assault rifle. (It's pretty clear the police are lying about this along with a number of other things.) But what's really getting me is the financial element here. The same financial industry that makes money on loan deals for school districts also makes money doing deals for the gun industry. They made money lending the school district money to pay for that door at Robb Elementary. They made money lending to the companies that make Ramos's assault rifle.

it's not just the same money--since the banks are the common denominator here, these flows are dependent on each other. If schools didn't need private credit markets for facilities, would banks hesitate to enforce anti-gun industry policies in Texas and elsewhere? Would they have to get down on their knees and pledge loyalty to guns? I think not. If school districts like Uvalde just got public financing for their facilities then banks couldn't chase after the profits to be had in Texas school bonds. Given the size of Texas's municipal bond market, and the proportion of bonds that go to education, then public credit for public schools might go some way towards neutralizing that law punishing banks for limiting credit to the gun industry. If there weren't so many bond deals in Texas, Citi wouldn't salivate and give up their pursuit of gun control.

If Uvalde didn't need to pay for that door with private credit, the assault rifle company might not have gotten the financing to make and sell the assault rifle to Ramos. But everyone's got to be loaded in the US, and the shootings keep happening.