New research: Toxic Finance--Underinvestment in Philly's School Buildings, 1993-2021

I'm so excited to announce that this paper with Dr. Camika Royal is out in the world as part of a special issue of the Journal of Educational Administration and History. It’s called "Toxic finance: underinvestment in Philadelphia's school buildings, 1993-2021."

We all know Philly's school buildings have huge problems that plague its diverse working class communities. In a word, they're toxic. But we ask: to what extent has the United States's financing regime responsible for this toxicity? We argue that this regime itself is toxic.

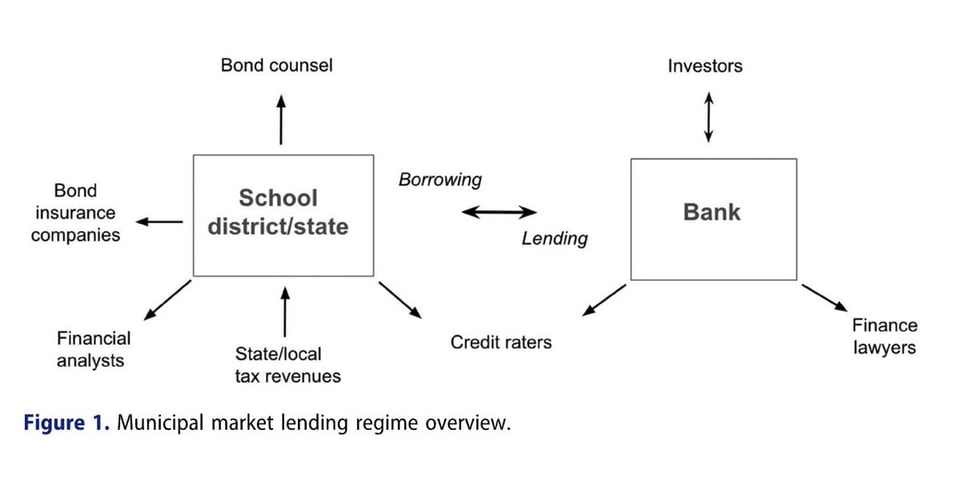

First, we have to talk about how this all works. People don't really understand that public school districts have to sell themselves as investment commodities on Wall Street to get money for their facilities. We offer a simple explanation for this regime.

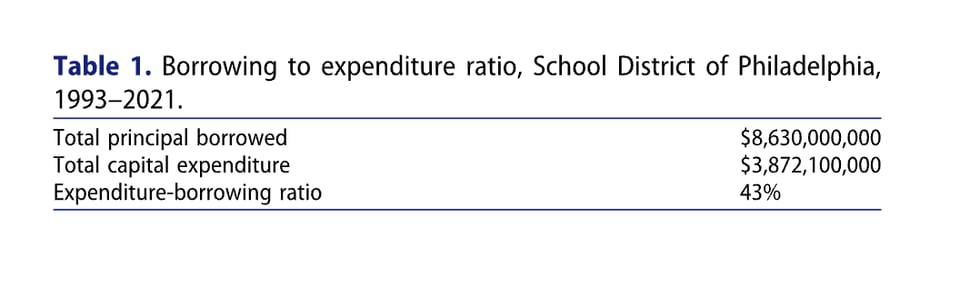

Then we compare bond principal lent to the district and the district's capital expenditures over a 28 period, we find that for every dollar that came in from the municipal bond market, the district was only able to spend 43 cents on its buildings.

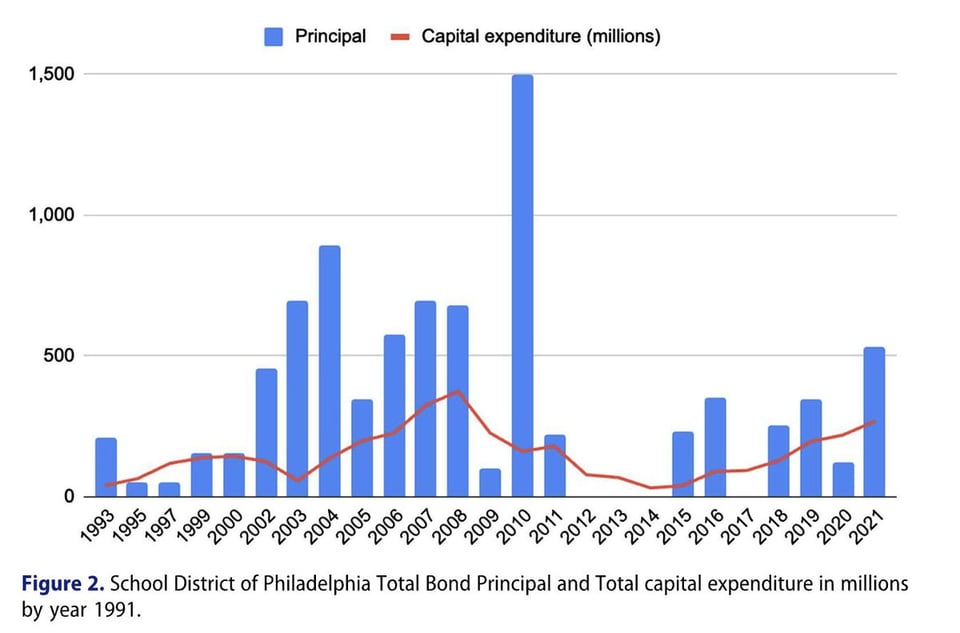

We argue that this is inefficient. Tracking the bond principal and capital expenditure over time, we do an historical analysis for exactly why this inefficiency has happened. In the graph below, the blue bars are bond principal and the red line is capital expenditure by year.

We break this nearly thirty year period into two moments 1993-2002 and 2004-2021. In the first period, we find that the district was exposed to cruel vicissitudes in bond market regulation and the 1987 savings and loan crisis. We call this an "exposure toxicity."

In the second period, we find that policy makers and market makers took irresponsible, predatory risks by using volatile debt instruments in the lead up to the Great Financial Crisis. We call this a “risk toxicity." Given these two toxicities, we conclude that the district was exposed to racial capitalist chaos, and we should understand the inefficiency in the financing regime from a lender-centric perspective. As Destin Jenkins has written, policy makers and market makers were the "spiders in the web" of this ongoing, racist, infrastructural catastrophe.

In conversations about why Philly's school buildings--and the entire country's school buildings--are in the bad state they are, we should be talking about how we finance them toxically. We need a National Infrastructure Bank and a Green New Deal for Schools instead!

Thanks to so many of you readers for the support, feedback, and in some cases direct edits and suggestions on the thinking and argumentation that made this paper possible!