Let them eat ITCs

I've written a few posts about the Inflation Reduction Act, focusing on how schools could take advantage of the green banking provisions in the law to get more control over the costs of green facilities expenditures. Since I wrote those posts, I've actually had a few exciting meetings with a number of players around that program and the wheels may be turning to do something in Philadelphia's schools. While having those conversations, I learned about other notable features of the law and there's one particular provision that I'm trying to understand better: the investment tax credits available for carbon emission-reducing infrastructure.

According to Sara Ross at UnDauntedK12, the IRA's section 13102 modifies and extends something called the Section 48 Energy Credit, which lets organizations who buy energy-saving technologies off the hook for a certain percentage of income tax. Section 48 lets you write off the income you use to pay for the renewable energy costs. (When you hear "tax credit" just think of the Internal Revenue Service either leaving you alone or actually paying you instead of taking your money.) Historically, this kind of investment tax credit (ITC) was limited in several ways.

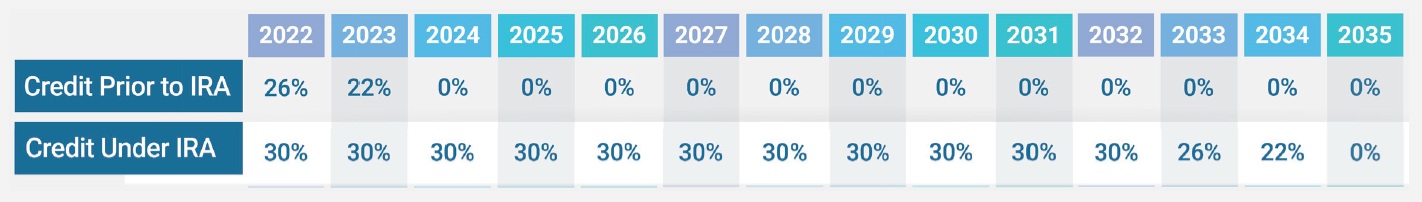

Before, only taxpaying entities--private businesses and private individuals--would get the tax credit. This tax credit encouraged a whole bunch of solar production in the US, increasing it by 200x since 2006. But what about tax-exempt organizations, like school districts? They could never apply and get the credit. If schools wanted to take advantage of this program and solarize their buildings, they'd actually have to contract with a private firm and lease out their roof to the private company, who would buy all the equipment and get the tax credit. The businesses would own the equipment and pass the savings they'd get along to schools. Also, these credits would only be good for a certain percentage of the income spent on them: 30% the first time and then a decreasing amount thereafter.

The IRA changes this situation pretty dramatically. Now, tax exempt entities like school districts can get this "tax credit" through a direct payment program. Those credits stay at 30% and will be supported for ten years, after which the decrease sets in (like in the chart above). When it came to renewable energy, these credits were pretty exclusively used to pay for solarization, but the IRA expands that coverage to geothermal heat pumps, battery storage, and "an expanded set" of other technologies.

What does this actually look like?

So if a school district wants to replace its old carbon-emitting boilers, which are probably too old anyway, with low/zero emission geothermal heat pumps, they can apply to a program that will subsidize through direct payment 30% of the project cost.

I'm pretty sure about the project cost thing. To me, if this program was formerly a tax credit for taxpaying entities, the credit was for taxes owed on the income used to buy the equipment. So I'm wondering whether it's not 30% of the project cost but rather 30% of the projected income tax that'd be paid on the project, which would be much lower. Ross told me that actually, the loans in this program happen in two parts. There's a "two loans in one" structure where the program lends 70% of the project, and then the federal government reimburses the 30%. It is a full 30% of the project, which is just a second and differently structured loan happening in tandem with the first.

A fun little wrinkle here is that entities like public school districts that finance their facilities with tax-exempt debt (municipal bonds) will get a little "haircut" on the savings. One analysis reads:

To the extent that a project is financed with tax-exempt debt and eligible for the PTC or ITC, the amount of the tax credit is reduced by the lesser of (i) 15% or (ii) the portion of the qualifying project that has been financed with tax-exempt debt. Because this is a “lesser of” test, this allows such projects to be financed 100% with tax-exempt debt, while only reducing the direct pay tax credit by 15%.

At first, this makes it seem like the possible gains from the direct pay program get erased if you finance your capital expenditures using bonds. But actually, all this means is that the 30% goes down to 25.5% because the 15% is a fraction of a fraction. What's 15% of 30%? 5.5%. So okay, you subtract that from the overall savings if, like many districts in the US, you finance your facilities with bonds.

How would this actually work? If you thought that the school district could just go to the federal government, hand in a plan, and get a check in the mail you'd be wrong. Solar Power World says that these details for direct pay aren't quite worked out, but that it'll probably go through the provider or a bank, who would give the district something called a "bridge loan." Here's how Amit Kalra puts it: "To take advantage of direct pay, tax-exempt entities will likely get a bridge loan from a solar installer or bank, pay the government incentive amount back to the loan company once they receive it, then pay the rest on an installment plan."

Um, okay? It doesn't sound super encouraging or easy to understand. It's even less great-sounding when Kalra puts it in his own words:

“The same parties that are currently willing to underwrite PPAs and take the credit exposure to a tax-exempt [entity], I don’t see why they wouldn’t be willing to underwrite a construction loan to a tax-exempt [entity], or a term loan for that matter, and say, ‘Here’s your $100. You go install this facility and then you pay us back,'” he said.

I bolded the part where he's speculating that banks and providers would be willing to extend loans to school districts. Maybe they actually wouldn't be? I don't know. It might depend where you are and who you are. If we're talking about small property-rich districts working with established providers, then maybe. But if we're talking large districts with huge facilities needs then it might be another story. Hopefully, that's where the green bank would come in. If the green bank is handling big projects for the district anyway, it could probably apply for the credits on the district's behalf and extend that bridge loan.

Bottom line: the IRA is trying to get the federal government to do for geothermal heat pumps and battery storage what it did for solarization with the ITC, and also extend that program to tax-exempt entities like school districts. But like anything else in our byzantine repressive apparatus, there are a lot of questions about just how this disbursement is supposed to work, particularly given the situation with the municipal bond market.

Whenever I read and write about these programs, I'm always left feeling like I wished financing school buildings was simple, easy, and adequate. Instead a streamlined and efficient transfer of funds, we get these pinball machine policies that boil down to some percentage of a percentage that only some kind of districts might get under certain conditions. If that's the best we can do right now then fine, but maybe we should dream a little bigger and better for next time. I'm told that this ITC modification and extension is a game changer, but part of me is feeling like it's the same old game.