MOU money MOU problems in Hingham

This is my second school budget crisis request from TikTok. It’s from Hingham, MA.

Apparently, as of March, the size of their budget deficit issue is at most $2.6 million, but it looks like the crisis is coming down to a $1.2 million hole. The local paper The Anchor is taking notes from the School Committee and Board, who’s position is basically to blame the union. The teachers are asking for too much money, so we’re in a crisis.

But actually there’s a lot more going on to this story. The teachers have been working without a contract. They’re just looking for better parental leave policies and more funding for special education programs. Is that so bad? I don’t think this is the union’s fault (but maybe it’s their fault for not pushing back more).

The town has a new Memorandum of Understanding (MOU) that limits municipal spending on particular services, including education. It caps growth in educational spending by 3.5% year to year. This is the first year this MOU is taking effect and its throwing things into disarray.

My question is: what’s up with the MOU? How’d they get to 3.5%? (There’s also a country club subplot that’s pretty funny.)

There’s a bit of urgency because the Hingham Town Meeting is coming up on April 24th and these issues are going to be important. There’s a huge PDF called the Town Warrant that talks about everything having to do with the town. It’s giving Puritan town meeting vibes. It’s Article 6 that’s the headline element, since it deals with paying for the town’s stuff, including schools. Let’s get into it.

MOU money MOU problems

The Anchor just takes the school committee leadership’s perspective without getting any comment from the union or community.

Based on the The Memorandum of Understanding crafted last year among the School Committee, Advisory Committee, and Select Board, “we cannot exceed our operating budget by more than 3.5%, therefore the base figure remains $68,003,624,” Correnti said. “The tricky part is that contract negotiations with the Hingham Education Association are still ongoing, and the current proposals that have been accepted by each side have a higher financial impact than we originally budgeted for. Any additional movement we need to make to settle the contract will have an impact on staffing next year.”

Why can’t the schools exceed 3.5% for municipal spending? Particularly in an uncertain time? The MOU is very recent, from last year. Apparently it was passed at the 2023 Town Hall meeting. Here’s a basic history.

At the height of the 1970s and 1980s tax revolts, Massachusetts passed Proposition 2.5, which created a threshold for tax increases every year in municipal government. You can’t increase taxes more than 2.5% because taxpayers get big mad. (Of course, it was an intense time with very high interest rates and stagflation, etc., but still.)

After Prop 2.5 passed, municipalities had to pass policies that led them “override” the 2.5% growth threshold if they needed more money than that. According to the 2023 Town Warrant, Hingham had been lucky because it didn’t need to do an override since 2009. But things had gotten worse and it was looking like that might be necessary. They decided on the MOU strategy:

A best practice among Municipalities that have had successful override votes is the creation of a Memorandum of Understanding (MOU) among Town leaders regarding services and future growth. The MOU is essentially an agreement between taxpayers and Town leaders that promises that, in return for an affirmative vote on the override, Town leaders pledge to limit the future growth of operating budgets and not request another override for a defined period of time. An additional feature of the Town’s MOU is that a Tax Mitigation Stabilization Fund would be established, subject to voter approval, to help delay the need for a future override.

I wonder whether there was much pushback against this plan, since it would create the very situation we’re seeing now: caps on municipal spending. Why’d they choose 3.5%? I think this is the root of the problem. The question becomes what to do about it at the upcoming meeting. I don’t see any way of changing that MOU threshold. But there are some questions we can ask.

Country Club?

First, the MOU doesn’t hold for every municipal entity.

Municipal departments — including general government, public safety, public works, human services, and culture and recreation — as well as the School Department — were held to the 3.5% growth rate stipulated by a 2023 memorandum of understanding among the Select Board, Advisory Committee, and School Committee.

But get this, even though culture and recreation are included in this cap, the country club in town, the South Shore Country Club, which is a municipal golf course, isn’t held to this standard because it’s “self-supporting.” So the country club can spend all it wants, but the school district has to be held within budgetary limits? Can’t the golf course be taxed a little more maybe? Or could it be similarly limited and then pay into a fund for the public schools? Could we put a ceiling for growth on that expenditure to feed into the schools? This is sort of rhetorical, but it draws a nice discursive energy to make a second point.

There’s an exception to this 3.5% rule for special education and I’m noticing something. Out of district tuitions for special ed are combined with special education contracts.

Within the school budget, out-of-district special education tuitions and special education contracts (transportation and specialized services) are considered separately for growth calculation due to the unknown/uncontrollable nature of these expenditures.

If the projected annual increase for OOD tuitions and special education contracts is above 2%, the referenced special education items are budgeted at 2% within the school budget. Any variance in costs above that amount will be paid through the reserve fund (rainy day fund) process at the end of the fiscal year.

My question, why do we have to add these things together? Can’t each of them have a 2% cap rather than a combined 2%?

Fund (im)balance

Another question that was brought to my attention while working on this post was the relatively high amount of fund balance the district insists on maintaining. In this document we can see that they maintain 16-20% of total annual expenditures, which is a lot of money! Why? Maybe they’re afraid of another tax revolt…

The union push

In an early version of this post, I asked whether/how the union was pushing on the situation, implying that union hadn’t done enough. I was very wrong! The piece I’d put together apparently traveled quickly and I heard from the president of HEA, Jacqueline Beaupre. She left this amazing comment on my original draft:

We pushed back on the non-binding 3.5% cap to no avail- they were convinced they needed to do it to get an override passed, we published several comments/opinions in the Anchor over the last year, have held multiple standouts and rallies (every school does a standout 2-3 times a week), practice picketed, had lawn signs all over town, been work to rule since Oct, sent over 5000 emails to School Committee, AdCom, Select Board, and Town Administrator, attended and spoke at hours upon hours of their meetings, voted no confidence in the superintendent, met with state legislators, and are now attempting to pull together a budget increase motion at Town Meeting funded by grossly underestimated revenue and over $9M extra in the “free cash” unassigned fund balance.

You can see evidence of their pushback at their Facebook page.

Other questions

The one non-union reason they give is “utilities,” and I’m wondering about that. Here’s the Hingham Public Schools’ budget presentation from their website.

According to a bond statement from this year describing a bond issued by Hingham, the biggest capital project for the town is Foster Elementary School, a new construction project that has $30 million in notes outstanding. I wonder about this, particularly if the district is relying on the town to finance the debt, and whether the town is hesitant to spend another million or more on special education. What’s happening with Foster? Is it creating pressure on everything else?

I also see in the bond statement that school enrollments are down overall from 2021, down a little less than 10%. It’s not a huge number but if students are decreasing then per pupil funding numbers can go down.

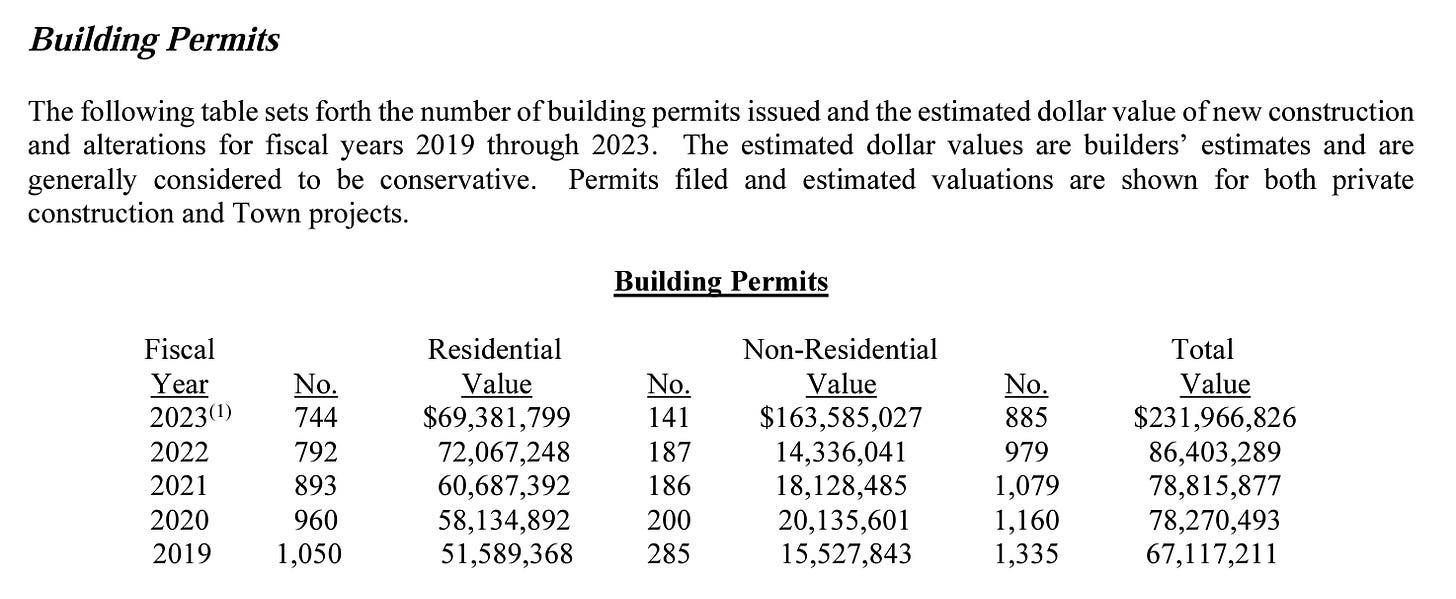

I’m noticing too that the town is a lot of building, thus the big bond they’ve sold. Is all of this necessary to do given the crisis they claim is happening?